DR 15 R 0125 Sales and Use Tax Return Rule 12A 1 Form

Understanding the DR 15 R 0125 Sales And Use Tax Return

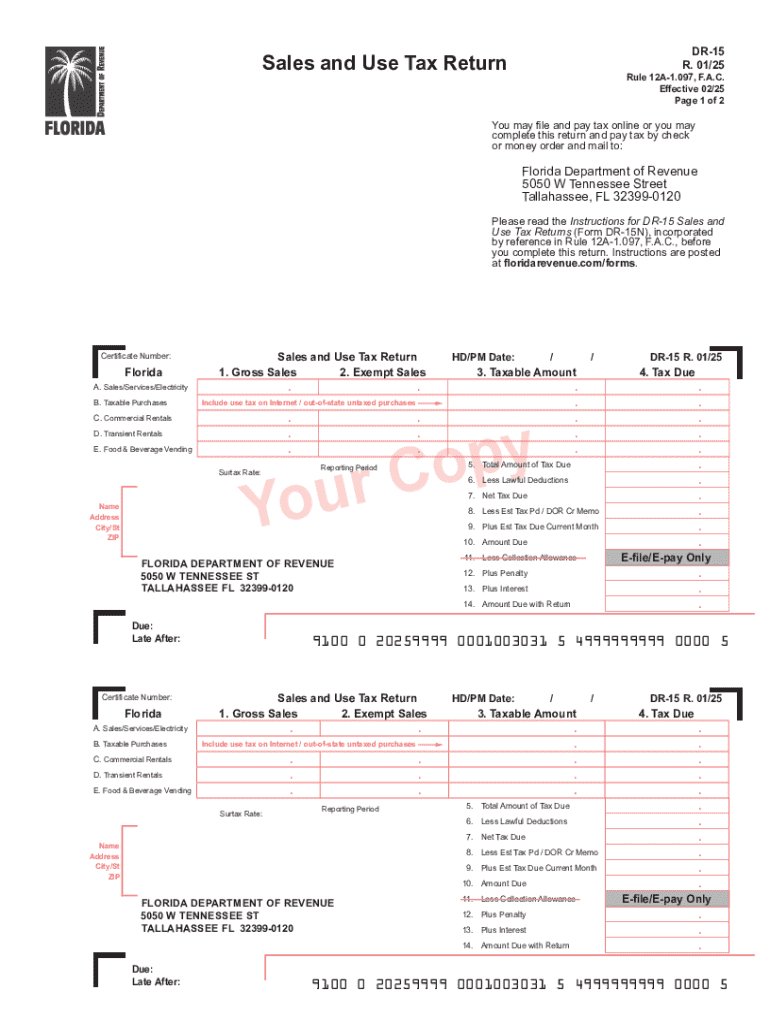

The DR 15 R 0125 Sales and Use Tax Return is a crucial document for businesses operating in Florida. It is used to report sales tax collected from customers and to remit the appropriate amount to the Florida Department of Revenue. This form is essential for compliance with state tax laws and helps ensure that businesses fulfill their tax obligations accurately. Understanding the details of this form, including its purpose and requirements, is vital for any business owner.

Steps to Complete the DR 15 R 0125 Sales And Use Tax Return

Completing the DR 15 R 0125 involves several important steps:

- Gather all necessary sales records for the reporting period.

- Calculate the total sales and any exempt sales that occurred.

- Determine the total sales tax collected based on applicable rates.

- Fill out the form accurately, ensuring all figures are correct.

- Review the completed form for any errors before submission.

Following these steps helps ensure that the return is completed accurately and submitted on time.

Required Documents for Filing the DR 15 R 0125

When preparing to file the DR 15 R 0125, several documents are essential:

- Sales records, including invoices and receipts.

- Any exemption certificates for tax-exempt sales.

- Previous tax returns for reference.

- Bank statements that reflect sales activity.

Having these documents ready will streamline the filing process and help ensure accuracy.

Filing Deadlines for the DR 15 R 0125

It is important to be aware of the filing deadlines for the DR 15 R 0125. Generally, the return is due on the first day of the month following the end of the reporting period. For example, if you are filing for the month of January, the return is due by February 1. Missing these deadlines can result in penalties and interest on unpaid taxes.

Penalties for Non-Compliance with Sales Use Tax Regulations

Failure to comply with sales use tax regulations can lead to significant penalties. Common penalties include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, calculated from the due date.

- Potential audits or increased scrutiny from the Florida Department of Revenue.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Examples of Using the DR 15 R 0125 in Business Scenarios

Businesses of various types utilize the DR 15 R 0125 for reporting sales tax. For instance:

- A retail store collects sales tax on each transaction and files the return monthly.

- An online business must report sales tax for sales made to Florida residents.

- A service provider may need to account for sales tax on taxable services rendered.

Each of these scenarios highlights the diverse applications of the DR 15 R 0125 across different business models.

Handy tips for filling out DR 15 R 0125 Sales And Use Tax Return Rule 12A 1 online

Quick steps to complete and e-sign DR 15 R 0125 Sales And Use Tax Return Rule 12A 1 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant solution for maximum simplicity. Use signNow to electronically sign and share DR 15 R 0125 Sales And Use Tax Return Rule 12A 1 for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 15 r 0125 sales and use tax return rule 12a 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is sales use tax and how does it affect my business?

Sales use tax is a tax imposed on the sale of goods and services. It affects your business by requiring you to collect and remit this tax on taxable transactions. Understanding sales use tax is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with sales use tax documentation?

airSlate SignNow streamlines the process of managing sales use tax documentation by allowing you to easily send and eSign necessary forms. This ensures that all your tax-related documents are organized and accessible, helping you stay compliant with sales use tax regulations.

-

What features does airSlate SignNow offer for managing sales use tax?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning, which are essential for managing sales use tax documentation efficiently. These features help reduce errors and save time, making tax compliance easier for your business.

-

Is airSlate SignNow cost-effective for small businesses dealing with sales use tax?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing sales use tax. With affordable pricing plans, it provides essential tools to streamline tax documentation without breaking the bank, ensuring you can focus on growing your business.

-

Can I integrate airSlate SignNow with my accounting software for sales use tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage sales use tax documentation alongside your financial records. This integration simplifies the process of tracking and reporting sales use tax, enhancing your overall efficiency.

-

What are the benefits of using airSlate SignNow for sales use tax compliance?

Using airSlate SignNow for sales use tax compliance offers numerous benefits, including improved accuracy, faster processing times, and enhanced security for your documents. These advantages help ensure that your business remains compliant with sales use tax regulations while minimizing the risk of errors.

-

How does airSlate SignNow ensure the security of sales use tax documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your sales use tax documents. This ensures that sensitive information remains confidential and secure, giving you peace of mind while managing your tax compliance.

Get more for DR 15 R 0125 Sales And Use Tax Return Rule 12A 1

- Fillable online form it 203 gr att c fax email print

- Printable new york form it 221 disability income exclusion

- Form it 112 c ampquotnew york state resident credit for taxes

- Pdf form it 204 cp new york corporate partners schedule k 1 tax

- Form it 203 gr group return for nonresident partners tax

- Form it 6111 claim for brownfield redevelopment tax credit tax year 2021

- Fillable online form it 203 att2019other tax credits and

- Wwwtaxformfinderorgindexnewyorknew york form ct 261 claim for empire state film post

Find out other DR 15 R 0125 Sales And Use Tax Return Rule 12A 1

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation