480 7C Rev 07 23 Form

What is the 480 7C Rev 07 23

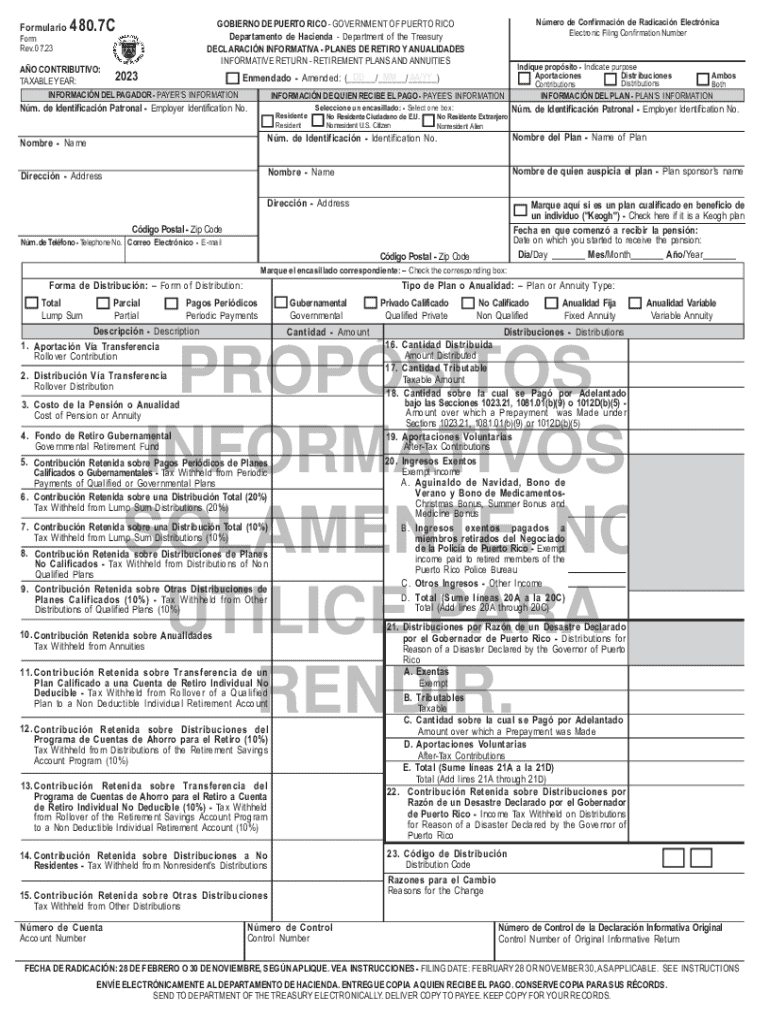

The 480 7C Rev 07 23 is a tax form used in Puerto Rico for reporting income and deductions. It is primarily utilized by individuals and businesses to declare their income and calculate their tax obligations. This form is essential for ensuring compliance with Puerto Rico's tax laws and is part of the broader set of tax documentation required by the Department of Treasury of Puerto Rico. Understanding this form is crucial for anyone who earns income in Puerto Rico, as it helps in accurately reporting financial information to the tax authorities.

How to use the 480 7C Rev 07 23

Using the 480 7C Rev 07 23 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and records of deductions. Next, fill out the form by entering your income details and applicable deductions in the designated sections. It is important to follow the instructions provided with the form closely to avoid errors. Once completed, review the form for accuracy before submitting it to the appropriate tax authority.

Steps to complete the 480 7C Rev 07 23

Completing the 480 7C Rev 07 23 requires a systematic approach:

- Collect all relevant financial documents, such as W-2 forms and receipts for deductible expenses.

- Begin filling out the form by entering your personal information, including your name, address, and taxpayer identification number.

- Report your total income from all sources in the specified section.

- List any deductions you are eligible for, ensuring you have documentation to support these claims.

- Calculate your total tax liability based on the information provided.

- Review the completed form for any errors or omissions.

- Submit the form by the deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the 480 7C Rev 07 23 are critical to avoid penalties. Typically, the form must be submitted by April 15 of the tax year following the income being reported. However, it is advisable to check for any updates or changes to deadlines each tax year, as they may vary. Additionally, extensions may be available, but they require filing specific forms to request additional time.

Required Documents

To complete the 480 7C Rev 07 23 accurately, certain documents are necessary:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses, including business expenses or medical costs.

- Previous year’s tax return for reference.

- Any additional documentation that supports claims made on the form.

Penalties for Non-Compliance

Failing to file the 480 7C Rev 07 23 on time or submitting incorrect information can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from the tax authorities. It is essential to understand the importance of compliance and to seek assistance if needed to ensure accurate and timely filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 480 7c rev 07 23

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the return 480 7c feature in airSlate SignNow?

The return 480 7c feature in airSlate SignNow allows users to efficiently manage document workflows and ensure compliance with specific regulatory requirements. This feature streamlines the process of returning documents, making it easier for businesses to stay organized and compliant.

-

How does airSlate SignNow pricing work for the return 480 7c feature?

airSlate SignNow offers flexible pricing plans that include access to the return 480 7c feature. Depending on your business needs, you can choose a plan that fits your budget while still benefiting from this essential functionality.

-

What are the benefits of using return 480 7c in airSlate SignNow?

Using the return 480 7c feature in airSlate SignNow enhances document management efficiency and reduces turnaround times. This feature also helps ensure that all necessary documentation is returned correctly, minimizing errors and improving overall workflow.

-

Can I integrate return 480 7c with other tools?

Yes, airSlate SignNow allows for seamless integration of the return 480 7c feature with various third-party applications. This capability enables businesses to enhance their existing workflows and improve productivity by connecting with tools they already use.

-

Is the return 480 7c feature user-friendly?

Absolutely! The return 480 7c feature in airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate. Whether you're a tech-savvy user or new to digital document management, you'll find this feature intuitive and straightforward.

-

What types of documents can I manage with return 480 7c?

With the return 480 7c feature, you can manage a wide variety of documents, including contracts, agreements, and compliance forms. This versatility ensures that all your essential documents are handled efficiently within airSlate SignNow.

-

How does return 480 7c improve compliance for businesses?

The return 480 7c feature helps businesses maintain compliance by ensuring that all required documents are returned and processed correctly. This reduces the risk of non-compliance and helps organizations adhere to industry regulations.

Get more for 480 7C Rev 07 23

- As your physician i am committed to providing you with the best possible medical care form

- Puppy agreement and contract form

- Public trust positions form

- Cupe 3902 unit 3 application form

- Travel health plan disclaimer please ensure all relevant form

- Philippines marriage form

- Dhcs 5014 initial application cover sheet dhcs 5014 initial application cover sheet form

- Form 04af017e dcfs 42 family health history

Find out other 480 7C Rev 07 23

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple