Mail to Florida Department of Revenue 5050 W Tenn 2024-2026

Understanding the Mail To Florida Department Of Revenue 5050 W Tenn

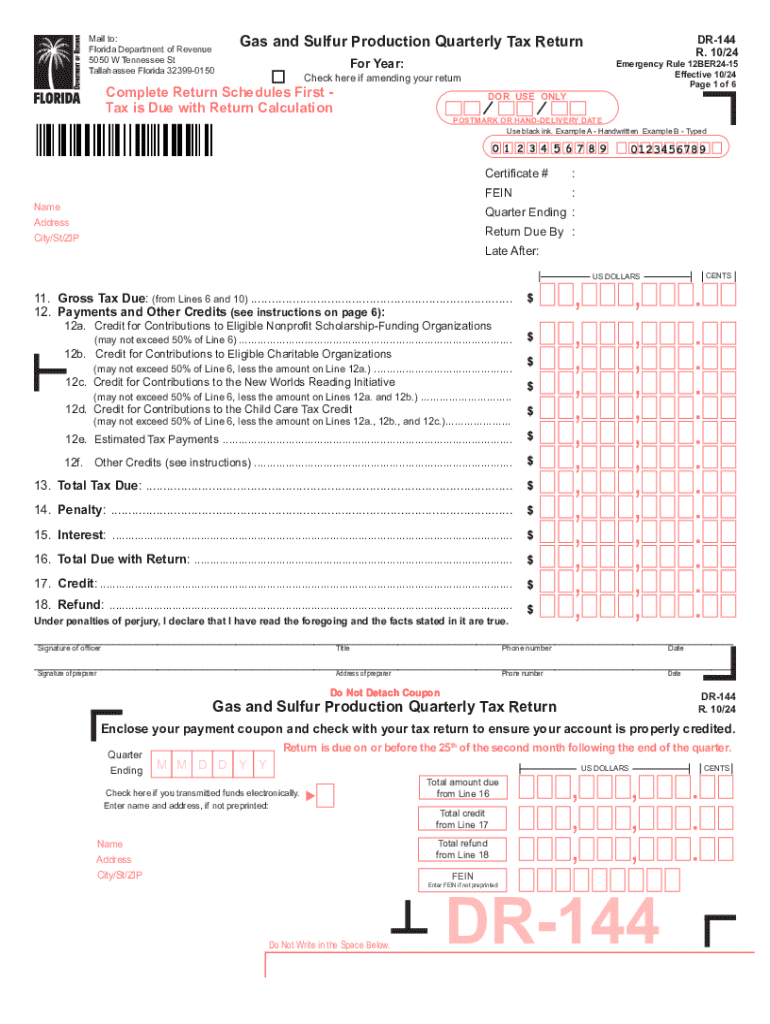

The Mail To Florida Department Of Revenue 5050 W Tenn is a specific address used for submitting various tax-related documents to the Florida Department of Revenue. This location is essential for individuals and businesses needing to communicate with the state regarding tax filings, payments, and other compliance matters. Ensuring that documents are sent to the correct address helps avoid delays and potential penalties associated with misdirected submissions.

Steps to Complete the Mail To Florida Department Of Revenue 5050 W Tenn

To successfully complete your submission to the Florida Department of Revenue at 5050 W Tenn, follow these steps:

- Gather all necessary documents related to your tax filing or inquiry.

- Ensure that each document is completed accurately and signed where required.

- Make copies of all documents for your records.

- Prepare an envelope addressed to the Florida Department of Revenue, 5050 W Tenn, ensuring all information is correct.

- Include any required payment, if applicable, in the envelope.

- Mail the envelope using a reliable postal service to ensure timely delivery.

Required Documents for Submission

When mailing documents to the Florida Department of Revenue at 5050 W Tenn, it is crucial to include the appropriate paperwork. Commonly required documents may include:

- Completed tax forms, such as the Florida corporate income tax return.

- Payment vouchers or checks for any taxes owed.

- Supporting documents that validate deductions or credits claimed.

- Any correspondence related to previous filings or inquiries.

Legal Use of the Mail To Florida Department Of Revenue 5050 W Tenn

Utilizing the Mail To Florida Department Of Revenue 5050 W Tenn is a legally recognized method for submitting tax documents. It is important to follow state guidelines regarding the type of documents that can be sent and to ensure that submissions are made within designated deadlines. Adhering to these legal requirements helps maintain compliance and avoid any penalties associated with late or incorrect submissions.

Filing Deadlines and Important Dates

Being aware of filing deadlines is essential when sending documents to the Florida Department of Revenue. Key dates include:

- Annual tax return due dates, typically April fifteenth for individuals.

- Quarterly estimated tax payment deadlines for businesses.

- Specific dates for submitting various forms related to state tax obligations.

Marking these dates on your calendar can help ensure timely submissions and compliance.

Examples of Using the Mail To Florida Department Of Revenue 5050 W Tenn

Individuals and businesses utilize the Mail To Florida Department Of Revenue 5050 W Tenn for various purposes, including:

- Filing annual tax returns for personal income or corporate taxes.

- Submitting amendments to previously filed tax returns.

- Responding to notices or requests for additional information from the Department of Revenue.

Each of these examples highlights the importance of accurate and timely communication with the state tax authority.

Create this form in 5 minutes or less

Find and fill out the correct mail to florida department of revenue 5050 w tenn 771897050

Create this form in 5 minutes!

How to create an eSignature for the mail to florida department of revenue 5050 w tenn 771897050

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Why would I get mail from the Florida Department of Revenue?

Florida DOR is usually for sales tax or possibly child support. Someone may have also given them an old or incorrect number. They are also working from home though I believe it does show up as DOR.

-

Where do I mail my state tax return in Florida?

If you do not have a window- style return envelope, mail your return and payment to: Florida Department of Revenue 5050 W Tennessee St Tallahassee FL 32399-0120 Due Dates: Tax returns and payments are due on the 1st and late after the 20th day of the month following each reporting period.

-

How do tax returns work in Florida?

Because Florida does not collect individual income tax, you will not get a tax refund in Florida for individual taxes.

-

Do Florida residents have to file state income tax returns?

Florida does not have a state income tax. The deadline for filing a 2024 federal tax return is April 15, 2025, or Oct. 15, 2025, with an extension.

-

Where do I mail my tax return if I live in Florida?

Where to File Addresses for Individual Taxpayers Filing Form 1040 Form 1040 Addresses for Individual Taxpayers If you live in ...then use this address if you ... Florida* or Georgia* Department of the Treasury Internal Revenue Service Atlanta, GA 39901-0002 Internal Revenue Service P.O. Box 105017 Atlanta, GA 30348-50178 more rows

-

Where do I mail my Florida sales tax?

If you do not have a window- style return envelope, mail your return and payment to: Florida Department of Revenue 5050 W Tennessee St Tallahassee FL 32399-0120 Due Dates: Tax returns and payments are due on the 1st and late after the 20th day of the month following each reporting period.

-

Where do I mail my IRS tax return if I live in Florida?

Florida Filing Form...Not enclosing a payment use this address...Enclosing a payment use this address... 4868 Department of the Treasury Internal Revenue Service Austin, TX 73301-0045 Internal Revenue Service P.O. Box 1302 Charlotte, NC 28201-13025 more rows • Dec 18, 2024

-

How do I email the Florida Department of Revenue?

Email Taxpayer Services taxpayerservices-contact@floridarevenue.com. fdortaxpayerservices@floridarevenue.com. FDORSpanish@floridarevenue.com. Search Frequently Asked Questions. or Ask a Tax Question.

Get more for Mail To Florida Department Of Revenue 5050 W Tenn

- Schedule j form 990 department of the treasury internal

- Packet r application for refund of motor vehicle payment form

- Wwwirsgovpubirs pdf2021 form 5695 internal revenue service

- Audits by mailwhat to docozby ampamp company llc form

- Form 320 c gross production request for change

- Form 945 x instructions for adjusted annual return of

- Fillable online tax virginia form fwv application for farm

- Do note write in this box form

Find out other Mail To Florida Department Of Revenue 5050 W Tenn

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form