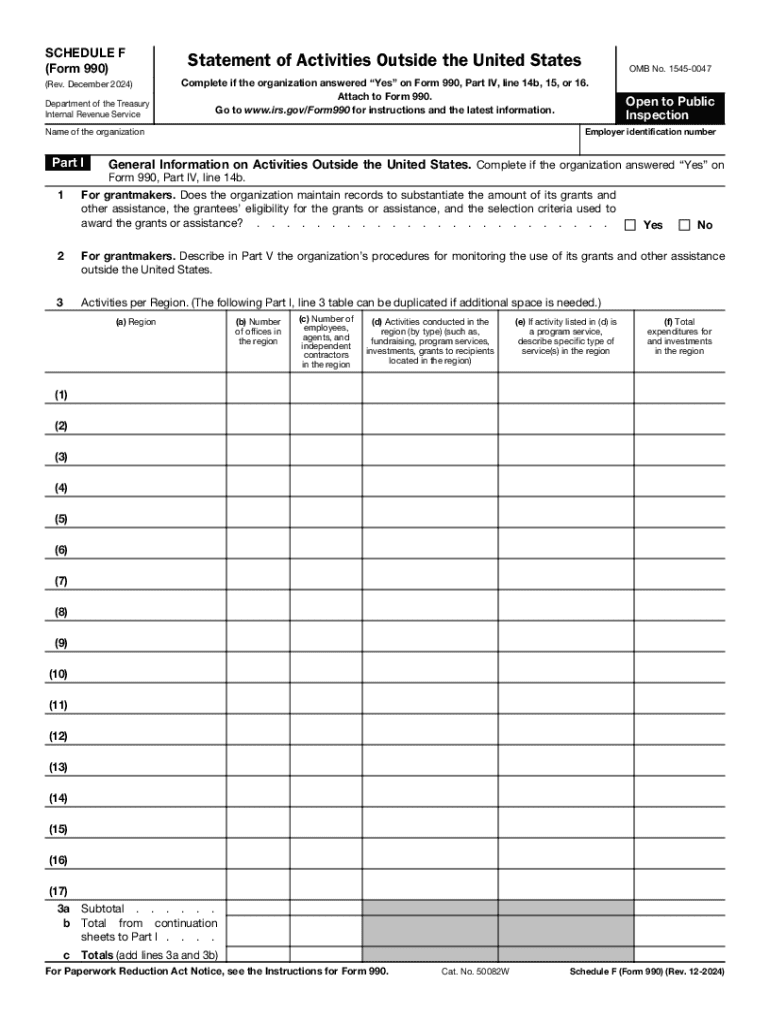

Does the Organization Maintain Records to Substantiate the Amount of Its Grants and Form

IRS Guidelines

The IRS provides comprehensive guidelines for farm tax deductions, detailing what expenses farmers can deduct to reduce their taxable income. Understanding these guidelines is crucial for maximizing tax benefits. Key deductions include the cost of seeds, fertilizers, and feed, as well as expenses related to machinery and equipment. Farmers should maintain accurate records of all expenses to substantiate their claims during tax filing.

Required Documents

To claim farm tax deductions, certain documents are necessary. Farmers must prepare and retain receipts for all deductible expenses, including invoices for purchased supplies and maintenance records for equipment. Additionally, Form 4835 is essential for reporting farm rental income and expenses. Keeping organized records simplifies the tax filing process and ensures compliance with IRS regulations.

Filing Deadlines / Important Dates

Farmers must adhere to specific filing deadlines to avoid penalties. The deadline for submitting Form 1040, which includes Schedule F for farming income and expenses, typically falls on April 15. However, if additional time is needed, farmers can file for an extension, allowing them until October 15 to submit their returns. Staying informed about these dates is crucial for timely compliance.

Taxpayer Scenarios

Different taxpayer scenarios can influence the application of farm tax deductions. For instance, self-employed farmers may have different deduction opportunities compared to those who operate as a corporation or partnership. Understanding the nuances of each scenario helps farmers effectively navigate tax obligations and maximize their deductions. Consulting with a tax professional can provide tailored advice based on individual circumstances.

Eligibility Criteria

Eligibility for farm tax deductions depends on various factors, including the type of farming operation and the nature of the expenses incurred. Generally, to qualify, the farming activity must be conducted with the intent to make a profit. Additionally, expenses must be ordinary and necessary for the operation of the farm. Familiarizing oneself with these criteria is essential for ensuring that all eligible deductions are claimed.

Examples of Using Farm Tax Deductions

Practical examples can illustrate how farm tax deductions work. For instance, a farmer who purchases a new tractor can deduct the depreciation of that asset over its useful life. Similarly, expenses for maintaining farm buildings, such as repairs and utilities, are also deductible. By examining real-life scenarios, farmers can better understand how to apply these deductions effectively in their own operations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the does the organization maintain records to substantiate the amount of its grants and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is included in the farm tax deductions list?

The farm tax deductions list includes various expenses that farmers can deduct from their taxable income, such as equipment purchases, maintenance costs, and operational expenses. Understanding this list can help you maximize your tax savings and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with managing farm tax deductions?

airSlate SignNow streamlines the process of documenting and signing necessary forms related to your farm tax deductions list. By using our eSignature solution, you can easily manage contracts and receipts, ensuring that all your tax-related documents are organized and accessible.

-

Are there any costs associated with using airSlate SignNow for tax documentation?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to features that can help you manage your farm tax deductions list efficiently, making it a cost-effective solution for farmers.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to sync your farm tax deductions list and related documents effortlessly. This integration helps streamline your financial processes and ensures accurate record-keeping.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including customizable templates, secure cloud storage, and real-time tracking of document status. These features are essential for managing your farm tax deductions list and ensuring that all necessary paperwork is completed on time.

-

How does eSigning benefit farmers regarding tax deductions?

eSigning with airSlate SignNow allows farmers to quickly sign and send documents related to their farm tax deductions list without the hassle of printing and scanning. This not only saves time but also ensures that all documents are securely stored and easily retrievable when needed.

-

Is airSlate SignNow user-friendly for those unfamiliar with technology?

Yes, airSlate SignNow is designed to be user-friendly, even for those who may not be tech-savvy. The intuitive interface makes it easy to navigate and manage your farm tax deductions list, ensuring that all users can benefit from its features without a steep learning curve.

Get more for Does The Organization Maintain Records To Substantiate The Amount Of Its Grants And

- 2021 california form 592 f foreign partner or member annual return

- Get the free new mexico rpd 41375 2018 2020 form pdffiller

- Individuals west virginia state tax department wvgov form

- Form 3372 michigan sales and use tax certificate of

- Form n 35 rev 2020 s corporation income tax return forms 2020 fillable

- Place quotxquot in box form

- N 11 rev 2020 individual income tax return resident forms 2020

- If amending form

Find out other Does The Organization Maintain Records To Substantiate The Amount Of Its Grants And

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word