Arizona Form 221

What is the Arizona Form 221

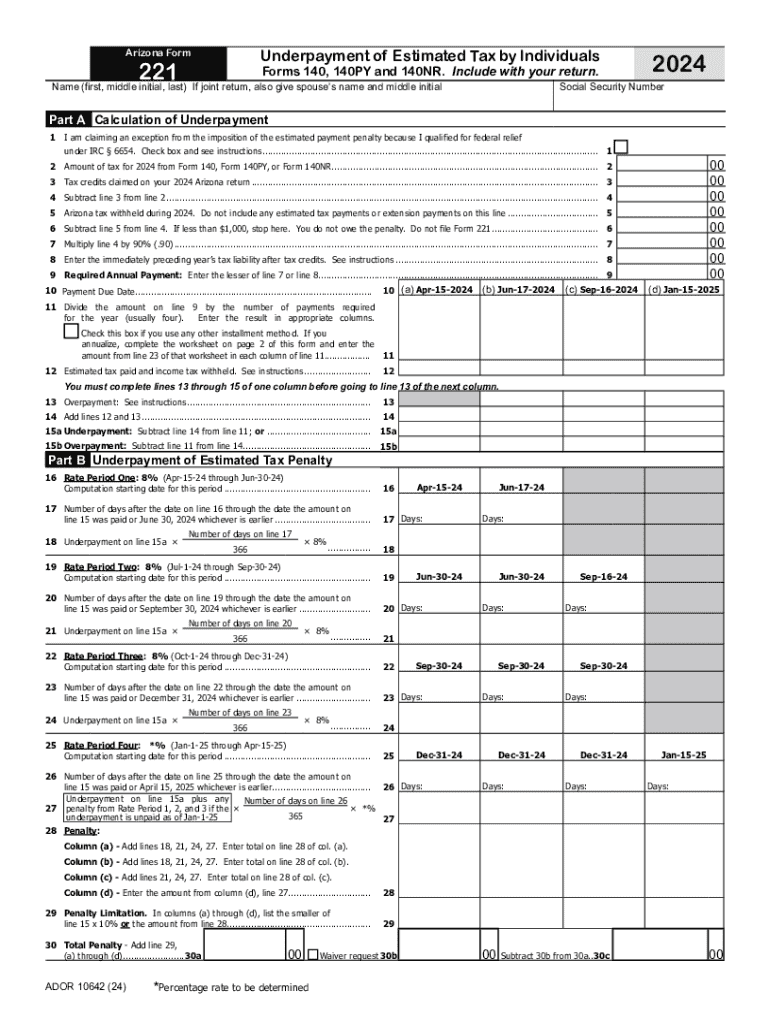

The Arizona Form 221 is a state-specific tax form used primarily for reporting income and calculating tax liabilities for individuals and businesses in Arizona. This form is essential for ensuring compliance with state tax regulations and is typically required for those who have earned income in the state. Understanding the purpose and requirements of Form 221 is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Arizona Form 221

Using the Arizona Form 221 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, fill out the form by providing personal information, income details, and applicable deductions. It is important to follow the instructions carefully to avoid mistakes that could lead to delays or penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the Arizona Department of Revenue.

Steps to complete the Arizona Form 221

Completing the Arizona Form 221 requires attention to detail. Start by entering your personal information, such as your name, address, and Social Security number. Then, report your total income from all sources, including wages, self-employment income, and investment earnings. After reporting your income, apply any deductions you qualify for, such as standard deductions or itemized deductions. Finally, calculate your total tax liability based on the provided tax rates and submit the form by the designated deadline.

Legal use of the Arizona Form 221

The Arizona Form 221 serves a legal purpose in the state's tax system. It is a formal document that taxpayers must file to report their income and calculate their tax obligations. Failing to file this form accurately and on time can result in penalties, interest, and potential legal consequences. Understanding the legal implications of Form 221 is essential for maintaining compliance with Arizona tax laws.

Filing Deadlines / Important Dates

Timely filing of the Arizona Form 221 is crucial to avoid penalties. The typical deadline for submitting this form aligns with the federal tax filing deadline, which is usually April fifteenth. However, taxpayers should verify any specific state extensions or changes that may apply. Marking important dates on your calendar can help ensure that you meet all filing requirements without delay.

Required Documents

To complete the Arizona Form 221 accurately, certain documents are required. These typically include W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation of any additional income sources. Additionally, records of deductible expenses, such as receipts for business expenses or medical costs, should be gathered to support your claims on the form. Having all necessary documents ready can streamline the filing process.

Form Submission Methods

The Arizona Form 221 can be submitted through various methods, providing flexibility for taxpayers. Options include electronic submission via the Arizona Department of Revenue's online portal, mailing a paper copy to the appropriate address, or delivering it in person at designated tax offices. Each method has its own guidelines and processing times, so it is advisable to choose the one that best fits your needs and ensure that you follow the specific instructions for that method.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 221

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 221?

The Arizona Form 221 is a specific document used for various administrative purposes in the state of Arizona. It is essential for businesses and individuals to understand its requirements and how to complete it accurately. Using airSlate SignNow can simplify the process of filling out and eSigning the Arizona Form 221.

-

How can airSlate SignNow help with the Arizona Form 221?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Arizona Form 221. With its intuitive interface, users can quickly fill out the form, add necessary signatures, and send it securely. This streamlines the process and ensures compliance with Arizona's regulations.

-

Is there a cost associated with using airSlate SignNow for the Arizona Form 221?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides excellent value for the features offered, including eSigning and document management for the Arizona Form 221. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the Arizona Form 221?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the Arizona Form 221. These features enhance efficiency and ensure that all parties involved can easily access and sign the document. Additionally, the platform supports collaboration among multiple users.

-

Can I integrate airSlate SignNow with other applications for the Arizona Form 221?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to manage the Arizona Form 221 alongside your existing tools. Whether you use CRM systems, cloud storage, or other document management solutions, you can streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the Arizona Form 221?

Using airSlate SignNow for the Arizona Form 221 provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform allows for quick eSigning and reduces the risk of errors associated with manual processes. This ensures that your documents are processed efficiently and securely.

-

Is airSlate SignNow compliant with Arizona regulations for the Form 221?

Yes, airSlate SignNow is designed to comply with Arizona regulations regarding electronic signatures and document management. This compliance ensures that your use of the Arizona Form 221 meets legal standards, providing peace of mind when sending and signing documents electronically.

Get more for Arizona Form 221

- Unemployment insurance tax information idaho department

- Form b6 profession experience report for educators

- Ages 19 form

- Platinum 4000 form

- Ivert application form maildoc

- 2019 newsletter iowa department of agriculture and land form

- Survey report form

- Iowa board of pharmacy petition for exemption from mandate form

Find out other Arizona Form 221

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF