Iowa Sales Tax Exemption Certificate Energy Used I Form

What is the Iowa Sales Tax Exemption Certificate Energy Used I

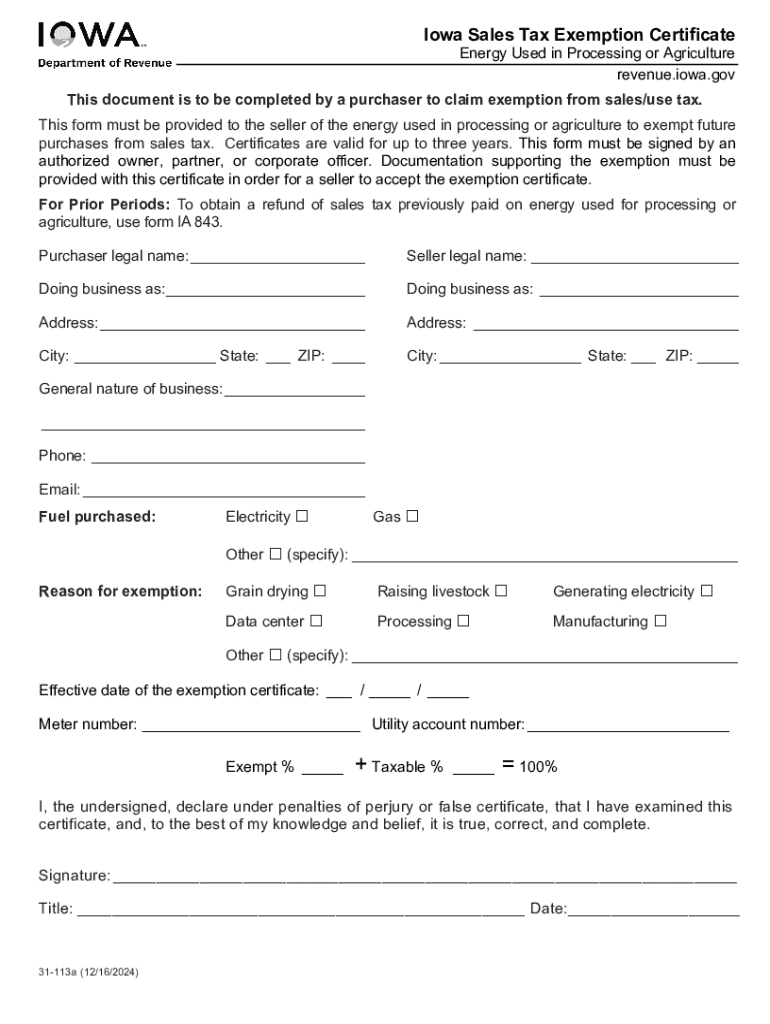

The Iowa Sales Tax Exemption Certificate Energy Used I is a specific form utilized by businesses and individuals in Iowa to claim exemptions from sales tax on energy used in manufacturing, processing, or other qualifying activities. This certificate allows eligible entities to purchase energy without incurring sales tax, thereby reducing operational costs. It is crucial for businesses engaged in activities that involve substantial energy consumption to understand the implications and benefits of this exemption.

How to use the Iowa Sales Tax Exemption Certificate Energy Used I

To use the Iowa Sales Tax Exemption Certificate Energy Used I, the holder must present the completed certificate to the supplier of energy. This document serves as proof that the energy purchased is exempt from sales tax. When filling out the certificate, it is essential to provide accurate information regarding the purchaser's business and the specific use of the energy. Suppliers are required to keep a copy of the certificate on file for their records, ensuring compliance with Iowa tax regulations.

Steps to complete the Iowa Sales Tax Exemption Certificate Energy Used I

Completing the Iowa Sales Tax Exemption Certificate Energy Used I involves several key steps:

- Obtain the certificate form from the Iowa Department of Revenue or an authorized source.

- Fill in the required information, including the name and address of the purchaser, the type of energy being purchased, and the intended use of that energy.

- Sign and date the certificate to validate the claim for exemption.

- Present the completed certificate to the energy supplier at the time of purchase.

Eligibility Criteria

Eligibility for the Iowa Sales Tax Exemption Certificate Energy Used I primarily depends on the nature of the business and the specific use of energy. Generally, businesses engaged in manufacturing, processing, or other qualifying activities that consume energy may be eligible. It is important to review the Iowa Department of Revenue guidelines to ensure compliance with the criteria established for the exemption. Additionally, the purchaser must be registered with the state and possess a valid sales tax permit.

Legal use of the Iowa Sales Tax Exemption Certificate Energy Used I

The legal use of the Iowa Sales Tax Exemption Certificate Energy Used I is strictly defined by state law. The certificate should only be used for purchases of energy that are directly related to exempt activities. Misuse of the certificate, such as using it for personal consumption or for non-qualifying activities, can result in penalties. It is vital for users to maintain accurate records and ensure that their claims for exemption are legitimate and substantiated by proper documentation.

Key elements of the Iowa Sales Tax Exemption Certificate Energy Used I

Several key elements must be included in the Iowa Sales Tax Exemption Certificate Energy Used I to ensure its validity:

- The name and address of the purchaser.

- The type of energy being purchased, such as electricity or gas.

- A clear statement of the intended use of the energy, specifying how it relates to exempt activities.

- The signature of the purchaser or an authorized representative.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iowa sales tax exemption certificate energy used i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa Sales Tax Exemption Certificate Energy Used I?

The Iowa Sales Tax Exemption Certificate Energy Used I is a document that allows businesses to purchase energy without paying sales tax. This certificate is specifically designed for entities that use energy in manufacturing or processing. By utilizing this exemption, businesses can reduce their operational costs signNowly.

-

How can airSlate SignNow help with the Iowa Sales Tax Exemption Certificate Energy Used I?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign the Iowa Sales Tax Exemption Certificate Energy Used I. Our easy-to-use interface ensures that you can manage your documents efficiently, saving time and reducing errors. This helps businesses stay compliant while maximizing their tax savings.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the management of documents like the Iowa Sales Tax Exemption Certificate Energy Used I. You can choose a plan that fits your budget while enjoying the benefits of our comprehensive eSigning solutions.

-

Are there any specific features for managing tax exemption certificates?

Yes, airSlate SignNow includes features specifically designed for managing tax exemption certificates, including the Iowa Sales Tax Exemption Certificate Energy Used I. Users can easily create templates, track document status, and ensure secure storage of sensitive information. These features enhance efficiency and compliance for businesses.

-

What benefits does the Iowa Sales Tax Exemption Certificate Energy Used I provide?

The Iowa Sales Tax Exemption Certificate Energy Used I provides signNow financial benefits by allowing businesses to avoid sales tax on energy purchases. This can lead to substantial savings, especially for companies with high energy consumption. Additionally, it simplifies the tax filing process, making compliance easier.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax management software. This allows businesses to seamlessly manage their documents, including the Iowa Sales Tax Exemption Certificate Energy Used I, alongside their financial records. Such integrations enhance overall efficiency and accuracy.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance when handling sensitive documents like the Iowa Sales Tax Exemption Certificate Energy Used I. Our platform employs advanced encryption and security protocols to protect your data. You can trust that your documents are safe and secure throughout the signing process.

Get more for Iowa Sales Tax Exemption Certificate Energy Used I

- Veterans affairs mental health form

- Commander s presidential support program questionnaire form

- Tn trademark search form

- Worksheet 1 questions form

- Swim lessons registration form

- Date change request form

- Wohnungsbewerbung in bern formular anmeldeformular f r eine wohnung in bern helvetia versicherungen immobilienbewirtschaftung

- Enlightenment worksheet pdf answers form

Find out other Iowa Sales Tax Exemption Certificate Energy Used I

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement