S Corp Schedule K 1 Form 1120S a Simple Guide

What is the S Corp Schedule K-1 Form 1120S?

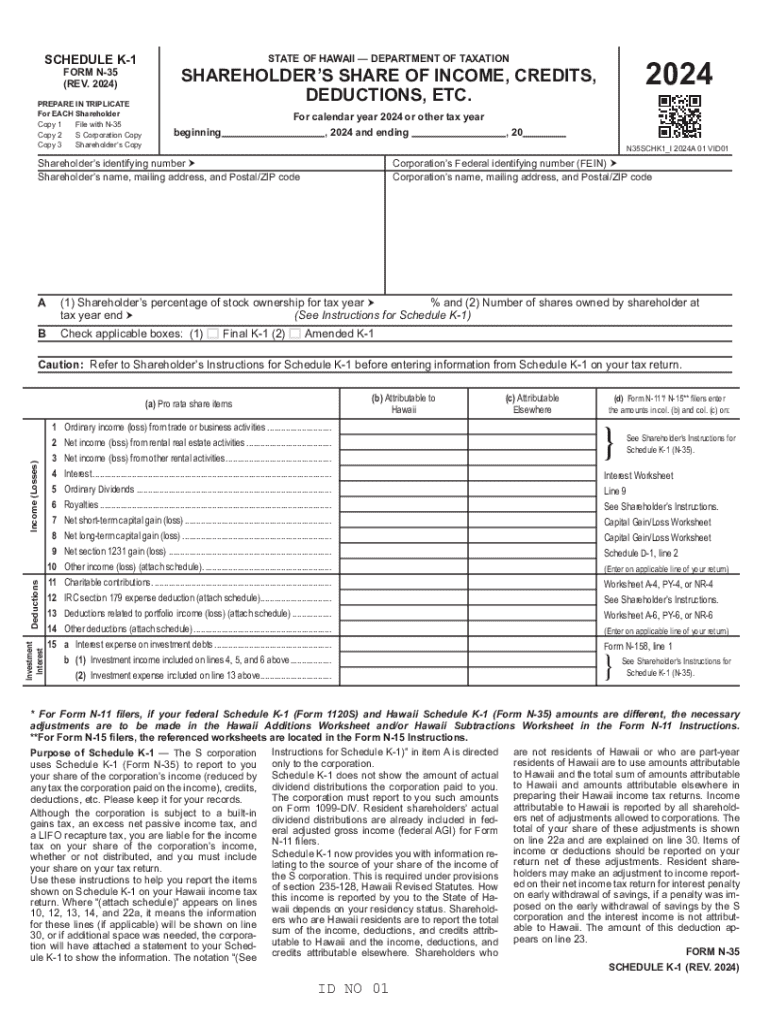

The Schedule K-1 (Form 1120S) is a tax document used by S corporations to report the income, deductions, and credits of the corporation to its shareholders. Each shareholder receives a K-1 form that details their share of the corporation's earnings, which they must report on their personal tax returns. This form is essential for ensuring that income is taxed appropriately at the individual level rather than at the corporate level, in line with the S corporation's tax structure.

Steps to Complete the S Corp Schedule K-1 Form 1120S

Completing the Schedule K-1 (Form 1120S) involves several steps:

- Gather necessary financial information from the S corporation's financial statements.

- Fill out the identifying information, including the corporation's name, address, and employer identification number (EIN).

- Report the shareholder's details, including their name, address, and ownership percentage.

- Detail the income, deductions, and credits allocated to the shareholder for the tax year.

- Review the completed form for accuracy before distributing it to shareholders.

IRS Guidelines for the S Corp Schedule K-1 Form 1120S

The Internal Revenue Service (IRS) provides specific guidelines for completing and filing the Schedule K-1 (Form 1120S). It is important to follow these guidelines to ensure compliance and avoid penalties. The IRS requires that the form be filled out accurately, reflecting the correct amounts of income, deductions, and credits. Additionally, the K-1 must be provided to shareholders by the due date of the S corporation's tax return, typically March 15, unless an extension has been filed.

Filing Deadlines for the S Corp Schedule K-1 Form 1120S

The Schedule K-1 (Form 1120S) must be filed along with the S corporation's tax return. The standard deadline for filing the S corporation tax return is March 15 of the following year. If the S corporation files for an extension, the deadline may be extended to September 15. Shareholders must receive their K-1 forms by the due date of the S corporation's return to accurately report their income on their personal tax returns.

Key Elements of the S Corp Schedule K-1 Form 1120S

The Schedule K-1 (Form 1120S) includes several key elements that are crucial for tax reporting:

- Shareholder Information: This section lists the shareholder's name, address, and ownership percentage.

- Income Items: This includes ordinary business income, rental income, and other types of income allocated to the shareholder.

- Deductions: Any deductions that the shareholder can claim, such as business expenses or losses.

- Credits: Tax credits that the shareholder is eligible for, which can reduce their overall tax liability.

Legal Use of the S Corp Schedule K-1 Form 1120S

The Schedule K-1 (Form 1120S) is legally required for S corporations to report income and deductions to shareholders. Failure to provide accurate K-1 forms can lead to penalties for both the corporation and the shareholders. It is important for shareholders to use the information provided on the K-1 to accurately report their income on their personal tax returns, as discrepancies can trigger audits or other legal issues with the IRS.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s corp schedule k 1 form 1120s a simple guide

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule K-1 Form 1120S?

The Schedule K-1 Form 1120S is a tax document used by S corporations to report income, deductions, and credits to shareholders. It provides detailed information about each shareholder's share of the corporation's income, which is essential for personal tax returns. Understanding this form is crucial for accurate tax reporting.

-

How can airSlate SignNow help with Schedule K-1 Form 1120S?

airSlate SignNow streamlines the process of sending and eSigning the Schedule K-1 Form 1120S, making it easier for S corporations to manage their tax documentation. With our user-friendly platform, you can quickly prepare, send, and track these forms, ensuring compliance and efficiency. This saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for Schedule K-1 Form 1120S?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that facilitate the management of documents like the Schedule K-1 Form 1120S, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

Are there any integrations available for managing Schedule K-1 Form 1120S?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the Schedule K-1 Form 1120S alongside your other financial documents. These integrations enhance workflow efficiency and ensure that all your data is synchronized across platforms. This allows for a smoother tax preparation process.

-

What features does airSlate SignNow offer for handling Schedule K-1 Form 1120S?

Our platform includes features such as customizable templates, automated reminders, and secure eSigning, all of which are beneficial for managing the Schedule K-1 Form 1120S. These tools help ensure that your documents are completed accurately and on time. Additionally, you can track the status of your forms in real-time.

-

How does airSlate SignNow ensure the security of Schedule K-1 Form 1120S documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your Schedule K-1 Form 1120S documents from unauthorized access. Our compliance with industry standards ensures that your sensitive information remains safe throughout the signing process.

-

Can I access my Schedule K-1 Form 1120S documents from any device?

Absolutely! airSlate SignNow is designed to be accessible from any device, whether it's a desktop, tablet, or smartphone. This flexibility allows you to manage your Schedule K-1 Form 1120S documents on the go, ensuring you can send and sign documents whenever and wherever you need to.

Get more for S Corp Schedule K 1 Form 1120S A Simple Guide

- Cochrane reviews cochrane library form

- Students cell phone or alternate number form

- Prescriptive authority pennsylvania department of state pagov form

- V1 verification worksheet 2017 2018 nyitedu form

- Your future starts here csn form

- Students that are also facultystaff must complete this process through human resources services form

- Volunteer services agreement for volunteers university form

- Health information and informatics management

Find out other S Corp Schedule K 1 Form 1120S A Simple Guide

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document