SC1120S3095 PDF Form

What is the SC1120S3095 PDF

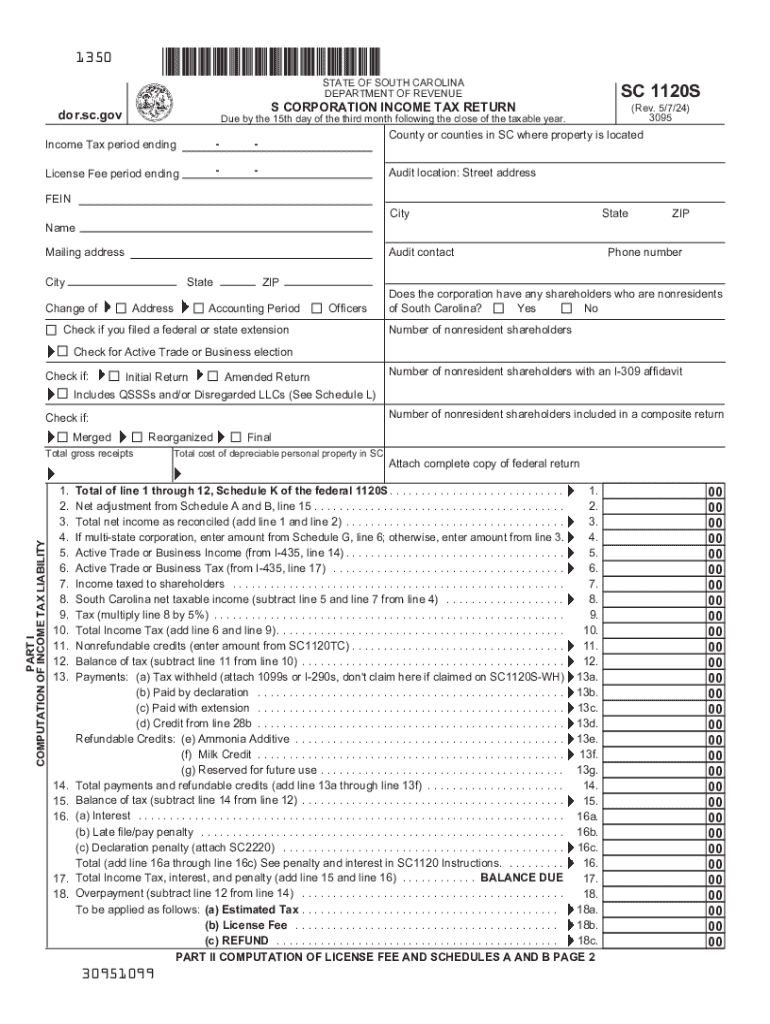

The SC1120S3095 PDF is the official form used by S corporations in South Carolina to report their income, deductions, and credits to the state. This form is specifically designed for S corporations that have elected to be taxed under Subchapter S of the Internal Revenue Code. The SC1120S3095 is essential for ensuring compliance with state tax laws, allowing businesses to accurately report their financial activities and determine their tax liabilities.

Steps to Complete the SC1120S3095 PDF

Completing the SC1120S3095 PDF involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Fill out the identification section with the corporation's name, address, and federal employer identification number (EIN).

- Report total income, deductions, and credits as applicable, following the instructions provided for each section.

- Calculate the total tax owed or refund due based on the information provided.

- Sign and date the form, ensuring that it is submitted by the appropriate deadline.

Filing Deadlines / Important Dates

For S corporations in South Carolina, the filing deadline for the SC1120S3095 is typically the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is March 15. It is important to be aware of any changes in deadlines or extensions that may be applicable, especially in light of state-specific regulations.

Required Documents

When preparing the SC1120S3095 PDF, S corporations must have several documents on hand:

- Financial statements, including profit and loss statements and balance sheets.

- Prior year tax returns for reference.

- Documentation of any credits or deductions claimed.

- SC1120S K-1 forms for shareholders, detailing each shareholder's share of income, deductions, and credits.

Form Submission Methods

The SC1120S3095 can be submitted through various methods to ensure compliance with state regulations:

- Online submission through the South Carolina Department of Revenue's e-filing system, if available.

- Mailing a printed copy of the completed form to the appropriate address specified by the state.

- In-person submission at designated tax offices, which may be beneficial for those needing immediate assistance.

Key Elements of the SC1120S3095 PDF

The SC1120S3095 PDF includes several critical sections that must be accurately completed:

- Identification information for the corporation.

- Income and deductions, including specific lines for various types of income.

- Tax credits that the corporation may qualify for, which can reduce overall tax liability.

- Signature and verification section, ensuring that the form is signed by an authorized representative.

Eligibility Criteria

To file the SC1120S3095, a corporation must meet certain eligibility criteria:

- The corporation must have elected S corporation status with the IRS.

- It must be registered to do business in South Carolina.

- Shareholders must meet the requirements set forth by both federal and state regulations regarding S corporations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc1120s3095 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a South Carolina S Corp tax return?

A South Carolina S Corp tax return is a specific tax filing required for S corporations operating in South Carolina. This return reports the income, deductions, and credits of the corporation, ensuring compliance with state tax laws. Understanding this process is crucial for S Corp owners to avoid penalties and optimize their tax obligations.

-

How can airSlate SignNow help with filing a South Carolina S Corp tax return?

airSlate SignNow streamlines the document signing process, making it easier to gather necessary signatures for your South Carolina S Corp tax return. With our user-friendly platform, you can quickly send, sign, and store tax documents securely. This efficiency helps ensure that your tax return is filed accurately and on time.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing your South Carolina S Corp tax return. These tools simplify the process of preparing and submitting your tax documents, ensuring you have everything you need at your fingertips. Additionally, our platform integrates seamlessly with various accounting software.

-

Is airSlate SignNow cost-effective for small businesses handling South Carolina S Corp tax returns?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing their South Carolina S Corp tax return. Our pricing plans are competitive, allowing you to choose a package that fits your budget while still providing essential features. This affordability helps small businesses save on administrative costs associated with tax filing.

-

Can I integrate airSlate SignNow with my accounting software for South Carolina S Corp tax returns?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to manage your South Carolina S Corp tax return. This integration allows for seamless data transfer, reducing the risk of errors and ensuring that your financial records are up-to-date. You can focus more on your business while we handle the paperwork.

-

What are the benefits of using airSlate SignNow for my South Carolina S Corp tax return?

Using airSlate SignNow for your South Carolina S Corp tax return provides numerous benefits, including enhanced efficiency, improved accuracy, and secure document management. Our platform allows you to quickly gather signatures and track document status, which can signNowly reduce the time spent on tax preparation. This means you can focus more on growing your business.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive tax documents, including your South Carolina S Corp tax return. Our platform ensures that your data is safe from unauthorized access while providing a reliable way to manage your documents. You can trust us to keep your information confidential and secure.

Get more for SC1120S3095 pdf

- Direct credit authorisation form only original and completed

- Wwwjudctgov webforms formsexemption claim form connecticut judicial branch

- 2022 students of the year application packet pdf louisiana form

- Imm 5444e form 2020 2021

- Studentaidgovfafsaannouncementsfederal student aid form

- Notice of application for accelerated connecticut form

- 2021 federal poverty level chart pdf search for federal form

- Custodyvisitation on an ex parte basis self help form packet

Find out other SC1120S3095 pdf

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure