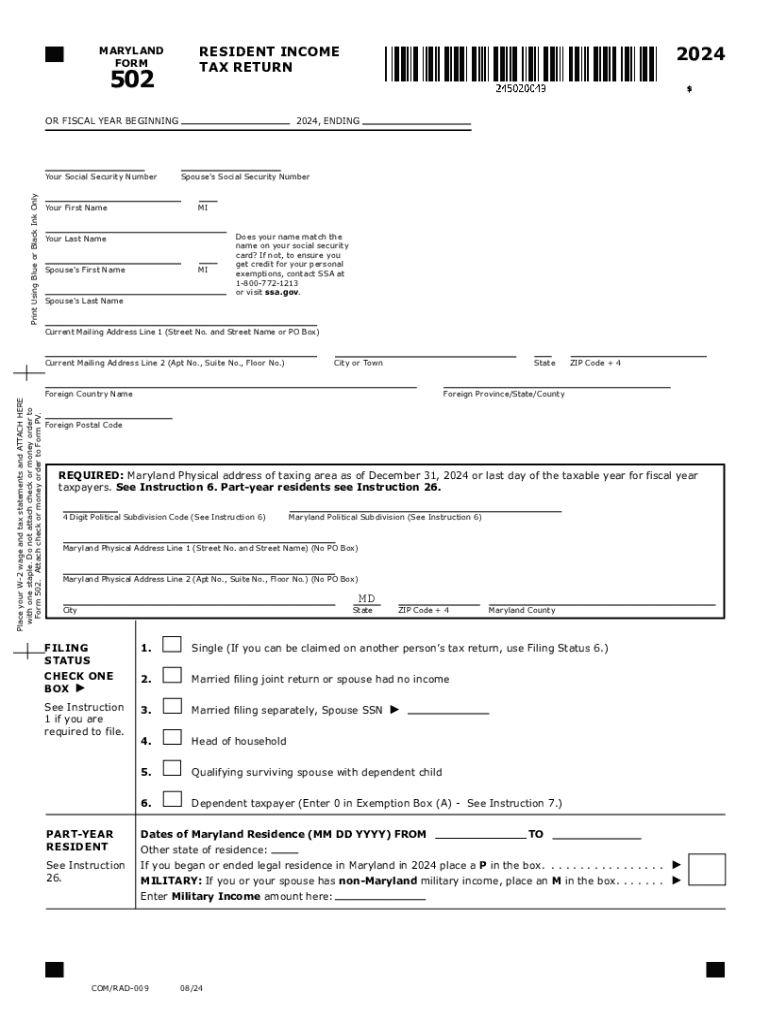

Maryland Form 502 Resident Income Tax Return

What is the Maryland Form 502 Resident Income Tax Return

The Maryland Form 502 is the official Resident Income Tax Return used by individuals who reside in Maryland to report their income and calculate their state tax liability. This form is essential for Maryland residents as it ensures compliance with state tax laws and allows for the accurate assessment of income tax owed. The form captures various income sources, deductions, and credits applicable to residents, providing a comprehensive overview of an individual's financial situation for the tax year.

Steps to complete the Maryland Form 502 Resident Income Tax Return

Completing the Maryland Form 502 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2 forms, 1099 forms, and any other income statements. Next, fill out the form by entering personal information, such as your name, address, and Social Security number. Report all sources of income, including wages, dividends, and business income. After calculating your total income, apply any deductions or credits you qualify for, which can reduce your taxable income. Finally, review the completed form for accuracy before submitting it to the Maryland State Comptroller's office.

How to obtain the Maryland Form 502 Resident Income Tax Return

The Maryland Form 502 can be easily obtained through the Maryland Comptroller's website, where it is available for download in PDF format. Additionally, physical copies of the form can be requested at local tax offices or public libraries throughout the state. For those who prefer digital options, many tax preparation software programs also include the Maryland Form 502, allowing for electronic completion and submission.

Filing Deadlines / Important Dates

Maryland residents must be aware of important filing deadlines to avoid penalties. The due date for submitting the Maryland Form 502 is typically April 15 of each year, aligning with the federal tax filing deadline. If April 15 falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, residents should be mindful of any extensions that may be available, allowing for additional time to file the return, although any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To accurately complete the Maryland Form 502, several documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits, such as mortgage interest statements or property tax receipts

- Documentation of any other income, including self-employment income

Having these documents ready will streamline the completion process and help ensure that all income is reported accurately.

Key elements of the Maryland Form 502 Resident Income Tax Return

The Maryland Form 502 consists of several key sections that must be completed. These include personal information, income reporting, deductions, and tax calculations. The personal information section requires the taxpayer's name, address, and Social Security number. The income reporting section details all sources of income, while the deductions section allows taxpayers to claim applicable deductions such as standard or itemized deductions. Finally, the tax calculation section determines the total tax owed or refund due based on the information provided.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 502 resident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form 502?

The Maryland Form 502 is the state's individual income tax return form. It is used by residents to report their income, claim deductions, and calculate their tax liability. Understanding how to fill out the Maryland Form 502 is essential for accurate tax filing.

-

How can airSlate SignNow help with the Maryland Form 502?

airSlate SignNow simplifies the process of signing and sending the Maryland Form 502 electronically. With our platform, you can easily upload your completed form, add signatures, and send it securely to the relevant parties. This streamlines your tax filing process and ensures compliance.

-

Is there a cost associated with using airSlate SignNow for the Maryland Form 502?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions provide access to features that make handling documents like the Maryland Form 502 efficient and straightforward. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Maryland Form 502?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to manage the Maryland Form 502 and other important documents. You can also track the status of your forms and ensure timely submissions.

-

Can I integrate airSlate SignNow with other software for the Maryland Form 502?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for the Maryland Form 502. Whether you use accounting software or document management systems, our integrations help streamline your processes and improve efficiency.

-

What are the benefits of using airSlate SignNow for the Maryland Form 502?

Using airSlate SignNow for the Maryland Form 502 offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform allows you to complete and send your forms quickly while ensuring that your sensitive information is protected. This leads to a smoother tax filing experience.

-

Is airSlate SignNow user-friendly for filing the Maryland Form 502?

Yes, airSlate SignNow is designed with user-friendliness in mind. Our intuitive interface makes it easy for anyone to navigate the platform and manage the Maryland Form 502 without extensive training. You can quickly learn how to upload, sign, and send your documents.

Get more for Maryland Form 502 Resident Income Tax Return

- Po box 40 south china me 04358 nichols self storage form

- Rental agreement schedule 1 berth rental terms ampamp conditions rules form

- Corona norco family ymca corona ca 92880 phone address ampamp hours form

- Fillable online all blocks should be marked with an x after attaching form

- Properties for rent in yakima wa form

- Wwwlinkedincompostscowrywisearm lists 6cowrywise on linkedin arm lists 6 mutual funds on cowrywise form

- Opengovcocombusiness20031201106fox crossing homeowners association1711 61st avenue suite form

- Tt follow up request formpdf

Find out other Maryland Form 502 Resident Income Tax Return

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word