Form 512 E Oklahoma Return of Organization Exempt from Income Tax

What is the Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

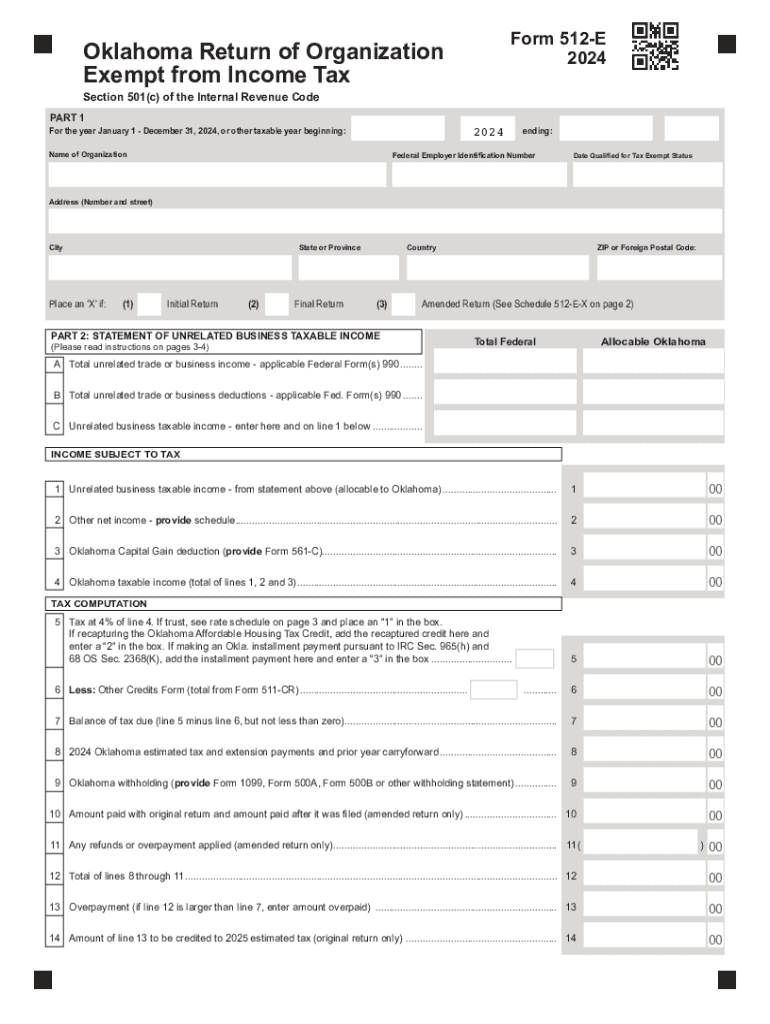

The Oklahoma Form 512 E is specifically designed for organizations that are exempt from income tax. This form allows qualifying entities, such as non-profit organizations, to report their income and maintain their tax-exempt status. It is essential for organizations to accurately complete this form to comply with state regulations and ensure they are recognized as tax-exempt under Oklahoma law.

How to use the Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

Using the Form 512 E involves several key steps. First, organizations must gather all necessary financial information, including income, expenses, and any relevant documentation that supports their tax-exempt status. Next, the form should be filled out accurately, ensuring that all sections are completed according to the guidelines provided by the Oklahoma Tax Commission. Finally, the completed form must be submitted by the designated deadline to avoid any penalties.

Steps to complete the Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

Completing the Form 512 E requires careful attention to detail. Here are the steps to follow:

- Gather financial statements, including income and expense reports.

- Access the latest version of the Form 512 E, which can be downloaded from the Oklahoma Tax Commission website.

- Fill out the organization’s basic information, including name, address, and tax identification number.

- Report all sources of income, ensuring to exclude any income that is not taxable under Oklahoma law.

- Detail the organization’s expenses, which may include operational costs and other expenditures related to maintaining tax-exempt status.

- Review the completed form for accuracy before submission.

Key elements of the Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

The Form 512 E includes several key elements that organizations must pay attention to. These elements consist of the organization’s identification information, a detailed account of income and expenses, and a declaration of tax-exempt status. Additionally, organizations must provide any supporting documentation that verifies their eligibility for tax exemption. Ensuring that all key elements are correctly filled out is crucial for the acceptance of the form.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines associated with the Form 512 E. Typically, the form is due on the fifteenth day of the fifth month following the end of the organization’s fiscal year. It is important to mark this date on the calendar to ensure timely submission and avoid any late fees or penalties. Organizations should also be aware of any specific changes in deadlines that may occur due to state regulations.

Required Documents

To successfully complete the Form 512 E, organizations must gather several required documents. These include:

- Financial statements, including balance sheets and income statements.

- Documentation supporting the organization’s tax-exempt status.

- Records of any income sources and expenses incurred during the reporting period.

- Previous year’s tax return, if applicable.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 512 e oklahoma return of organization exempt from income tax 771915658

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma 512E 2024 form and how can airSlate SignNow help?

The Oklahoma 512E 2024 form is a crucial document for tax purposes in Oklahoma. airSlate SignNow simplifies the process of filling out and eSigning this form, ensuring that you can complete your tax submissions efficiently and securely.

-

How much does airSlate SignNow cost for Oklahoma 512E 2024 users?

airSlate SignNow offers competitive pricing plans tailored for businesses needing to manage documents like the Oklahoma 512E 2024. Our plans are designed to be cost-effective, providing excellent value for the features and integrations included.

-

What features does airSlate SignNow offer for managing the Oklahoma 512E 2024?

With airSlate SignNow, you can easily create, edit, and eSign the Oklahoma 512E 2024 form. Our platform includes features like templates, automated workflows, and secure storage, making document management seamless and efficient.

-

Can I integrate airSlate SignNow with other tools for the Oklahoma 512E 2024?

Yes, airSlate SignNow integrates with various applications to enhance your workflow for the Oklahoma 512E 2024. You can connect with tools like Google Drive, Dropbox, and CRM systems to streamline your document processes.

-

What are the benefits of using airSlate SignNow for the Oklahoma 512E 2024?

Using airSlate SignNow for the Oklahoma 512E 2024 provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your documents are handled efficiently, allowing you to focus on your business.

-

Is airSlate SignNow secure for handling the Oklahoma 512E 2024?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data. You can confidently manage sensitive documents like the Oklahoma 512E 2024 without worrying about unauthorized access.

-

How can I get started with airSlate SignNow for the Oklahoma 512E 2024?

Getting started with airSlate SignNow for the Oklahoma 512E 2024 is easy. Simply sign up for an account, choose a pricing plan that suits your needs, and begin creating and eSigning your documents in minutes.

Get more for Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

- Eviction diversion program edp ownerlandlord application form

- Aggieship application form

- School bus application form

- International acceptance letter normandale community college normandale form

- Please complete this questionnaire attach the requested document see document list below form

- Avoid bad survey questions loaded question leading form

- Sa427 form

- Carer payment medical report sa427 form

Find out other Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure