SC10403075 PDF Form

What is the SC10403075 PDF?

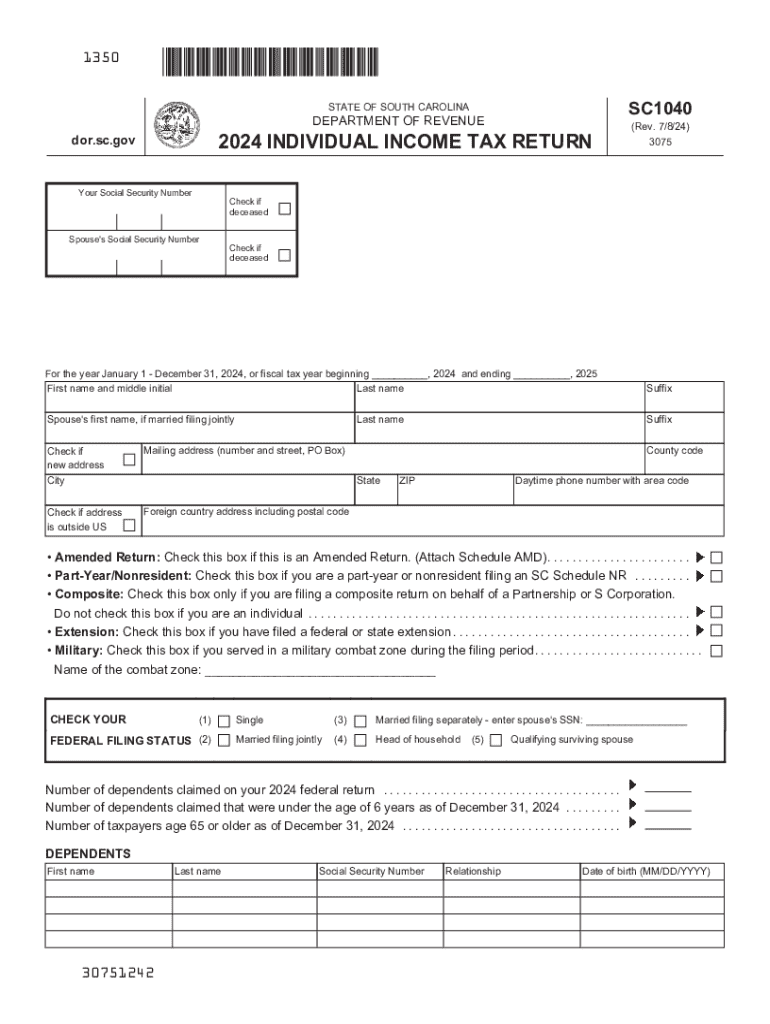

The SC10403075 PDF is a state tax form specifically designed for residents of South Carolina. This form is used for reporting individual income tax, allowing taxpayers to calculate their tax liability based on their income and applicable deductions. It is essential for ensuring compliance with state tax regulations and for accurately reporting financial information to the South Carolina Department of Revenue.

How to Obtain the SC10403075 PDF

To obtain the SC10403075 PDF, taxpayers can visit the official website of the South Carolina Department of Revenue. The form is available for download in a printable format, making it easy for individuals to access and fill out. Additionally, local tax offices may provide physical copies of the form for those who prefer to collect it in person.

Steps to Complete the SC10403075 PDF

Completing the SC10403075 PDF involves several key steps:

- Begin by entering your personal information, including name, address, and Social Security number.

- Report your total income, including wages, interest, and any other sources of income.

- Apply any eligible deductions to reduce your taxable income, ensuring you reference the latest guidelines.

- Calculate your total tax liability based on the provided tax tables for the current year.

- Sign and date the form before submission to confirm the accuracy of the information provided.

Filing Deadlines / Important Dates

Taxpayers in South Carolina should be aware of important filing deadlines for the SC10403075 PDF. Typically, the deadline for submitting this form coincides with the federal tax filing deadline, which is usually April 15. However, it is advisable to check for any specific extensions or changes announced by the South Carolina Department of Revenue for the current tax year.

Form Submission Methods

The SC10403075 PDF can be submitted through various methods, allowing flexibility for taxpayers. Options include:

- Online submission via the South Carolina Department of Revenue's secure portal.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local tax offices, which may offer assistance with the filing process.

Key Elements of the SC10403075 PDF

Key elements of the SC10403075 PDF include:

- Personal identification information, such as name and Social Security number.

- Income reporting sections for various sources of income.

- Deductions and credits applicable to South Carolina taxpayers.

- Tax calculation sections that guide users through determining their tax liability.

- Signature line for verification of the information provided.

Eligibility Criteria

Eligibility to file the SC10403075 PDF generally includes individuals who are residents of South Carolina and have earned income during the tax year. Specific criteria may apply based on income levels, filing status, and other factors. It is essential for taxpayers to review these criteria to ensure they are filing the correct form and claiming all eligible deductions and credits.

Handy tips for filling out SC10403075 pdf online

Quick steps to complete and e-sign SC10403075 pdf online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant solution for optimum straightforwardness. Use signNow to e-sign and share SC10403075 pdf for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc10403075 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it benefit businesses in South Carolina?

airSlate SignNow is a powerful eSignature solution that allows businesses in South Carolina to send and sign documents electronically. This platform streamlines the signing process, reduces paperwork, and enhances efficiency, making it an ideal choice for companies looking to improve their document management.

-

How much does airSlate SignNow cost for businesses in South Carolina?

The pricing for airSlate SignNow varies based on the plan selected, catering to different business needs in South Carolina. We offer flexible pricing options that are designed to be cost-effective, ensuring that businesses of all sizes can benefit from our eSignature solutions.

-

What features does airSlate SignNow offer for users in South Carolina?

airSlate SignNow provides a range of features including customizable templates, real-time tracking, and secure cloud storage. These features are tailored to meet the needs of businesses in South Carolina, helping them manage their documents efficiently and securely.

-

Can airSlate SignNow integrate with other software used by businesses in South Carolina?

Yes, airSlate SignNow offers seamless integrations with various software applications commonly used by businesses in South Carolina. This includes CRM systems, cloud storage services, and productivity tools, allowing for a smooth workflow and enhanced productivity.

-

Is airSlate SignNow compliant with legal standards in South Carolina?

Absolutely! airSlate SignNow complies with all legal standards and regulations for electronic signatures in South Carolina. This ensures that your signed documents are legally binding and secure, giving you peace of mind when managing important agreements.

-

How can airSlate SignNow improve document workflows for South Carolina businesses?

By utilizing airSlate SignNow, businesses in South Carolina can signNowly improve their document workflows. The platform allows for quick sending, signing, and storing of documents, which reduces turnaround time and enhances overall operational efficiency.

-

What types of documents can be signed using airSlate SignNow in South Carolina?

airSlate SignNow supports a wide variety of document types that can be signed electronically in South Carolina. This includes contracts, agreements, forms, and more, making it a versatile tool for any business looking to streamline their document processes.

Get more for SC10403075 pdf

- Mmabatho high school matric upgrade form

- Nsfas lease agreement form 2021

- Gizmos student exploration human homeostasis answer key form

- How to get an i 20 form

- Vehicle registrationtitle application use to register vehicles renew vehicle registration amend or request duplicate vehicle form

- Research literacy project term paper grading rubric bxscience form

- Declaration of conversion to islam elmadina travel form

- Us youth soccer player membership form not required

Find out other SC10403075 pdf

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure