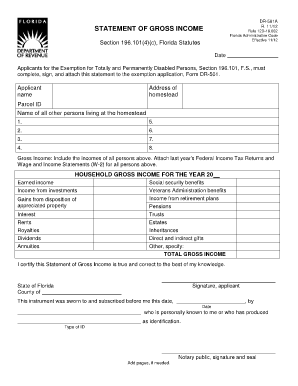

STATEMENT of GROSS INCOME, Used with DR 501, 416, 416B Form

What is the statement of gross income used with DR 501, 416, 416B

The statement of gross income is a crucial document used in conjunction with the DR 501, 416, and 416B forms. It serves to provide a comprehensive overview of an individual's or entity's total earnings over a specified period. This statement is often required for various applications, including tax filings and financial assessments, ensuring transparency and accuracy in reported income. It typically includes wages, salaries, bonuses, and other forms of compensation, which are essential for determining eligibility for benefits or loans.

Steps to complete the statement of gross income used with DR 501, 416, 416B

Completing the statement of gross income involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including pay stubs, tax returns, and any additional income sources. Next, calculate your total gross income by summing all earnings for the reporting period. It is important to clearly categorize different types of income, such as employment income, self-employment income, and other earnings. Once the figures are compiled, fill out the DR 501 form accurately, ensuring that all information aligns with the statement of gross income. Finally, review the completed form for any errors before submission.

Legal use of the statement of gross income used with DR 501, 416, 416B

The statement of gross income must adhere to specific legal standards to be considered valid. It should reflect accurate and truthful information, as providing false data can lead to legal repercussions, including penalties or denial of applications. The document must also comply with relevant state and federal regulations governing income reporting. By using a reliable digital platform, such as signNow, individuals can ensure that their electronic signatures and submissions meet the necessary legal requirements, reinforcing the document's legitimacy.

Key elements of the statement of gross income used with DR 501, 416, 416B

Several key elements are essential for a complete statement of gross income. These include:

- Identification Information: Full name, address, and Social Security number or Tax ID.

- Income Sources: Detailed breakdown of all income types, including wages, self-employment earnings, and any additional income.

- Time Period: Clearly defined reporting period for the income stated.

- Supporting Documentation: Attachments such as pay stubs or tax returns that validate the reported income.

How to obtain the statement of gross income used with DR 501, 416, 416B

Obtaining the statement of gross income typically involves collecting information from various sources. Individuals can request documentation from their employers, such as W-2 forms, or compile personal records of income from self-employment or freelance work. For those who have filed taxes, tax returns can serve as a primary source of income information. Additionally, financial institutions may provide statements that reflect income for loans or other financial assessments. It is advisable to ensure all documents are current and accurately reflect the income for the reporting period.

Examples of using the statement of gross income used with DR 501, 416, 416B

The statement of gross income can be utilized in various scenarios. For instance, when applying for a mortgage, lenders often require this statement to assess the applicant's financial stability and ability to repay the loan. Similarly, when applying for government assistance programs, individuals may need to submit this statement to demonstrate their income level. Additionally, self-employed individuals may use the statement to provide proof of income for tax purposes or when seeking business loans. Each example highlights the importance of accurately reporting income to meet specific requirements.

Quick guide on how to complete statement of gross income used with dr 501 416 416b

Effortlessly prepare STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B on any device

The management of online documents has gained signNow traction among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed materials, allowing you to find the right form and securely keep it online. airSlate SignNow provides all the tools you need to swiftly create, edit, and eSign your documents without delays. Handle STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B on any device using the airSlate SignNow applications for Android or iOS and streamline your document-related processes today.

How to edit and eSign STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B with ease

- Obtain STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for such purposes.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or shared link, or download it to your computer.

Say goodbye to lost or misplaced documents, lengthy form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks, from any device you prefer. Edit and eSign STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B and ensure seamless communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the statement of gross income used with dr 501 416 416b

How to generate an eSignature for the Statement Of Gross Income Used With Dr 501 416 416b online

How to generate an eSignature for the Statement Of Gross Income Used With Dr 501 416 416b in Google Chrome

How to make an electronic signature for putting it on the Statement Of Gross Income Used With Dr 501 416 416b in Gmail

How to create an eSignature for the Statement Of Gross Income Used With Dr 501 416 416b from your smartphone

How to make an electronic signature for the Statement Of Gross Income Used With Dr 501 416 416b on iOS

How to generate an eSignature for the Statement Of Gross Income Used With Dr 501 416 416b on Android devices

People also ask

-

What is a STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B?

The STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B, is a crucial document for individuals applying for various financial assistance programs. It provides a clear overview of your income sources, which is essential for determining eligibility. By utilizing this statement, applicants can ensure that their financial information is accurately represented.

-

How can airSlate SignNow help me manage my STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B?

airSlate SignNow simplifies the process of creating and signing your STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B. Our platform allows you to easily prepare, eSign, and share this document securely. With intuitive features, you can ensure your statements are always up-to-date and compliant.

-

What features does airSlate SignNow offer for handling the STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B?

airSlate SignNow offers robust features for managing your STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B, including customizable templates, eSignature capabilities, and document tracking. These tools enhance efficiency and ensure that you can manage your documents effectively from anywhere, anytime.

-

Is airSlate SignNow a cost-effective solution for creating a STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B?

Yes, airSlate SignNow is a cost-effective solution for creating your STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B. Our pricing plans are designed to fit various budgets while providing the essential features you need to streamline your document processes without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for managing my STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, allowing you to manage your STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B alongside your other business tools. This integration enhances your workflow and ensures that all your documents are easily accessible.

-

How secure is my data when using airSlate SignNow for my STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B?

Security is a top priority at airSlate SignNow. When you create and manage your STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B, your data is protected with advanced encryption and compliance measures. You can trust that your sensitive information is safe throughout the signing and storage process.

-

What are the benefits of using airSlate SignNow for my STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B?

Using airSlate SignNow for your STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B brings numerous benefits, including increased efficiency, reduced paperwork, and easy access to documents. Our user-friendly platform ensures that you can quickly create, sign, and send your statements without hassle.

Get more for STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B

Find out other STATEMENT OF GROSS INCOME, Used With DR 501, 416, 416B

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document