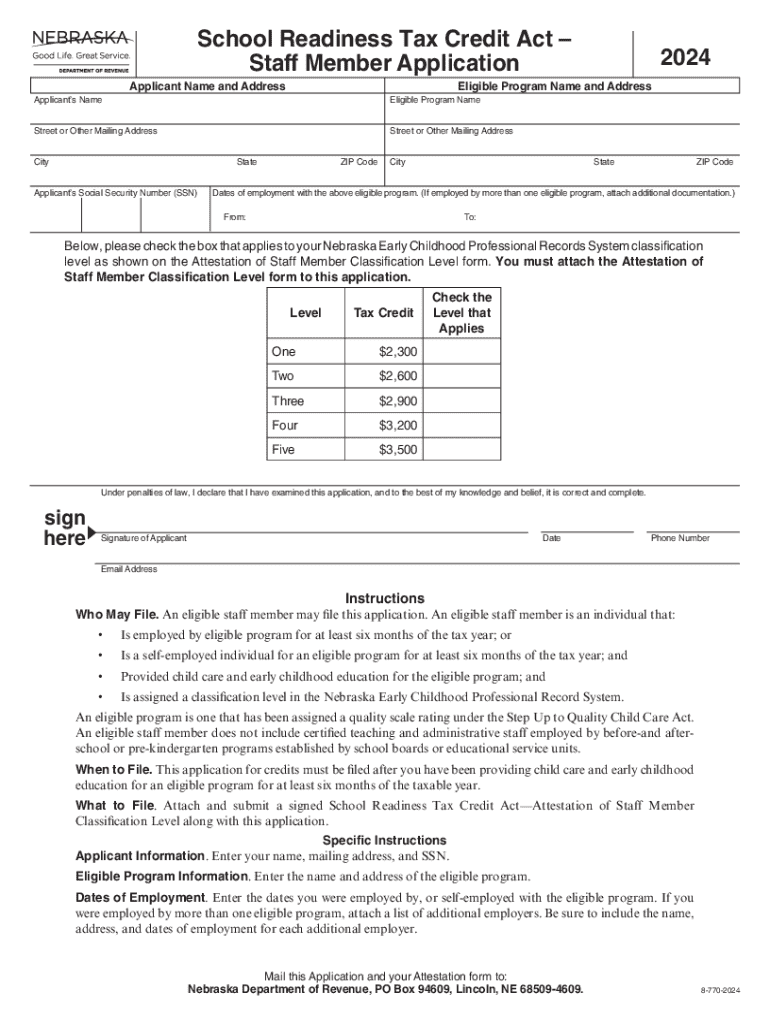

School Readiness Tax Credit ActStaff Member Application Form

Understanding the School Readiness Tax Credit Act

The School Readiness Tax Credit Act is designed to support families in accessing quality early childhood education. This credit aims to reduce the financial burden associated with school readiness programs, making it easier for families to invest in their children's education. The act provides tax credits to eligible taxpayers, helping to offset the costs of tuition and related expenses for preschool and early education programs.

Eligibility Criteria for the School Readiness Tax Credit

To qualify for the School Readiness Tax Credit, taxpayers must meet specific criteria. Eligibility typically includes:

- Being a resident of the state where the credit is applied.

- Having a dependent child enrolled in an approved early education program.

- Meeting income thresholds as defined by the state tax regulations.

It is essential for applicants to review the state-specific guidelines to ensure they meet all requirements before applying for the credit.

Steps to Complete the School Readiness Tax Credit Application

Completing the application for the School Readiness Tax Credit involves several key steps:

- Gather necessary documentation, including proof of income and enrollment in an eligible program.

- Fill out the application form accurately, ensuring all information is complete.

- Submit the application by the specified deadline, either online or via mail.

- Keep a copy of the submitted application and any supporting documents for your records.

Following these steps can help streamline the application process and improve the chances of receiving the credit.

Required Documents for the Application

When applying for the School Readiness Tax Credit, specific documents are required to verify eligibility and support your application:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of the child’s enrollment in an approved early education program.

- Any additional forms or identification as specified by state guidelines.

Ensuring that all required documents are included can help prevent delays in processing your application.

Filing Deadlines for the School Readiness Tax Credit

Staying informed about filing deadlines is crucial for successfully claiming the School Readiness Tax Credit. Typically, applications must be submitted by a specific date each year, often aligned with the general tax filing season. It is advisable to check the current year’s deadlines and ensure that your application is submitted on time to avoid missing out on potential credits.

Form Submission Methods for the School Readiness Tax Credit

Taxpayers have various options for submitting their applications for the School Readiness Tax Credit. Common methods include:

- Online submission through the state tax department’s website.

- Mailing a printed application to the designated tax office.

- In-person submission at local tax offices or designated locations.

Choosing the right submission method can help ensure that your application is processed efficiently.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the school readiness tax credit actstaff member application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 tax form and why is it important?

The 2024 tax form is a crucial document that individuals and businesses must complete to report their income and calculate their tax obligations for the year. Understanding the requirements of the 2024 tax form can help ensure compliance with tax laws and avoid penalties. Using airSlate SignNow can simplify the process of preparing and signing these forms electronically.

-

How can airSlate SignNow help with the 2024 tax form?

airSlate SignNow provides an easy-to-use platform for businesses to send and eSign the 2024 tax form securely. With features like templates and automated workflows, you can streamline the process of gathering signatures and ensure that all necessary documents are completed accurately. This efficiency can save time and reduce errors during tax season.

-

Is there a cost associated with using airSlate SignNow for the 2024 tax form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when handling the 2024 tax form. These plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose a plan that fits your budget while still accessing essential features for document management.

-

What features does airSlate SignNow offer for managing the 2024 tax form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all of which are beneficial for managing the 2024 tax form. These tools help you create, send, and sign documents efficiently, ensuring that you stay organized during tax season. Additionally, the platform is user-friendly, making it accessible for all team members.

-

Can I integrate airSlate SignNow with other software for the 2024 tax form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the 2024 tax form alongside your existing tools. Whether you use accounting software or CRM systems, these integrations enhance your workflow and ensure that all your documents are in sync. This connectivity can signNowly improve your overall efficiency.

-

What are the benefits of using airSlate SignNow for the 2024 tax form?

Using airSlate SignNow for the 2024 tax form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick electronic signatures, which can expedite the filing process. Additionally, you can access your documents from anywhere, making it easier to manage your tax obligations on the go.

-

Is airSlate SignNow secure for handling the 2024 tax form?

Yes, airSlate SignNow prioritizes security, ensuring that your 2024 tax form and other sensitive documents are protected. The platform employs advanced encryption and complies with industry standards to safeguard your data. You can confidently use airSlate SignNow, knowing that your information is secure during the signing and storage processes.

Get more for School Readiness Tax Credit ActStaff Member Application

- Specialty select from drop down form

- Request for a specialty clinic appointment form

- You have been scheduled for your new patient appointment on at form

- Thank you for choosing dynamic pain and wellness form

- Member forms arkansas blue cross and blue shield

- Bcbs companies and licenseesblue cross blue shield form

- Group employee vision application and change form

- Arizona state trauma registry data request form

Find out other School Readiness Tax Credit ActStaff Member Application

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template