Salvation Army Valuation Guide Form

What is the Salvation Army Valuation Guide

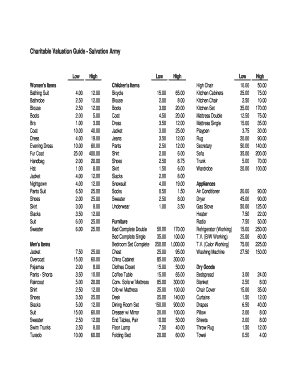

The Salvation Army Valuation Guide serves as a comprehensive resource for individuals looking to determine the fair market value of donated items. This guide is particularly useful for those making charitable contributions, as it provides a standardized method for assessing the worth of various goods. The guide includes a range of items, from clothing and household goods to furniture and electronics, ensuring that donors can accurately report their donations for tax purposes.

How to use the Salvation Army Valuation Guide

Using the Salvation Army Valuation Guide is straightforward. Donors can refer to the guide to find the estimated values of their items based on condition and type. To use the guide effectively, follow these steps:

- Identify the item you wish to donate.

- Locate the item in the guide to find its corresponding value.

- Assess the condition of the item, as values may vary based on wear and tear.

- Document the value for your records and tax filings.

Key elements of the Salvation Army Valuation Guide

The Salvation Army Valuation Guide includes several key elements that enhance its utility for donors. These elements consist of:

- A comprehensive list of items with estimated values.

- Guidance on how to assess the condition of items.

- Information on tax deductions related to charitable contributions.

- Examples of typical items and their corresponding values.

Examples of using the Salvation Army Valuation Guide

Practical examples can help clarify how to use the Salvation Army Valuation Guide. For instance, if a donor has a used sofa in good condition, they can refer to the guide to find that similar sofas are valued between one hundred and three hundred dollars. By documenting this value, the donor can accurately report the donation on their tax return. Another example includes clothing donations, where a pair of gently used shoes might be valued at twenty to fifty dollars, depending on the brand and condition.

IRS Guidelines

When using the Salvation Army Valuation Guide, it is important to adhere to IRS guidelines regarding charitable contributions. The IRS requires that donors maintain accurate records of their donations, including the fair market value of items donated. The Salvation Army Valuation Guide can assist in establishing this value, ensuring compliance with IRS regulations. Donors should also be aware that contributions exceeding five hundred dollars require additional documentation, including IRS Form 8283.

Legal use of the Salvation Army Valuation Guide

The legal use of the Salvation Army Valuation Guide is essential for ensuring that donations are reported accurately for tax purposes. Donors should utilize the guide to substantiate the values of their contributions, as this documentation can be crucial in the event of an audit. It is advisable to keep a copy of the guide alongside any receipts or acknowledgment letters received from the Salvation Army to provide a complete record of the donation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the salvation army valuation guide

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Salvation Army valuation guide?

The Salvation Army valuation guide is a resource that helps individuals determine the value of items they wish to donate. It provides a comprehensive list of common household items along with their estimated values, making it easier for donors to assess their contributions.

-

How can the Salvation Army valuation guide assist with tax deductions?

Using the Salvation Army valuation guide can help you accurately report the value of your donations for tax purposes. By following the guide, you can ensure that you are claiming the correct amount, which can maximize your tax deductions and provide financial benefits.

-

Is the Salvation Army valuation guide available online?

Yes, the Salvation Army valuation guide is available online for easy access. You can find it on the Salvation Army's official website, allowing you to view and reference it anytime you need assistance with valuing your donated items.

-

What types of items are included in the Salvation Army valuation guide?

The Salvation Army valuation guide includes a wide range of items, from clothing and furniture to electronics and household goods. This comprehensive list ensures that donors can find appropriate values for various items they wish to donate.

-

How often is the Salvation Army valuation guide updated?

The Salvation Army valuation guide is regularly updated to reflect current market values and trends. This ensures that donors have access to the most accurate and relevant information when determining the value of their donations.

-

Can I use the Salvation Army valuation guide for items not listed?

If you have items that are not specifically listed in the Salvation Army valuation guide, you can use similar items as a reference for valuation. Additionally, consider consulting local thrift stores or online marketplaces for comparable pricing to help establish a fair value.

-

How does the Salvation Army valuation guide benefit the community?

The Salvation Army valuation guide benefits the community by encouraging donations that support various programs and services. By providing a clear understanding of item values, it motivates individuals to contribute, ultimately helping those in need through the Salvation Army's initiatives.

Get more for Salvation Army Valuation Guide

Find out other Salvation Army Valuation Guide

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online