For the Taxable Year January 1, through December 31, or Other Taxable Year Form

Understanding the Nebraska Income Tax Year

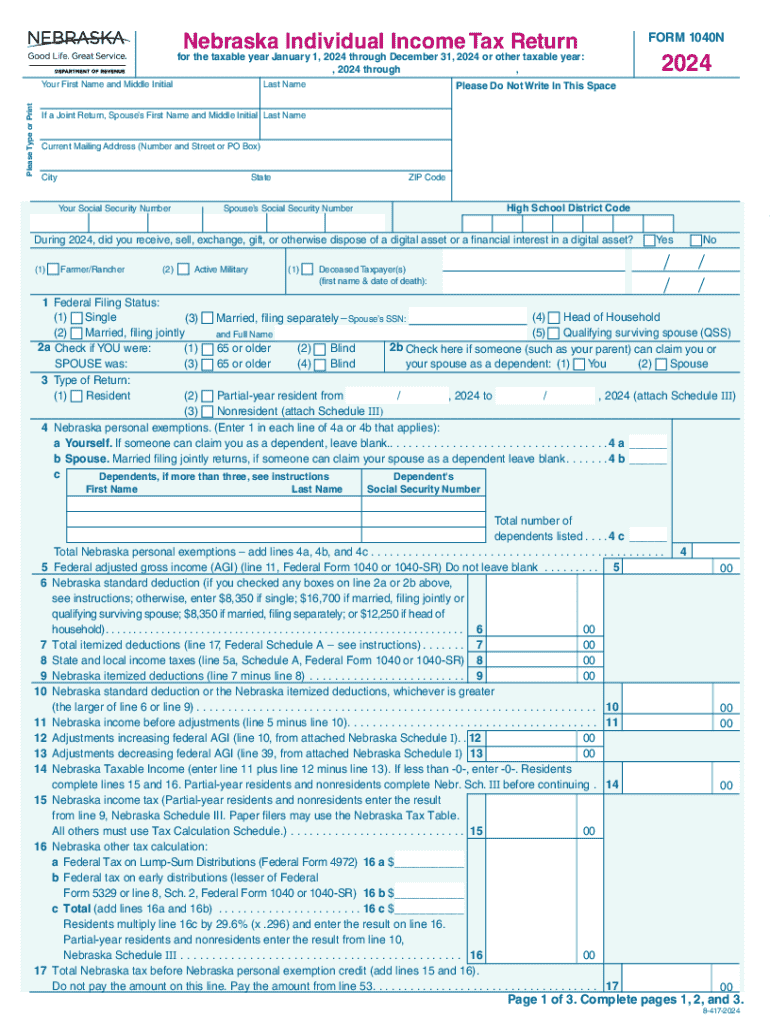

The taxable year for Nebraska income tax purposes generally runs from January 1 through December 31. This period is applicable to most individual taxpayers unless they have chosen a different fiscal year. For those operating on a fiscal year, it is crucial to adhere to the specific guidelines set forth by the Nebraska Department of Revenue. This ensures that all income earned during the designated period is reported accurately on the appropriate Nebraska income tax forms.

Steps to Complete Nebraska Income Tax Forms

Completing the Nebraska income tax forms involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rates and eligibility for certain deductions.

- Download the appropriate Nebraska tax form, typically the 1040N for individual income tax.

- Carefully fill out the form, ensuring that all income, deductions, and credits are accurately reported.

- Review the completed form for any errors or omissions before submission.

- Submit the form either electronically or by mail, following the guidelines provided by the Nebraska Department of Revenue.

Filing Deadlines and Important Dates

For the tax year, the deadline to file Nebraska income tax forms is typically April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, but it is essential to pay any estimated taxes owed by the original deadline to avoid penalties. Keeping track of these dates helps ensure compliance and avoids unnecessary fees.

Obtaining Nebraska Income Tax Forms

Nebraska income tax forms can be obtained directly from the Nebraska Department of Revenue's website. The site offers downloadable PDFs of all required forms, including the 1040N and any accompanying schedules. Additionally, physical copies of the forms may be available at local government offices or libraries. It is advisable to ensure you have the most current version of the forms, especially for the 2024 tax year, as updates may occur annually.

Required Documents for Filing

When preparing to file Nebraska income tax forms, certain documents are essential:

- W-2 forms from employers showing wages and tax withheld.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Records of any deductions or credits you plan to claim, such as receipts for charitable contributions or medical expenses.

- Previous year’s tax return for reference.

Penalties for Non-Compliance

Failure to file Nebraska income tax forms on time or inaccurately reporting income can lead to penalties. The Nebraska Department of Revenue may impose fines based on the amount of tax owed and the length of the delay. Additionally, interest may accrue on any unpaid taxes. It is important to file accurately and on time to avoid these financial repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for the taxable year january 1 through december 31 or other taxable year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Nebraska income tax forms?

Nebraska income tax forms are official documents required by the state of Nebraska for filing individual income taxes. These forms include various schedules and instructions to help taxpayers accurately report their income and calculate their tax liability. Using airSlate SignNow, you can easily fill out and eSign these forms, streamlining your tax filing process.

-

How can airSlate SignNow help with Nebraska income tax forms?

airSlate SignNow provides a user-friendly platform to complete and eSign Nebraska income tax forms efficiently. With our solution, you can access templates, collaborate with others, and ensure your documents are securely signed. This simplifies the often complex process of preparing and submitting your tax forms.

-

Are there any costs associated with using airSlate SignNow for Nebraska income tax forms?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, ensuring you can manage your Nebraska income tax forms without breaking the bank. You can choose a plan that fits your budget and usage requirements.

-

What features does airSlate SignNow offer for managing Nebraska income tax forms?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage for your Nebraska income tax forms. Additionally, our platform allows for real-time collaboration, making it easy to work with tax professionals or family members. These features enhance the efficiency of your tax filing process.

-

Can I integrate airSlate SignNow with other software for Nebraska income tax forms?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, allowing you to streamline your workflow when handling Nebraska income tax forms. This means you can easily import data, manage documents, and ensure compliance without switching between multiple applications.

-

Is airSlate SignNow secure for handling Nebraska income tax forms?

Yes, security is a top priority at airSlate SignNow. Our platform uses advanced encryption and security protocols to protect your Nebraska income tax forms and personal information. You can confidently eSign and share your documents, knowing they are safe and secure.

-

How do I get started with airSlate SignNow for Nebraska income tax forms?

Getting started with airSlate SignNow is simple! You can sign up for an account on our website and explore our features tailored for Nebraska income tax forms. Once registered, you can access templates, fill out your forms, and begin the eSigning process in just a few clicks.

Get more for For The Taxable Year January 1, Through December 31, Or Other Taxable Year

- Forms divorce_or_separation_selfhelp california courts

- Fa 4128vb order to show cause with minor children form

- Dv 140 response to request to modify extend dissolve protective order form

- Homesuperior court of californiacounty of napa form

- Hhs income withholding for support fill and sign form

- Fillable online fl 303 declaration regarding notice and form

- Wwwtemplaterollercomgroup11029form fl 235 ampquotadvisement and waiver of rights re

- Fc d no form

Find out other For The Taxable Year January 1, Through December 31, Or Other Taxable Year

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple