For Calendar Year , or Fiscal Year Beginning Form

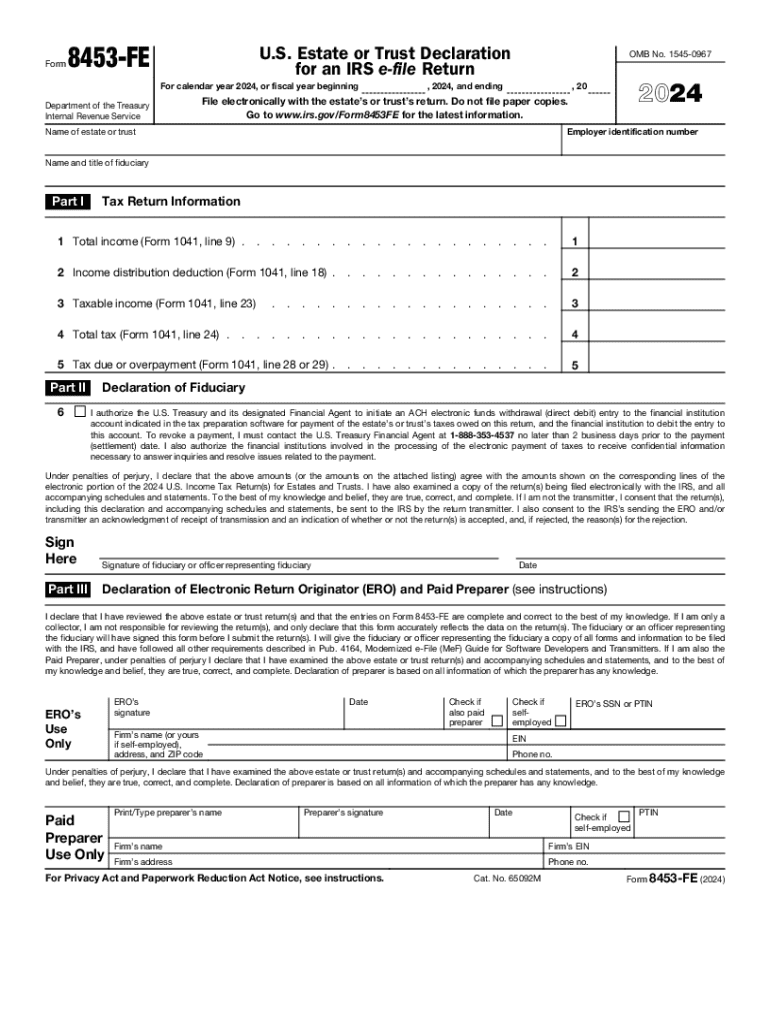

What is Form 8453?

Form 8453, also known as the U.S. Individual Income Tax Declaration for an IRS e-file Return, is a document used by taxpayers to authorize the electronic filing of their tax returns. This form serves as a declaration that the information provided in the electronic return is accurate and complete. It is particularly important for those who e-file their taxes, as it ensures compliance with IRS regulations.

Steps to Complete Form 8453

Completing Form 8453 involves several key steps:

- Gather necessary information, including your Social Security number, tax return details, and any supporting documents.

- Fill out the form accurately, ensuring all personal information matches your tax return.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate your declaration.

- Submit the form along with your e-filed tax return, either by attaching it to your electronic submission or mailing it to the IRS as instructed.

IRS Guidelines for Form 8453

The IRS provides specific guidelines for completing and submitting Form 8453. These guidelines include:

- Ensure that all information is accurate and corresponds with your tax return.

- Use the correct version of the form for the tax year you are filing.

- Submit the form within the required time frame to avoid penalties.

- Keep a copy of the completed form for your records.

Filing Deadlines for Form 8453

Filing deadlines for Form 8453 align with the standard tax filing deadlines. Typically, individual tax returns are due on April 15th of each year. If you are unable to meet this deadline, you may file for an extension, but it is essential to submit Form 8453 by the extended deadline to ensure compliance.

Required Documents for Form 8453

When completing Form 8453, you may need several supporting documents, including:

- W-2 forms from employers.

- 1099 forms for other income.

- Receipts for deductible expenses.

- Any other relevant tax documents that support your e-filed return.

Form Submission Methods

Form 8453 can be submitted in various ways, depending on how you choose to file your taxes:

- Online: Attach the form to your e-filed return through compatible tax software.

- By Mail: If required, print and send the completed form to the IRS address specified in the instructions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for calendar year or fiscal year beginning

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8453 and how is it used?

Form 8453 is a declaration form used by taxpayers to authorize the electronic filing of their tax returns. It serves as a signature document that confirms the accuracy of the information provided in the e-filed return. Using airSlate SignNow, you can easily eSign and submit form 8453, streamlining your tax filing process.

-

How does airSlate SignNow simplify the process of signing form 8453?

airSlate SignNow offers a user-friendly platform that allows you to quickly eSign form 8453 from anywhere, at any time. With its intuitive interface, you can upload your form, add your signature, and send it securely without the hassle of printing or scanning. This saves you time and ensures your form 8453 is filed promptly.

-

What are the pricing options for using airSlate SignNow for form 8453?

airSlate SignNow provides flexible pricing plans to accommodate various business needs. Whether you are an individual or a large organization, you can choose a plan that fits your budget while ensuring you have access to features necessary for managing form 8453 efficiently. Visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other software for managing form 8453?

Yes, airSlate SignNow offers seamless integrations with popular software applications, enhancing your workflow for managing form 8453. You can connect with tools like CRM systems, document management platforms, and accounting software to streamline your processes. This integration capability ensures that your form 8453 is handled efficiently within your existing systems.

-

What security measures does airSlate SignNow implement for form 8453?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your sensitive information when signing form 8453. Additionally, our platform complies with industry standards to ensure that your data remains confidential and secure throughout the signing process.

-

Is it possible to track the status of my form 8453 after sending it through airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including form 8453. You can easily monitor the status of your sent forms, receive notifications when they are viewed or signed, and ensure that your tax documents are processed without delays.

-

What are the benefits of using airSlate SignNow for form 8453 compared to traditional methods?

Using airSlate SignNow for form 8453 offers numerous benefits over traditional methods. It eliminates the need for printing, signing, and scanning, which saves time and reduces paper waste. Additionally, the electronic signing process is faster and more efficient, allowing you to complete your tax filings with ease.

Get more for For Calendar Year , Or Fiscal Year Beginning

- Principles of gender inclusive puberty and health education form

- Alsina m form

- Njdcaapp new jersey division of consumer affairspages state board of social work examinersapplication for licensure as a form

- Application for licensure as a licensed social worker division of njconsumeraffairs form

- New jersey division of consumer affairs newark nj form

- Health care professional responsibility and reporting njconsumeraffairs form

- Business phone ext form

- Consent for treatment and payment agreement consent form

Find out other For Calendar Year , Or Fiscal Year Beginning

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word