Arizona Form 312

What is the Arizona Form 312

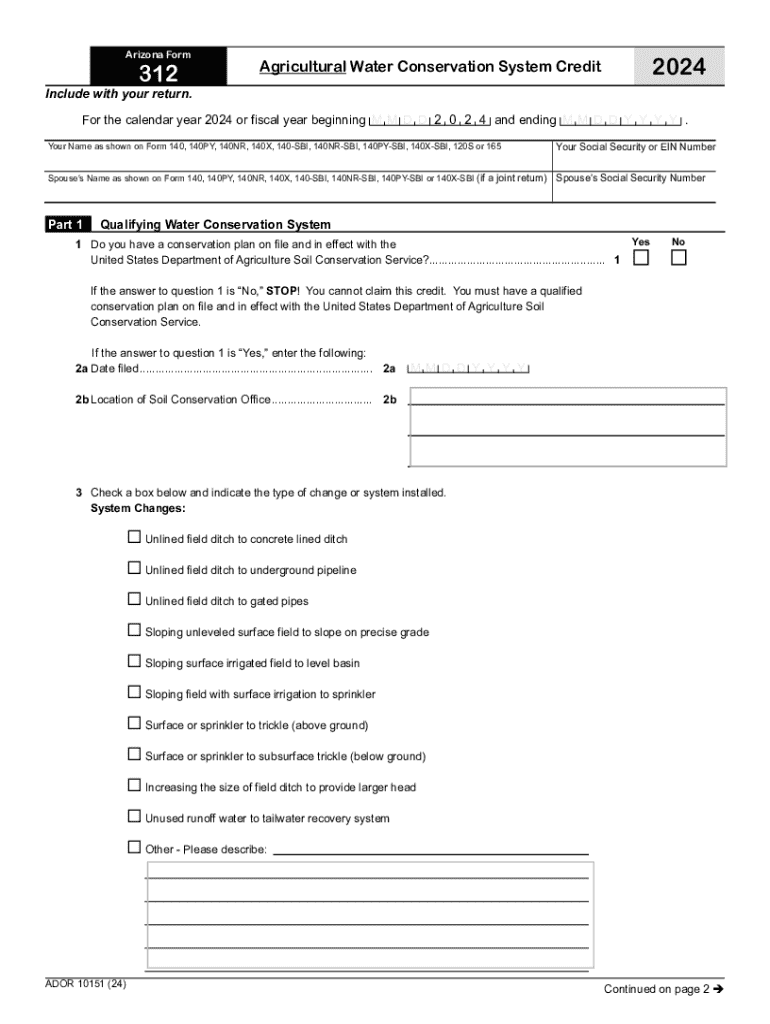

The Arizona Form 312 is a tax form used by businesses and individuals in Arizona to report specific financial information to the state. This form is primarily associated with the Arizona Department of Revenue and is essential for complying with state tax regulations. It is typically utilized for reporting income and calculating tax liabilities, ensuring that taxpayers meet their obligations under Arizona law.

How to use the Arizona Form 312

To effectively use the Arizona Form 312, taxpayers must first gather all necessary financial documents, including income statements and expense records. The form requires detailed information about the taxpayer's financial activities during the reporting period. After filling out the form accurately, it should be reviewed for completeness before submission. This ensures that all information is correct and reduces the likelihood of delays in processing.

Steps to complete the Arizona Form 312

Completing the Arizona Form 312 involves several key steps:

- Gather all relevant financial documents, such as income statements and receipts.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Double-check the calculations to confirm accuracy.

- Sign and date the form to validate it.

- Submit the form by the designated deadline, either online or via mail.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Arizona Form 312. Generally, the form must be submitted by the tax deadline for the corresponding tax year. For most individuals and businesses, this is typically April 15. However, specific circumstances may warrant different deadlines, so it is advisable to verify the exact date each year.

Required Documents

When preparing to complete the Arizona Form 312, several documents are necessary to ensure accurate reporting. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts for business expenses.

- Previous tax returns for reference.

- Any supporting documentation for deductions or credits claimed.

Form Submission Methods

Taxpayers have multiple options for submitting the Arizona Form 312. The form can be filed online through the Arizona Department of Revenue’s e-filing system, which offers a convenient and efficient process. Alternatively, taxpayers can print the completed form and mail it to the appropriate address. In-person submissions may also be possible at designated state offices, depending on current regulations and availability.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 312

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 312?

The Arizona Form 312 is a crucial document used for various legal and administrative purposes in Arizona. It is essential for businesses and individuals to understand its requirements to ensure compliance. airSlate SignNow simplifies the process of filling out and eSigning the Arizona Form 312, making it accessible and efficient.

-

How can airSlate SignNow help with the Arizona Form 312?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Arizona Form 312. With its intuitive interface, users can quickly fill out the form, add necessary signatures, and send it securely. This streamlines the process, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for the Arizona Form 312?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those who frequently handle the Arizona Form 312. Users can choose from monthly or annual subscriptions, ensuring they only pay for what they need. Additionally, a free trial is available to explore the features before committing.

-

Are there any integrations available for the Arizona Form 312 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing the workflow for the Arizona Form 312. Users can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management. This integration capability ensures that your documents are always accessible and organized.

-

What features does airSlate SignNow offer for managing the Arizona Form 312?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage specifically for the Arizona Form 312. These features help users manage their documents efficiently and ensure timely completion. The platform also provides tracking capabilities to monitor the status of sent forms.

-

Is airSlate SignNow secure for handling the Arizona Form 312?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect the Arizona Form 312 and other sensitive documents. Users can trust that their information is safe while using the platform for eSigning and document management.

-

Can I access the Arizona Form 312 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing users to access and manage the Arizona Form 312 from their smartphones or tablets. This flexibility ensures that you can complete and eSign documents on the go, making it convenient for busy professionals.

Get more for Arizona Form 312

- Civ 561 service instructions for writ of execution state of form

- Dr 721 instructions for response state of alaska form

- Dr 700motion packet coversheet domestice relations forms

- Dr 105 petition for dissolution of marriage with state of form

- Motion for intervention in family matters form

- Jv 215 order after hearing on waiver of presumptive transfer judicial council forms

- Participants response th 120 california courts form

- Information about the petitioner check if in military

Find out other Arizona Form 312

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later