PRINT CLEAR Form G 4 Rev 081524 STATE of GEOR

Understanding the Georgia G-4 Form

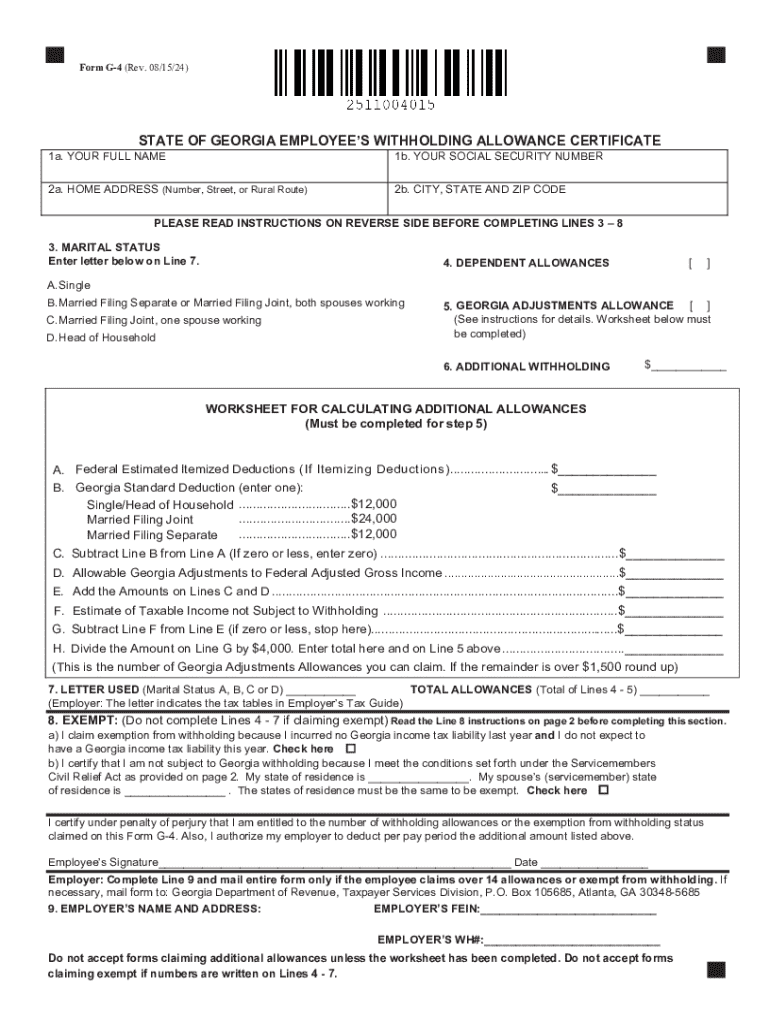

The Georgia G-4 form is a state withholding certificate used by employers to determine the amount of state income tax to withhold from employees' paychecks. This form is essential for ensuring compliance with Georgia state tax regulations. It allows employees to claim allowances based on their personal and financial situations, which can affect their tax withholding amounts. Understanding the purpose and function of this form is crucial for both employers and employees in the state of Georgia.

Steps to Complete the Georgia G-4 Form

Completing the Georgia G-4 form involves several key steps:

- Provide personal information, including your name, address, and Social Security number.

- Indicate your marital status, which can impact your withholding allowances.

- Claim allowances based on your situation, including dependents and other factors that may affect your tax liability.

- Sign and date the form to certify that the information provided is accurate.

It is important to review the completed form for accuracy before submission to avoid any issues with tax withholding.

Obtaining the Georgia G-4 Form

The Georgia G-4 form can be obtained from the Georgia Department of Revenue's website or through your employer. Many employers provide this form during the onboarding process for new employees. Additionally, the form is available in printable format, making it easy to fill out and submit as needed.

Legal Use of the Georgia G-4 Form

The Georgia G-4 form is legally required for employees who wish to adjust their state tax withholding. Employers must ensure that they are withholding the correct amount of state income tax based on the information provided on this form. Failure to comply with withholding regulations can lead to penalties for both employers and employees, making it essential to understand the legal implications of this form.

Key Elements of the Georgia G-4 Form

Several key elements must be included when filling out the Georgia G-4 form:

- Personal Information: Name, address, and Social Security number.

- Marital Status: Indicate whether you are single, married, or head of household.

- Allowances: Claim allowances based on dependents and other considerations.

- Signature: A signature is required to validate the form.

Each of these elements plays a crucial role in determining the correct amount of state tax withholding.

Filing Deadlines and Important Dates

It is important for employees to be aware of any deadlines associated with submitting the Georgia G-4 form. Generally, this form should be submitted to your employer upon starting a new job or when there are changes in your personal or financial situation that affect your withholding. Keeping track of these important dates ensures compliance with state tax laws and prevents any unnecessary withholding issues.

Handy tips for filling out PRINT CLEAR Form G 4 Rev 081524 STATE OF GEOR online

Quick steps to complete and e-sign PRINT CLEAR Form G 4 Rev 081524 STATE OF GEOR online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant solution for optimum simpleness. Use signNow to e-sign and send out PRINT CLEAR Form G 4 Rev 081524 STATE OF GEOR for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the print clear form g 4 rev 081524 state of geor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the Georgia?

airSlate SignNow is a powerful eSignature solution that enables businesses in the Georgia to send and sign documents electronically. It streamlines the signing process, making it faster and more efficient for users in the Georgia. With its user-friendly interface, businesses can easily manage their documents and improve workflow.

-

What are the pricing options for airSlate SignNow in the Georgia?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses in the Georgia. Whether you are a small startup or a large enterprise, you can find a plan that fits your budget. Each plan includes essential features to help you manage your document signing process effectively.

-

What features does airSlate SignNow offer for users in the Georgia?

airSlate SignNow provides a range of features designed to enhance document management for users in the Georgia. Key features include customizable templates, real-time tracking, and secure cloud storage. These tools help businesses streamline their operations and ensure compliance with legal standards.

-

How can airSlate SignNow benefit businesses in the Georgia?

Businesses in the Georgia can benefit from airSlate SignNow by reducing the time and costs associated with traditional document signing. The platform allows for quick turnaround times and enhances collaboration among team members. Additionally, it helps improve customer satisfaction by providing a seamless signing experience.

-

Does airSlate SignNow integrate with other software commonly used in the Georgia?

Yes, airSlate SignNow integrates seamlessly with various software applications that businesses in the Georgia commonly use. This includes CRM systems, project management tools, and cloud storage services. These integrations help streamline workflows and enhance productivity.

-

Is airSlate SignNow secure for users in the Georgia?

Absolutely! airSlate SignNow prioritizes security for its users in the Georgia. The platform employs advanced encryption and complies with industry standards to protect sensitive information. Businesses can trust that their documents are safe and secure while using airSlate SignNow.

-

Can I use airSlate SignNow on mobile devices in the Georgia?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing users in the Georgia to manage their documents on the go. The mobile app provides the same features as the desktop version, ensuring that you can send and sign documents anytime, anywhere. This flexibility is ideal for busy professionals.

Get more for PRINT CLEAR Form G 4 Rev 081524 STATE OF GEOR

- Pdf do 10 power of attorney rev 1 22 kansas department of revenue form

- K 40 individual income kansas department of revenue form

- Business ax application kansas department of tax form

- Wwwtax bracketsorgrhodeislandtaxformsform rirhode island tax bracketsorg federal ampamp state income tax

- Fillable online kansas business tax application part 1 fax form

- Consumers compensating use tax fill out and sign form

- About form 1040 v payment voucherinternal revenue service2020 form 1040 v irs tax forms2020 form 1040 v irs tax forms2020 form

- Business axes for hotels and r kansas department of form

Find out other PRINT CLEAR Form G 4 Rev 081524 STATE OF GEOR

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure