IA 1120 Iowa Corporation Income Tax Return 42001 Form

What is the IA 1120 Iowa Corporation Income Tax Return 42001

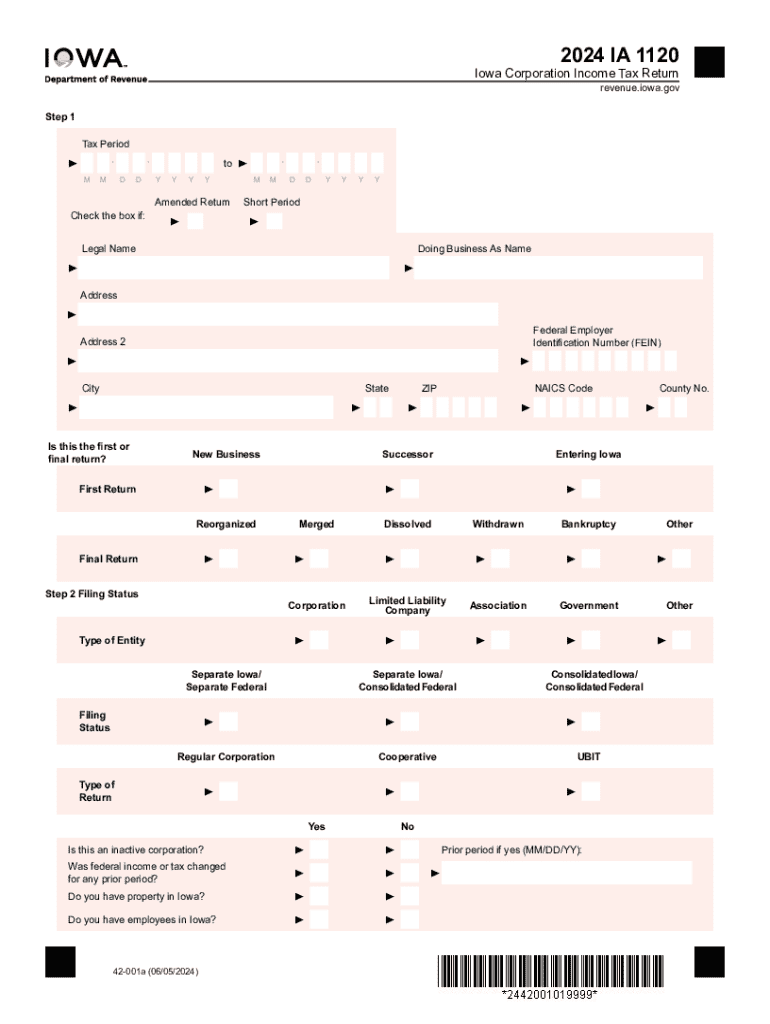

The IA 1120 Iowa Corporation Income Tax Return 42001 is a tax form specifically designed for corporations operating in Iowa. This form is used to report the income, deductions, and credits of a corporation to the Iowa Department of Revenue. It is essential for corporations to accurately complete this form to ensure compliance with state tax laws and to determine their tax liability. The IA 1120 form includes various sections that require detailed financial information, allowing the state to assess the corporation's tax obligations fairly.

Steps to complete the IA 1120 Iowa Corporation Income Tax Return 42001

Completing the IA 1120 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and previous tax returns. Next, fill out the form by entering your corporation's income, deductions, and credits in the appropriate sections. It is crucial to follow the instructions provided with the form carefully, as each section has specific requirements. After completing the form, review it for errors and ensure all calculations are correct. Finally, sign and date the form before submission.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the IA 1120 form to avoid penalties. The standard deadline for submitting the IA 1120 is the first day of the fourth month following the close of the corporation's tax year. For corporations operating on a calendar year, this typically falls on April 1. If additional time is needed, corporations can file for an extension, which allows for an additional six months to submit the form. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To successfully complete the IA 1120 Iowa Corporation Income Tax Return, several documents are required. Corporations should prepare their financial statements, including income statements and balance sheets, which provide a comprehensive overview of their financial position. Additionally, documentation of all deductions and credits claimed must be included, such as receipts and invoices. Previous tax returns may also be necessary for reference. Ensuring all required documents are organized and readily available will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

Corporations have multiple options for submitting the IA 1120 form. The form can be filed electronically through the Iowa Department of Revenue's online portal, which offers a convenient and efficient way to submit tax returns. Alternatively, corporations may choose to mail the completed form to the appropriate address provided in the filing instructions. For those who prefer in-person submissions, visiting a local Department of Revenue office is also an option. Each method has its own advantages, and corporations should select the one that best fits their needs.

Penalties for Non-Compliance

Failure to file the IA 1120 Iowa Corporation Income Tax Return or to pay any taxes owed can result in significant penalties. The Iowa Department of Revenue imposes late filing and late payment penalties, which can accumulate over time. Additionally, interest may accrue on any unpaid tax amounts, further increasing the corporation's financial burden. To avoid these penalties, it is crucial for corporations to adhere to filing deadlines and ensure accurate reporting of their financial information.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia 1120 iowa corporation income tax return 42001 771914701

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IA 1120 Iowa Corporation Income Tax Return 42001?

The IA 1120 Iowa Corporation Income Tax Return 42001 is a tax form used by corporations operating in Iowa to report their income, deductions, and tax liability. This form is essential for compliance with Iowa tax laws and ensures that corporations fulfill their tax obligations accurately.

-

How can airSlate SignNow help with the IA 1120 Iowa Corporation Income Tax Return 42001?

airSlate SignNow simplifies the process of preparing and submitting the IA 1120 Iowa Corporation Income Tax Return 42001 by allowing users to eSign and send documents securely. Our platform streamlines document management, making it easier for businesses to handle their tax returns efficiently.

-

What features does airSlate SignNow offer for managing the IA 1120 Iowa Corporation Income Tax Return 42001?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are particularly useful for managing the IA 1120 Iowa Corporation Income Tax Return 42001. These tools help ensure that your tax documents are completed accurately and submitted on time.

-

Is airSlate SignNow cost-effective for filing the IA 1120 Iowa Corporation Income Tax Return 42001?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to file the IA 1120 Iowa Corporation Income Tax Return 42001. Our pricing plans are designed to accommodate various business sizes, ensuring that you get the best value for your document management needs.

-

Can I integrate airSlate SignNow with other accounting software for the IA 1120 Iowa Corporation Income Tax Return 42001?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage the IA 1120 Iowa Corporation Income Tax Return 42001 alongside your financial records. This integration helps streamline your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the IA 1120 Iowa Corporation Income Tax Return 42001?

Using airSlate SignNow for the IA 1120 Iowa Corporation Income Tax Return 42001 offers numerous benefits, including enhanced security, improved efficiency, and reduced paperwork. Our platform allows for quick eSigning and document sharing, which can save your business time and resources during tax season.

-

How secure is airSlate SignNow when handling the IA 1120 Iowa Corporation Income Tax Return 42001?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the IA 1120 Iowa Corporation Income Tax Return 42001. You can trust that your sensitive tax information is safe and secure while using our platform.

Get more for IA 1120 Iowa Corporation Income Tax Return 42001

- Ridge augmentation surgery consent form

- Service credit under the federal employees retirement system form

- The purposes of such uses form

- N a h u e l forma color

- Canada criminal record check form

- Hiv andor hepatitis screen consent form to be completed when undertaking a test for hiv hepatitis b or hepatitis c

- Shelter care washington state courts court forms

- Hospitalization consent formdocx

Find out other IA 1120 Iowa Corporation Income Tax Return 42001

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy