Maryland Form 505NR Nonresident Income Tax Calculation

Understanding the Maryland Form 505NR Nonresident Income Tax Calculation

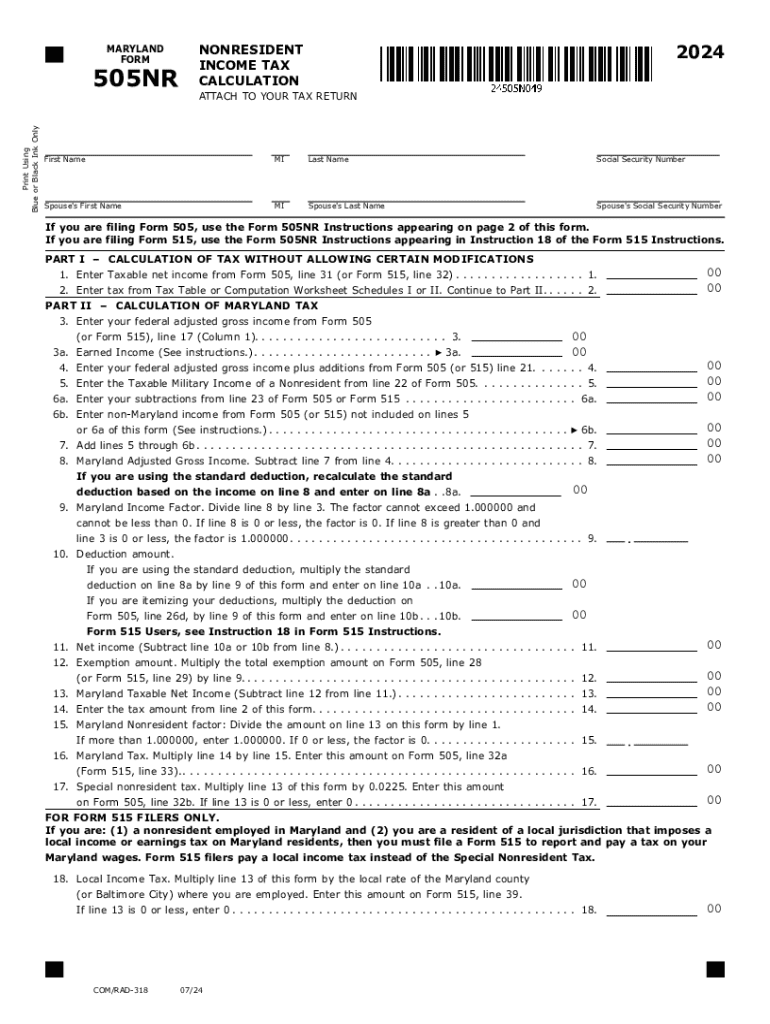

The Maryland Form 505NR is specifically designed for nonresidents who earn income within the state. This form is essential for calculating the income tax owed by individuals who do not reside in Maryland but have taxable income sourced from Maryland. It ensures that nonresidents pay the correct amount of tax based on their Maryland income, which may differ from their total income reported in their home state.

The form takes into account various factors, including the type of income earned, deductions, and credits applicable to nonresidents. Understanding how to accurately complete this form is crucial for compliance and to avoid potential penalties.

Steps to Complete the Maryland Form 505NR Nonresident Income Tax Calculation

Completing the Maryland Form 505NR involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements that reflect earnings from Maryland sources.

- Fill out the personal information section, ensuring that your name, address, and Social Security number are accurate.

- Report all income earned in Maryland. This includes wages, rental income, and any other taxable earnings.

- Calculate deductions specific to nonresidents, which may include certain expenses related to earning income in Maryland.

- Apply any tax credits that you may qualify for, which can help reduce your overall tax liability.

- Review the completed form for accuracy before submitting it.

Obtaining the Maryland Form 505NR Nonresident Income Tax Calculation

The Maryland Form 505NR can be obtained through several avenues:

- Visit the official Maryland Comptroller's website, where the form is available for download in PDF format.

- Request a physical copy from the Maryland Comptroller's office if you prefer a paper version.

- Consult with a tax professional who can provide you with the form and assist in its completion.

Key Elements of the Maryland Form 505NR Nonresident Income Tax Calculation

Several key elements must be included when filling out the Maryland Form 505NR:

- Personal Information: Your name, address, and Social Security number.

- Income Section: Detailed reporting of all Maryland-sourced income.

- Deductions: Any applicable deductions that can be claimed by nonresidents.

- Tax Calculation: The method for calculating the tax owed based on the income reported.

- Signature: A signed declaration certifying the accuracy of the information provided.

Filing Deadlines for the Maryland Form 505NR Nonresident Income Tax Calculation

Filing deadlines for the Maryland Form 505NR are critical to ensure compliance and avoid penalties. Typically, the form is due by April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to the filing schedule each tax year.

Penalties for Non-Compliance with the Maryland Form 505NR Nonresident Income Tax Calculation

Failure to file the Maryland Form 505NR on time or inaccuracies in reporting can lead to significant penalties. Common penalties include:

- Late filing penalties, which can accrue daily until the form is submitted.

- Interest on any unpaid tax amounts, which compounds over time.

- Potential legal action for persistent non-compliance, which may include liens or garnishments.

It is essential to adhere to all filing requirements to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 505nr nonresident income tax calculation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Maryland form nonresident?

The 2024 Maryland form nonresident is a tax form that nonresidents must complete to report their income earned in Maryland. This form is essential for ensuring compliance with state tax regulations. By using airSlate SignNow, you can easily eSign and submit this form, streamlining your tax filing process.

-

How can airSlate SignNow help with the 2024 Maryland form nonresident?

airSlate SignNow provides a user-friendly platform to eSign the 2024 Maryland form nonresident quickly and securely. Our solution simplifies document management, allowing you to focus on your tax obligations without the hassle of traditional paperwork. Plus, you can access your documents anytime, anywhere.

-

What are the pricing options for using airSlate SignNow for the 2024 Maryland form nonresident?

airSlate SignNow offers flexible pricing plans to accommodate various needs, whether you're an individual or a business. Our plans include features that make completing the 2024 Maryland form nonresident efficient and cost-effective. You can choose a plan that best fits your budget and requirements.

-

Are there any features specifically designed for the 2024 Maryland form nonresident?

Yes, airSlate SignNow includes features tailored for the 2024 Maryland form nonresident, such as customizable templates and automated reminders. These features help ensure that you complete your form accurately and on time. Additionally, our platform supports multiple file formats for your convenience.

-

What benefits does airSlate SignNow offer for eSigning the 2024 Maryland form nonresident?

Using airSlate SignNow to eSign the 2024 Maryland form nonresident offers numerous benefits, including enhanced security and reduced turnaround time. Our platform ensures that your documents are encrypted and legally binding. This means you can submit your tax forms with confidence and peace of mind.

-

Can I integrate airSlate SignNow with other applications for the 2024 Maryland form nonresident?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your documents efficiently. Whether you use accounting software or cloud storage services, our integrations make it easy to access and eSign the 2024 Maryland form nonresident without switching platforms.

-

Is there customer support available for questions about the 2024 Maryland form nonresident?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions regarding the 2024 Maryland form nonresident. Our team is available to help you navigate the eSigning process and ensure that you have all the resources you need. You can signNow out via chat, email, or phone.

Get more for Maryland Form 505NR Nonresident Income Tax Calculation

- Policieseducationnswgovaucontentdamvocational training assistance scheme vtas signed statement form

- New jersey supreme court form

- Pdf information sheet for medical gas instructor certification examination

- Pcard manual form

- Asd registration authorization template facility form

- Roseville administration department 2660 civic center dr form

- Cmhadurhamcanurse practitioner led clinicnurse practitioner led clinic cmha durham form

- Silent partner agreement pdf fill out and sign printable form

Find out other Maryland Form 505NR Nonresident Income Tax Calculation

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure