it 711 Partnership Income Tax General Instructions 2024-2026

Understanding the IT 711 Partnership Income Tax General Instructions

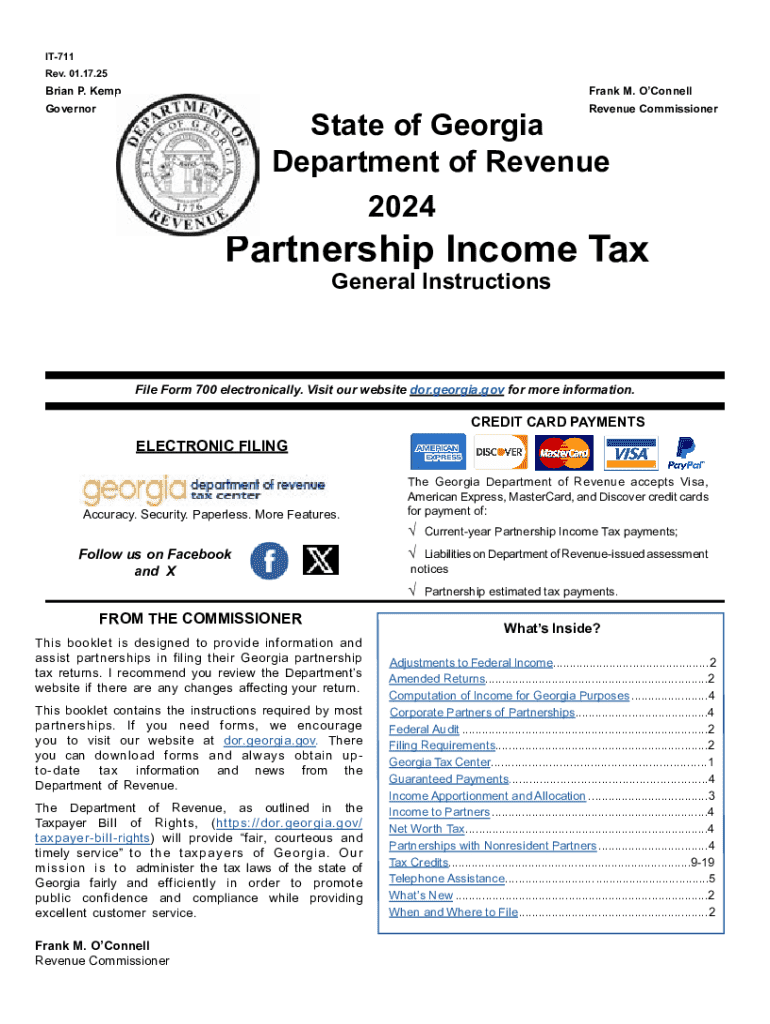

The IT 711 Partnership Income Tax General Instructions provide essential guidelines for partnerships in the United States to accurately report their income, deductions, and credits. This form is specifically designed for partnerships, which are business entities where two or more individuals share ownership and responsibilities. The instructions outline the necessary steps to complete the form, ensuring compliance with federal tax regulations. Understanding these instructions is crucial for partnerships to avoid errors that could lead to penalties or audits.

Steps to Complete the IT 711 Partnership Income Tax General Instructions

Completing the IT 711 form involves several key steps. First, partnerships must gather all necessary financial documents, including income statements, expense records, and prior year tax returns. Next, partnerships should carefully follow the instructions to fill out each section of the form, ensuring that all income and deductions are accurately reported. It is important to double-check calculations and ensure that all required signatures are included. Finally, partnerships must choose a submission method, whether online, by mail, or in person, and adhere to the filing deadlines to avoid late penalties.

Key Elements of the IT 711 Partnership Income Tax General Instructions

The IT 711 instructions cover several critical elements that partnerships must understand. These include the definitions of various terms used in the tax code, the types of income that must be reported, and the specific deductions that partnerships can claim. Additionally, the instructions detail the reporting requirements for partners, including how to allocate income and losses among partners. Understanding these key elements helps ensure that partnerships are compliant with tax laws and can maximize their allowable deductions.

Filing Deadlines and Important Dates

Partnerships must be aware of specific filing deadlines associated with the IT 711 form. Typically, the form is due on the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is generally due by March 15. It is essential for partnerships to mark these dates on their calendars to ensure timely submission and avoid potential penalties for late filing.

Required Documents for the IT 711 Partnership Income Tax General Instructions

To complete the IT 711 form accurately, partnerships need to prepare several key documents. These include financial statements that detail income and expenses, prior year tax returns for reference, and any supporting documentation for deductions claimed. Additionally, partnerships should have records of each partner's capital contributions and distributions. Having these documents organized and readily available streamlines the completion process and helps ensure compliance with tax regulations.

Form Submission Methods for the IT 711 Partnership Income Tax General Instructions

Partnerships have multiple options for submitting the IT 711 form. They can file electronically through approved tax software, which often simplifies the process and reduces the chance of errors. Alternatively, partnerships can submit the form by mail, ensuring it is sent to the correct IRS address based on their location. In-person submissions are also an option, although less common. Regardless of the method chosen, partnerships should keep copies of their submissions for their records.

Create this form in 5 minutes or less

Find and fill out the correct it 711 partnership income tax general instructions 771908958

Create this form in 5 minutes!

How to create an eSignature for the it 711 partnership income tax general instructions 771908958

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IT 711 Partnership Income Tax General Instructions?

The IT 711 Partnership Income Tax General Instructions provide guidelines for partnerships in filing their income tax returns. These instructions help ensure compliance with state tax laws and outline the necessary forms and documentation required for accurate reporting.

-

How can airSlate SignNow assist with the IT 711 Partnership Income Tax General Instructions?

airSlate SignNow simplifies the process of preparing and submitting documents related to the IT 711 Partnership Income Tax General Instructions. Our platform allows users to easily eSign and send necessary tax documents, ensuring a smooth filing experience.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing tax documents like the IT 711 Partnership Income Tax General Instructions. These features enhance efficiency and reduce the risk of errors during the filing process.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing tax documents, including those related to the IT 711 Partnership Income Tax General Instructions. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you get the best value for your document management needs.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your tax documents, including the IT 711 Partnership Income Tax General Instructions. This integration streamlines your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing offers numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security. By utilizing our platform for the IT 711 Partnership Income Tax General Instructions, you can ensure that your documents are handled securely and efficiently.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents, including those related to the IT 711 Partnership Income Tax General Instructions. You can trust our platform to keep your information safe and confidential.

Get more for IT 711 Partnership Income Tax General Instructions

- Arizona 2012 form 140es

- Arizona form 140es individual estimated tax payment azdor

- Arizona schedule apyn itemized deductions for part year residents 397759531 form

- Arizona form 221 taxhow

- Alberta personal tax credits return iatse local 210 form

- Lcdp counseling experience form state of delaware

- Readmission screening and resident review parr l form

- Abbb e rental agreement for use of school facilities form

Find out other IT 711 Partnership Income Tax General Instructions

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now