IA 1040Iowa Individual Income Tax Return Reve Form

What is the IA 1040 Iowa Individual Income Tax Return?

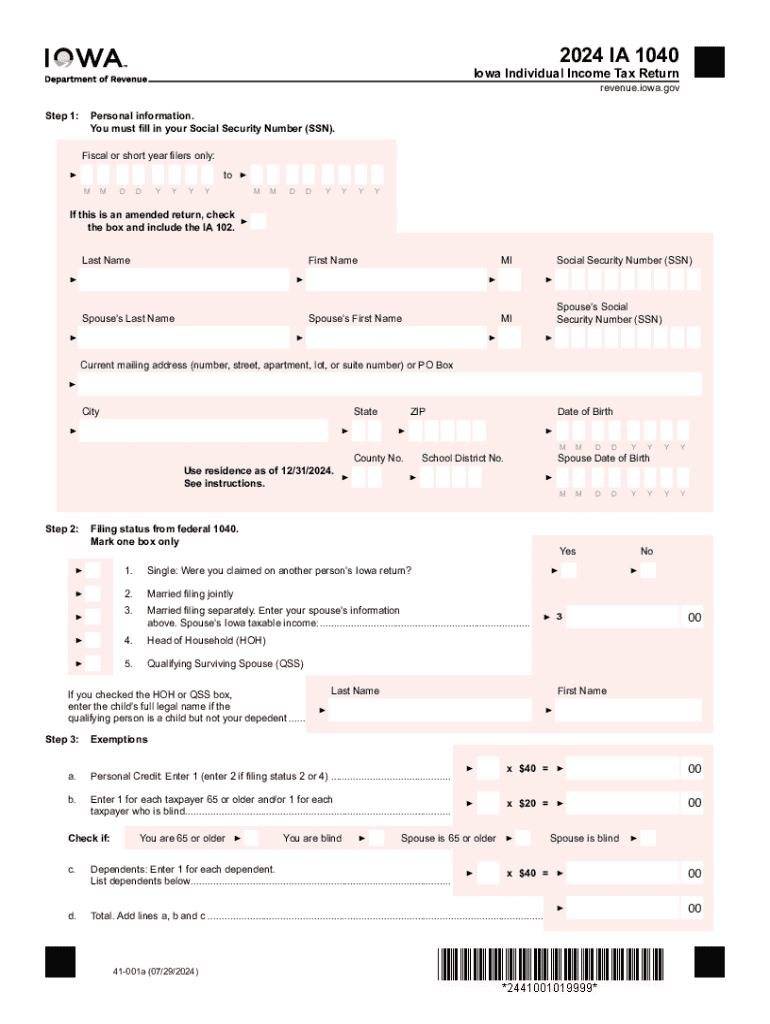

The IA 1040, also known as the Iowa Individual Income Tax Return, is the official form used by residents of Iowa to report their income and calculate their state income tax obligations. This form is essential for individuals earning income within the state, as it captures various types of income, deductions, and credits applicable to Iowa taxpayers. The IA 1040 is designed to ensure compliance with state tax laws and to facilitate the accurate assessment of tax liabilities.

Steps to Complete the IA 1040 Iowa Individual Income Tax Return

Completing the IA 1040 involves several key steps to ensure accurate reporting of income and tax obligations. Begin by gathering all necessary documents, such as W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Report your total income, including wages, interest, and dividends, and then apply any applicable deductions and credits. Finally, calculate your tax liability and determine whether you owe additional taxes or are due a refund.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the IA 1040 to avoid penalties. Typically, the deadline for submitting your Iowa income tax return is April 30 of the year following the tax year. For example, for the 2024 tax year, the due date is April 30, 2025. If additional time is needed, taxpayers may file for an extension, but it is important to pay any estimated taxes owed by the original deadline to avoid interest and penalties.

Required Documents for the IA 1040 Iowa Individual Income Tax Return

To accurately complete the IA 1040, certain documents are required. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for any deductions, such as mortgage interest statements

- Records of tax credits claimed

- Previous year’s tax return for reference

Having these documents organized will streamline the process of filling out the IA 1040 and ensure all income is reported accurately.

Form Submission Methods for the IA 1040 Iowa Individual Income Tax Return

Taxpayers have several options for submitting their IA 1040 forms. The form can be filed electronically using approved e-filing software, which is often the fastest method and allows for quicker refunds. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate Iowa Department of Revenue address. In-person submissions may also be possible at designated tax offices, though this option may vary by location.

Key Elements of the IA 1040 Iowa Individual Income Tax Return

The IA 1040 includes several key elements that taxpayers must complete. These elements typically consist of personal identification information, income reporting sections, deduction and credit claims, and a summary of tax calculations. Understanding these components is essential for accurately completing the form and ensuring compliance with Iowa tax regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia 1040iowa individual income tax return reve

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Iowa 1040 form?

The 2024 Iowa 1040 form is the state income tax return that residents of Iowa must file to report their income and calculate their tax liability for the year. It includes various sections for income, deductions, and credits specific to Iowa taxpayers. Understanding this form is crucial for ensuring compliance and maximizing potential refunds.

-

How can airSlate SignNow help with the 2024 Iowa 1040 filing process?

airSlate SignNow streamlines the process of preparing and submitting your 2024 Iowa 1040 by allowing you to easily send and eSign necessary documents. Our platform ensures that all forms are securely handled and can be accessed from anywhere, making tax season less stressful. With our user-friendly interface, you can focus on your finances rather than paperwork.

-

What are the pricing options for using airSlate SignNow for my 2024 Iowa 1040?

airSlate SignNow offers flexible pricing plans that cater to both individuals and businesses, making it a cost-effective solution for managing your 2024 Iowa 1040. You can choose from monthly or annual subscriptions, depending on your needs. Each plan includes features that simplify document management and eSigning, ensuring you get the best value.

-

Are there any integrations available for airSlate SignNow to assist with the 2024 Iowa 1040?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage the 2024 Iowa 1040. These integrations allow for easy data transfer and document sharing, reducing the risk of errors. By connecting your tools, you can streamline your tax preparation process signNowly.

-

What features does airSlate SignNow offer for the 2024 Iowa 1040?

airSlate SignNow provides a range of features designed to simplify the 2024 Iowa 1040 filing process, including customizable templates, secure eSigning, and document tracking. These tools help ensure that your forms are completed accurately and submitted on time. Additionally, our platform offers reminders and notifications to keep you on track during tax season.

-

Can I use airSlate SignNow for multiple tax forms, including the 2024 Iowa 1040?

Absolutely! airSlate SignNow is versatile and can be used for various tax forms, including the 2024 Iowa 1040 and other state or federal documents. This flexibility allows you to manage all your tax-related paperwork in one place, making it easier to stay organized and compliant. Our platform supports a wide range of document types.

-

Is airSlate SignNow secure for handling my 2024 Iowa 1040 documents?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your sensitive information, including your 2024 Iowa 1040 documents. You can trust that your data is safe with us, allowing you to focus on completing your tax filings without worry.

Get more for IA 1040Iowa Individual Income Tax Return Reve

- Po box 144103 392975991 form

- Dal 002 answer disability access fillable editable and saveable california judicial council forms

- The employee benefit plan indicated below has been selected for audit form

- Aka sponsor requirements form

- Boat slip rental agreement florida form

- Certification of trustee under the trust form

- D youville college strongly recommends all students have dyc form

- Smart goal setting worksheet form

Find out other IA 1040Iowa Individual Income Tax Return Reve

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free