Arizona Form 140PTC

What is the Arizona Form 140PTC

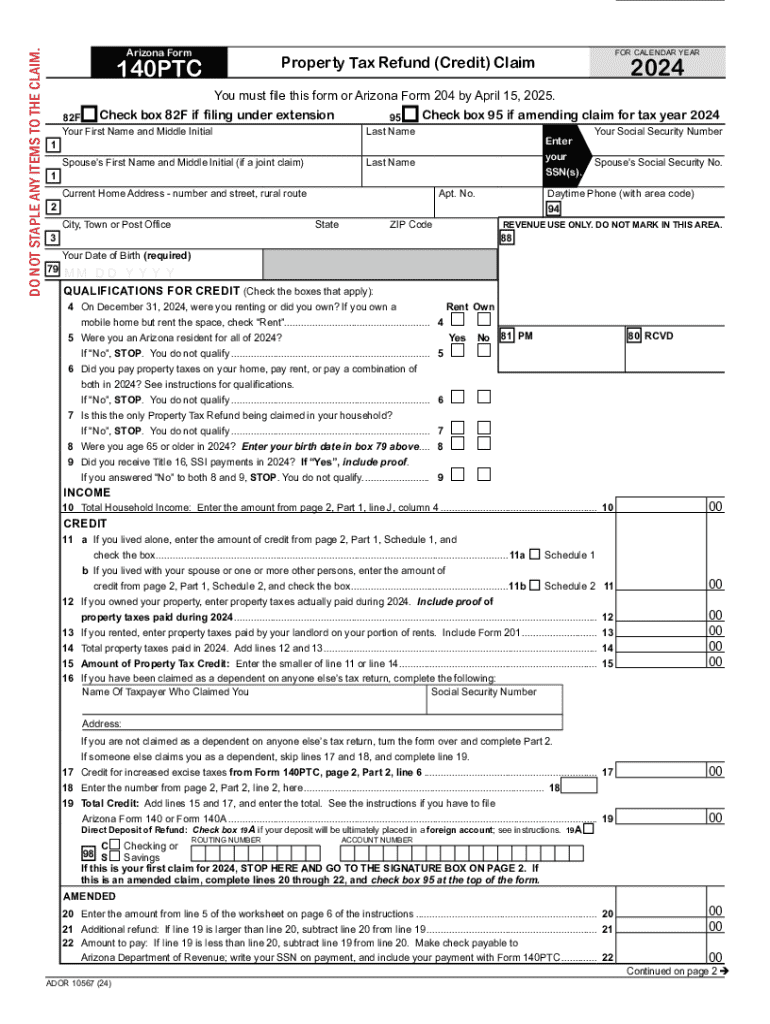

The Arizona Form 140PTC is a tax form specifically designed for residents of Arizona who are applying for a property tax credit. This form is essential for individuals seeking to claim a refund on property taxes paid, particularly for those who meet specific eligibility criteria. The 2024 version of this form reflects the latest updates and requirements set forth by the Arizona Department of Revenue.

How to use the Arizona Form 140PTC

To effectively use the Arizona Form 140PTC, individuals must first ensure they meet the eligibility requirements. Once eligibility is confirmed, the form should be filled out accurately, providing all necessary information regarding property ownership and income levels. It is important to follow the instructions included with the form to avoid any errors that could delay processing. After completing the form, it can be submitted through the appropriate channels as outlined by the state.

Steps to complete the Arizona Form 140PTC

Completing the Arizona Form 140PTC involves several key steps:

- Gather necessary documents, including proof of income and property ownership.

- Download the form from the Arizona Department of Revenue website or obtain a physical copy.

- Fill out the form accurately, ensuring all sections are completed.

- Review the completed form for any errors or omissions.

- Submit the form via mail, online, or in person, depending on the submission options available for the year.

Eligibility Criteria

To qualify for the Arizona Form 140PTC, applicants must meet specific criteria set by the state. Generally, this includes being a resident of Arizona, owning property, and having an income that falls below a certain threshold. Additional factors, such as age or disability status, may also influence eligibility. It is crucial for applicants to review the detailed eligibility requirements for the 2024 tax year to ensure compliance.

Required Documents

When completing the Arizona Form 140PTC, several documents are typically required to support the application. These may include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of property ownership, such as a deed or property tax statement.

- Identification documents to verify residency and identity.

Having these documents ready will streamline the application process and help ensure that all necessary information is provided.

Form Submission Methods

The Arizona Form 140PTC can be submitted through various methods, providing flexibility for applicants. Options typically include:

- Online submission via the Arizona Department of Revenue website.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices or designated locations.

Each method has its own processing times and requirements, so it is advisable to choose the one that best fits the applicant's needs.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140ptc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the az form 140ptc 2024 and how can airSlate SignNow help?

The az form 140ptc 2024 is a tax form used in Arizona for claiming a credit for taxes paid. airSlate SignNow simplifies the process of completing and eSigning this form, ensuring that you can submit it quickly and efficiently. With our user-friendly interface, you can easily fill out the az form 140ptc 2024 and send it directly to the relevant authorities.

-

How much does it cost to use airSlate SignNow for the az form 140ptc 2024?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, which provide access to features that streamline the completion of the az form 140ptc 2024. Our cost-effective solution ensures that you get the best value while managing your document signing needs.

-

What features does airSlate SignNow provide for the az form 140ptc 2024?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the experience of handling the az form 140ptc 2024. These tools help you manage your documents efficiently and ensure compliance with state regulations. Additionally, our platform allows for easy collaboration with team members.

-

Can I integrate airSlate SignNow with other software for the az form 140ptc 2024?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the az form 140ptc 2024 alongside your existing tools. Whether you use CRM systems, cloud storage, or accounting software, our platform can connect with them to streamline your workflow. This integration capability enhances productivity and reduces manual data entry.

-

What are the benefits of using airSlate SignNow for the az form 140ptc 2024?

Using airSlate SignNow for the az form 140ptc 2024 provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform ensures that your documents are signed and stored securely, reducing the risk of errors. Additionally, the ease of use allows you to focus on your core business activities rather than paperwork.

-

Is airSlate SignNow compliant with legal standards for the az form 140ptc 2024?

Absolutely! airSlate SignNow complies with all legal standards for electronic signatures, ensuring that your az form 140ptc 2024 is valid and enforceable. Our platform adheres to regulations such as the ESIGN Act and UETA, providing peace of mind that your signed documents meet legal requirements. This compliance is crucial for businesses handling sensitive information.

-

How can I get started with airSlate SignNow for the az form 140ptc 2024?

Getting started with airSlate SignNow for the az form 140ptc 2024 is simple. You can sign up for a free trial on our website, which allows you to explore our features and see how they can benefit your document signing process. Once you're ready, you can choose a subscription plan that fits your needs and start managing your forms efficiently.

Get more for Arizona Form 140PTC

Find out other Arizona Form 140PTC

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online