PIT 1 *240180200* NEW MEXICO PERSONAL INCOME 2024-2026

What is the PIT 1 New Mexico Personal Income Form?

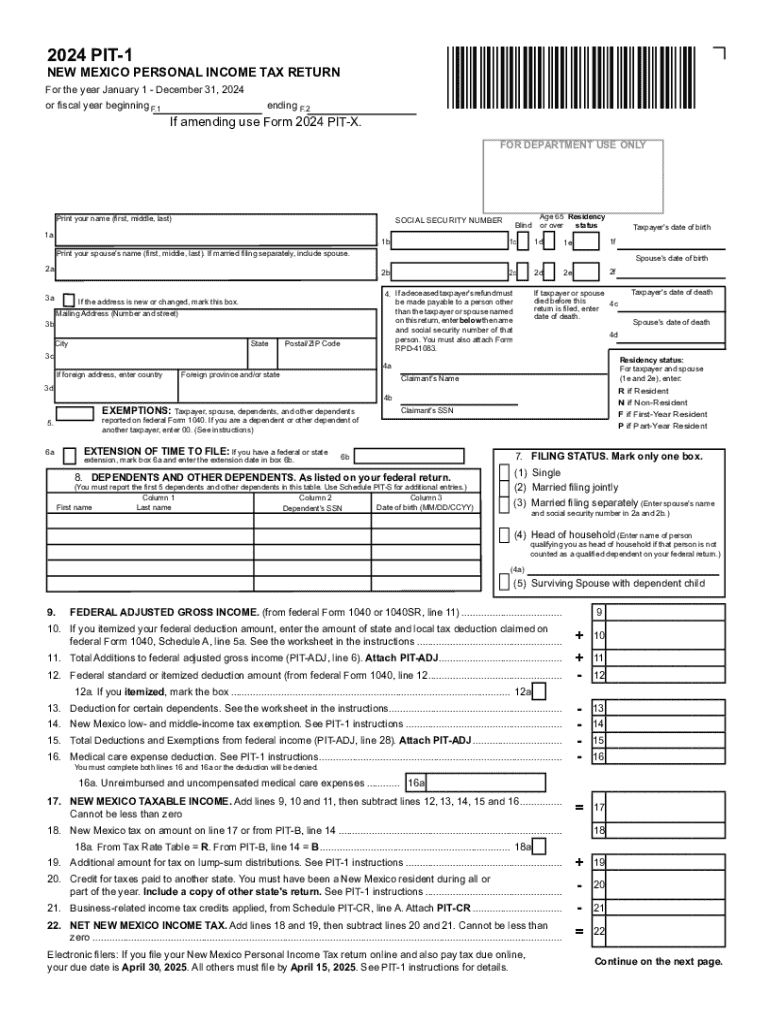

The PIT 1 form, officially known as the New Mexico Personal Income Tax Return, is a crucial document for residents of New Mexico who need to report their personal income to the state. This form is used to calculate the amount of state income tax owed based on the taxpayer's income, deductions, and credits. The PIT 1 is essential for ensuring compliance with New Mexico tax laws and is typically required for individuals earning income within the state.

Steps to Complete the PIT 1 New Mexico Personal Income Form

Completing the PIT 1 form involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain credits.

- Fill out the PIT 1 form by entering your personal information, income details, and applicable deductions.

- Calculate your total tax liability by following the instructions provided on the form.

- Review the completed form for accuracy before submission.

Legal Use of the PIT 1 New Mexico Personal Income Form

The PIT 1 form is legally required for residents of New Mexico who earn taxable income. Filing this form accurately and on time helps taxpayers avoid penalties and interest charges. It is important to understand the legal implications of underreporting income or failing to file, as this can lead to audits and additional fines. Compliance with state tax laws is essential for maintaining good standing with the New Mexico Taxation and Revenue Department.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the PIT 1 form. Typically, the deadline for submitting the form is April 15 of the following year after the tax year ends. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to the filing schedule each year to ensure timely submission.

Required Documents for the PIT 1 New Mexico Personal Income Form

To accurately complete the PIT 1 form, taxpayers need to gather several key documents:

- W-2 forms from employers detailing annual wages and taxes withheld.

- 1099 forms for any freelance or contract work completed.

- Records of other income sources, such as interest, dividends, or rental income.

- Documentation for deductions, including receipts for medical expenses, education costs, and mortgage interest.

Form Submission Methods

The PIT 1 form can be submitted through various methods to accommodate different preferences. Taxpayers can file electronically using approved e-filing software, which often simplifies the process and reduces errors. Alternatively, the form can be printed and mailed to the New Mexico Taxation and Revenue Department. In-person submissions may also be available at designated tax offices, offering assistance for those who prefer face-to-face interactions.

Create this form in 5 minutes or less

Find and fill out the correct pit 1 240180200 new mexico personal income

Create this form in 5 minutes!

How to create an eSignature for the pit 1 240180200 new mexico personal income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 pit 1 feature in airSlate SignNow?

The 2024 pit 1 feature in airSlate SignNow enhances document management by providing advanced eSigning capabilities. This feature allows users to streamline their workflows, ensuring that documents are signed quickly and securely. With 2024 pit 1, businesses can improve efficiency and reduce turnaround times.

-

How does pricing work for the 2024 pit 1 plan?

The pricing for the 2024 pit 1 plan is designed to be cost-effective, catering to businesses of all sizes. Users can choose from various subscription tiers that offer different features and capabilities. This flexibility ensures that you can find a plan that fits your budget while still accessing the powerful tools of airSlate SignNow.

-

What are the key benefits of using the 2024 pit 1 solution?

The 2024 pit 1 solution offers numerous benefits, including enhanced security, ease of use, and improved collaboration. By utilizing airSlate SignNow, businesses can ensure that their documents are handled securely while also facilitating seamless communication among team members. This leads to faster decision-making and increased productivity.

-

Can I integrate the 2024 pit 1 with other software?

Yes, the 2024 pit 1 plan allows for seamless integration with various third-party applications. This capability enables users to connect airSlate SignNow with their existing tools, such as CRM systems and project management software. Integrating these platforms enhances workflow efficiency and ensures that all your tools work together harmoniously.

-

Is the 2024 pit 1 suitable for small businesses?

Absolutely! The 2024 pit 1 plan is tailored to meet the needs of small businesses by providing an affordable and user-friendly eSigning solution. With its intuitive interface and robust features, small businesses can easily manage their document signing processes without the need for extensive training or resources.

-

What types of documents can I sign with the 2024 pit 1?

With the 2024 pit 1 feature, you can sign a wide variety of documents, including contracts, agreements, and forms. airSlate SignNow supports multiple file formats, ensuring that you can handle all your signing needs in one place. This versatility makes it an ideal solution for businesses across different industries.

-

How secure is the 2024 pit 1 eSigning process?

The 2024 pit 1 eSigning process is highly secure, utilizing advanced encryption and authentication methods to protect your documents. airSlate SignNow complies with industry standards and regulations, ensuring that your sensitive information remains confidential. This commitment to security gives users peace of mind when managing their documents.

Get more for PIT 1 *240180200* NEW MEXICO PERSONAL INCOME

Find out other PIT 1 *240180200* NEW MEXICO PERSONAL INCOME

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast