TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B Form

What is the TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B

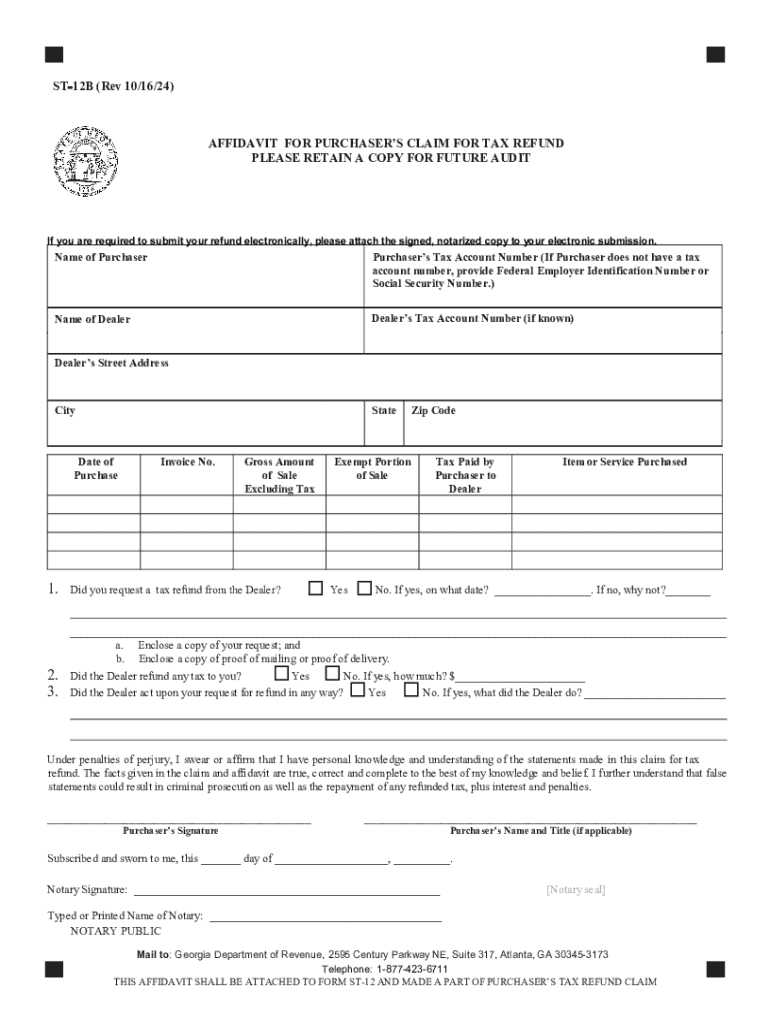

The TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B is a legal document used in the United States for claiming a refund of sales tax. This affidavit is specifically designed for purchasers who have paid sales tax on items that are later returned or for which a refund is warranted due to various reasons. The form serves as a formal declaration, allowing individuals or businesses to assert their right to a refund from the state tax authority.

How to use the TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B

Using the TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B involves several steps. First, ensure that you have all necessary information regarding the sales tax paid, including receipts and transaction details. Next, fill out the affidavit accurately, providing details such as the reason for the refund, the amount of sales tax paid, and any relevant identification numbers. Once completed, submit the affidavit to the appropriate state tax authority, following their specific submission guidelines.

Steps to complete the TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B

Completing the TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B requires careful attention to detail. Follow these steps:

- Gather all relevant documentation, including receipts and proof of sales tax payment.

- Obtain the TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B form from the state tax authority's website or office.

- Fill out the form, ensuring all fields are completed accurately.

- Attach any required supporting documents that substantiate your claim.

- Review the completed form for accuracy before submission.

- Submit the form via the designated method, which may include online, by mail, or in-person.

Eligibility Criteria

To be eligible to use the TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B, the claimant must have paid sales tax on eligible purchases. This includes items that were returned or for which the sales tax was incorrectly charged. Additionally, the claim must be filed within the time limits set by the state tax authority, and the claimant must provide adequate documentation to support the refund request.

Required Documents

When submitting the TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B, it is essential to include certain documents to support your claim. Required documents typically include:

- Original receipts or proof of purchase showing sales tax paid.

- Any correspondence related to the purchase or refund.

- Identification documents if required by the state tax authority.

Form Submission Methods

The TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B can usually be submitted through various methods, depending on the state’s regulations. Common submission methods include:

- Online submission through the state tax authority's website.

- Mailing the completed form and supporting documents to the designated address.

- In-person submission at local tax offices.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tsdpurchasersclaimforsalestaxrefundaffidavitst 12 b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B?

The TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B is a legal document used by purchasers to claim a refund of sales tax paid on eligible purchases. This affidavit is essential for businesses seeking to recover sales tax expenses, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B?

airSlate SignNow simplifies the process of completing and submitting the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B. Our platform allows users to easily fill out, eSign, and send the affidavit, streamlining the refund process and reducing paperwork.

-

What are the pricing options for using airSlate SignNow for the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, our cost-effective solutions ensure that you can efficiently manage the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B without breaking the bank.

-

What features does airSlate SignNow provide for managing the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all tailored to assist with the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B. These tools enhance efficiency and ensure that your documents are processed quickly and securely.

-

Are there any benefits to using airSlate SignNow for the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B?

Using airSlate SignNow for the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B offers numerous benefits, including reduced processing time, improved accuracy, and enhanced security. Our solution helps businesses save time and resources while ensuring compliance with tax regulations.

-

Can airSlate SignNow integrate with other software for the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to manage the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B alongside your existing tools. This integration enhances workflow efficiency and ensures that all your documents are in one place.

-

Is airSlate SignNow user-friendly for completing the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the TSD Purchaser's Claim for Sales Tax Refund Affidavit ST 12 B. Our intuitive interface ensures that users can navigate the platform effortlessly, regardless of their technical expertise.

Get more for TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B

- Mao transportation form

- Abkc registration number lookup form

- Under armour lifetime warranty pdf form

- Marketing media advertising amp technology registration form

- Participant media registration form

- Application amp dues invoice form

- Exhibitor ampampamp sponsor prospectus cancer metastasis through form

- Aviation safety faas near midair collision reporting form

Find out other TSDPurchaser'sClaimforSalesTaxRefundAffidavitST 12 B

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors