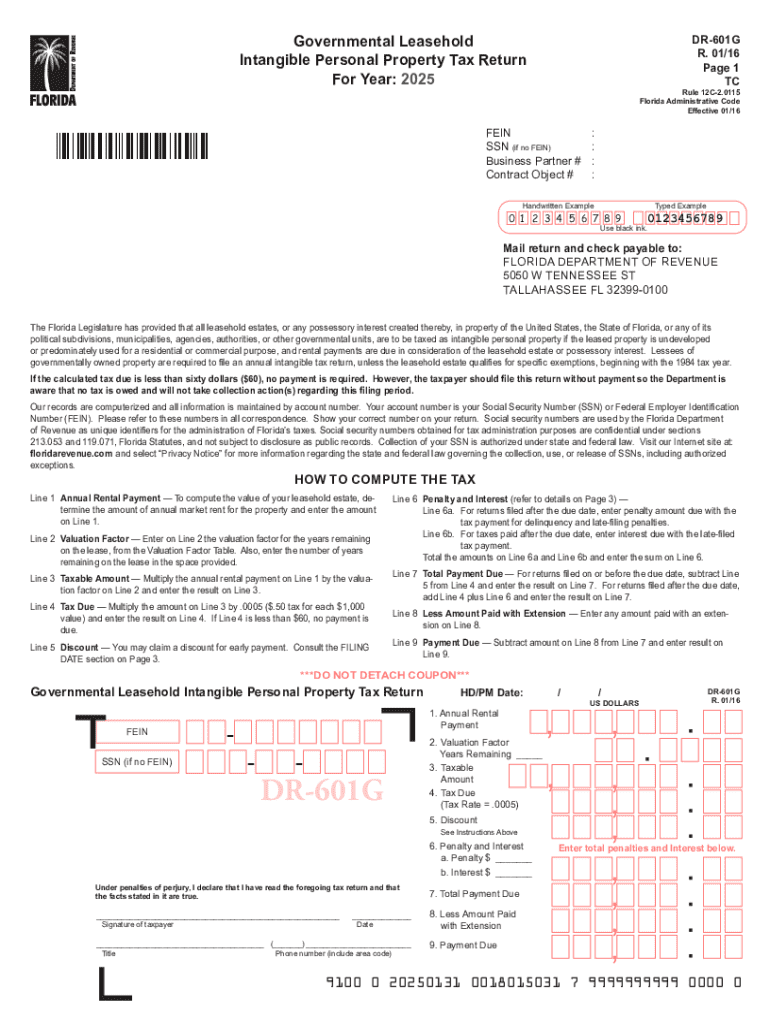

Governmental Leasehold Intangible Personal Propert Form

Understanding the Governmental Leasehold Intangible Personal Property

The Governmental Leasehold Intangible Personal Property refers to specific rights associated with leasehold interests held by governmental entities in Florida. This type of property is not tangible but represents a legal interest in land or property that is leased. It is crucial for entities engaged in leasing arrangements with government bodies to understand how this form of property is classified and treated under Florida law.

In Florida, leasehold interests can be subject to various regulations and tax implications. These interests may arise from agreements where a governmental body leases property to private entities or individuals. Understanding the nuances of this classification helps in compliance with state regulations and ensures proper tax treatment.

Steps to Complete the Governmental Leasehold Intangible Personal Property Form

Completing the Governmental Leasehold Intangible Personal Property form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the leasehold interest, including the lease agreement and any amendments. Next, accurately fill out the form, ensuring that all required fields are completed. It is essential to provide precise information regarding the property, including its location, the nature of the lease, and the parties involved.

Once the form is completed, review it for any errors or omissions. After confirming that all information is correct, submit the form according to the specified submission methods, whether online, by mail, or in person. Keeping a copy of the submitted form and any supporting documents is advisable for your records.

Legal Use of the Governmental Leasehold Intangible Personal Property

The legal use of the Governmental Leasehold Intangible Personal Property is governed by state laws and regulations. This form is essential for ensuring that leasehold interests are properly recognized and taxed. It is important for businesses and individuals to understand their legal obligations when engaging in lease agreements with government entities.

Entities must comply with Florida statutes regarding the reporting and taxation of leasehold interests. Failure to adhere to these regulations can result in penalties or legal complications. Therefore, consulting with a legal professional knowledgeable in Florida property law can provide valuable insights and guidance.

Required Documents for the Governmental Leasehold Intangible Personal Property

When preparing to complete the Governmental Leasehold Intangible Personal Property form, several documents are required. These typically include:

- The original lease agreement

- Any amendments or modifications to the lease

- Proof of payment for any applicable fees or taxes

- Identification of the parties involved in the lease

Having these documents readily available will streamline the process and help ensure compliance with state requirements.

Filing Deadlines and Important Dates

Filing deadlines for the Governmental Leasehold Intangible Personal Property form are crucial for compliance. In Florida, the deadline for submitting the form typically aligns with the annual property tax assessment cycle. It is important to stay informed about specific dates, as late submissions may incur penalties.

Entities should mark their calendars with important dates related to the filing process and any associated payment deadlines to avoid any disruptions in their leasehold arrangements.

Eligibility Criteria for the Governmental Leasehold Intangible Personal Property

Eligibility for the Governmental Leasehold Intangible Personal Property form generally depends on the nature of the leasehold interest and the parties involved. Typically, entities that hold a leasehold interest in property owned by a governmental body are eligible to file this form. This includes businesses and individuals who have entered into lease agreements with state or local government entities.

Understanding the eligibility criteria is vital for ensuring that the correct parties are filing the form and that all necessary documentation is provided to support the application.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the governmental leasehold intangible personal propert

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Florida leasehold?

A Florida leasehold is a legal agreement where a tenant has the right to occupy and use a property for a specified period, typically in exchange for rent. This type of arrangement is common in Florida, especially for commercial properties. Understanding the terms of a Florida leasehold is crucial for both landlords and tenants to ensure compliance and protect their rights.

-

How does airSlate SignNow facilitate Florida leasehold agreements?

airSlate SignNow simplifies the process of creating and signing Florida leasehold agreements by providing an intuitive platform for eSigning documents. Users can easily upload their lease agreements, add necessary fields, and send them for signature. This streamlines the leasing process, making it faster and more efficient.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for small businesses and larger enterprises. Each plan includes features that support the management of Florida leasehold agreements, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Florida leasehold documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all designed to enhance the management of Florida leasehold documents. These tools help ensure that all parties can easily access and sign agreements, reducing the risk of errors and delays. Additionally, the platform supports real-time tracking of document status.

-

Can airSlate SignNow integrate with other software for Florida leasehold management?

Yes, airSlate SignNow offers integrations with various software applications that can enhance your Florida leasehold management process. This includes CRM systems, document management tools, and accounting software. These integrations help streamline workflows and ensure that all aspects of lease management are connected and efficient.

-

What are the benefits of using airSlate SignNow for Florida leasehold agreements?

Using airSlate SignNow for Florida leasehold agreements provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround, which is essential in the fast-paced real estate market. Additionally, eSigning ensures that all agreements are legally binding and securely stored.

-

Is airSlate SignNow compliant with Florida leasehold laws?

Yes, airSlate SignNow is designed to comply with Florida leasehold laws, ensuring that your documents meet legal requirements. The platform provides templates that are tailored to Florida regulations, helping users create valid and enforceable lease agreements. This compliance is crucial for protecting both landlords and tenants in leasehold transactions.

Get more for Governmental Leasehold Intangible Personal Propert

- About form 709 united states gift and irs tax forms

- 2021 instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return

- Form 943 employers annual federal tax return for

- Form 8582 fill out and sign printable pdf templatesignnow

- Form 8833 fillable treaty based return position disclosure

- 2021 form 1095 b health coverage

- 2017 2021 form il dsd cdts 8 fill online printable

- Instructions for form 1040 x rev september 2021 instructions for form 1040 x amended us individual income tax return use with

Find out other Governmental Leasehold Intangible Personal Propert

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form