Form 4868 Sp Online

What is the Form 4868?

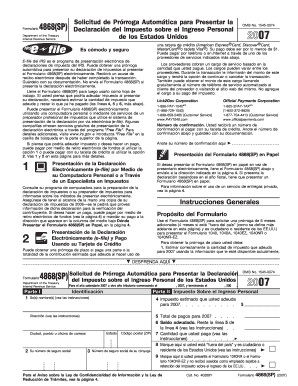

The Form 4868 is an application for an automatic extension of time to file U.S. individual income tax returns. This form allows taxpayers to extend their filing deadline by six months, providing additional time to gather necessary documents and complete their tax returns. It is important to note that while the form extends the filing deadline, it does not extend the time to pay any taxes owed. Taxpayers should estimate their tax liability and pay any amount due to avoid penalties and interest.

Steps to Complete the Form 4868

Completing the Form 4868 involves several straightforward steps:

- Gather necessary information, including your name, address, Social Security number, and estimated tax liability.

- Fill out the form with your personal information and the amount of tax you expect to owe. Ensure that your estimates are as accurate as possible.

- Sign and date the form. If you are filing jointly, your spouse must also sign.

- Submit the completed form either electronically or by mail, depending on your preference.

Legal Use of the Form 4868

The Form 4868 is legally recognized as a valid request for an extension to file your tax return. To ensure compliance with IRS regulations, it is essential to file the form by the original tax deadline. Failure to do so may result in penalties. Additionally, using a reliable eSignature solution, such as signNow, can help ensure that your submission is secure and legally binding. Compliance with eSignature laws, including ESIGN and UETA, is crucial for the validity of electronically signed documents.

Filing Deadlines / Important Dates

For most taxpayers, the deadline to file the Form 4868 is April 15 of the tax year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to submit the form before this deadline to avoid penalties. If you file the form on time, your new deadline to file your tax return will be October 15.

How to Obtain the Form 4868

The Form 4868 is readily available online through the IRS website. You can download a printable version of the form for your convenience. Additionally, many tax preparation software programs include the form, allowing you to complete and file it electronically. Ensure you are using the most current version of the form to avoid any issues with your extension request.

Examples of Using the Form 4868

There are various scenarios in which taxpayers might find the Form 4868 useful:

- A self-employed individual needing more time to compile income and expense records.

- A taxpayer awaiting documents from third parties, such as investment income statements or K-1s.

- Individuals facing personal circumstances, such as illness or family emergencies, that delay their ability to file on time.

Quick guide on how to complete form 4868 sp online

Complete Form 4868 Sp Online effortlessly on any device

Digital document management has become increasingly popular with both companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 4868 Sp Online on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Form 4868 Sp Online without hassle

- Find Form 4868 Sp Online and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device. Modify and electronically sign Form 4868 Sp Online and ensure exceptional communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4868 sp online

How to make an electronic signature for your Form 4868 Sp Online in the online mode

How to make an eSignature for the Form 4868 Sp Online in Chrome

How to make an eSignature for putting it on the Form 4868 Sp Online in Gmail

How to generate an eSignature for the Form 4868 Sp Online straight from your mobile device

How to make an eSignature for the Form 4868 Sp Online on iOS

How to make an eSignature for the Form 4868 Sp Online on Android

People also ask

-

What is Form 4868 Sp Online and how can it help me?

Form 4868 Sp Online is an electronic solution that allows you to file for an extension on your tax return in Spanish. By using airSlate SignNow, you can easily complete and submit this form online, ensuring compliance with the IRS while saving time on paperwork.

-

How do I fill out Form 4868 Sp Online using airSlate SignNow?

Filling out Form 4868 Sp Online with airSlate SignNow is straightforward. Simply select the form from our template library, fill in your information, and sign electronically. Our user-friendly interface guides you through the process step by step.

-

Is there a cost associated with using airSlate SignNow for Form 4868 Sp Online?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. You can choose a plan that suits your budget, ensuring you can file Form 4868 Sp Online without breaking the bank. Plus, there are often promotions for new users.

-

What features does airSlate SignNow provide for Form 4868 Sp Online?

airSlate SignNow offers a variety of features for filing Form 4868 Sp Online, including customizable templates, secure e-signature capabilities, and easy document sharing. These features streamline the filing process, making it efficient and hassle-free.

-

Can I use airSlate SignNow on mobile to file Form 4868 Sp Online?

Absolutely! airSlate SignNow is fully compatible with mobile devices, allowing you to file Form 4868 Sp Online anytime, anywhere. This flexibility means you can complete your tax extension on the go.

-

What integrations does airSlate SignNow offer for filing Form 4868 Sp Online?

airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and Microsoft Office. This means you can easily import your documents when filing Form 4868 Sp Online, enhancing your workflow efficiency.

-

How secure is my information when using airSlate SignNow for Form 4868 Sp Online?

Your security is our priority. When you file Form 4868 Sp Online using airSlate SignNow, all data is protected with advanced encryption methods, ensuring your personal and financial information remains confidential and secure.

Get more for Form 4868 Sp Online

- Bbt directpdffillercom form

- For crfoo2 in ga form

- Alaska employer registration form 2007

- Form il 941 a 2008

- Lexington fayette urban county net profits license fee return fillable 2008 form

- Ibr 1 form

- Authorization to release protected nuway form

- Mail renewal application for driver license class d and cdl form 21 1900a

Find out other Form 4868 Sp Online

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will