Maryland Form 502AE Subtraction for Income Derived within Arts and Entertainment Districts

Understanding the Maryland Form 502AE Subtraction for Income Derived Within Arts and Entertainment Districts

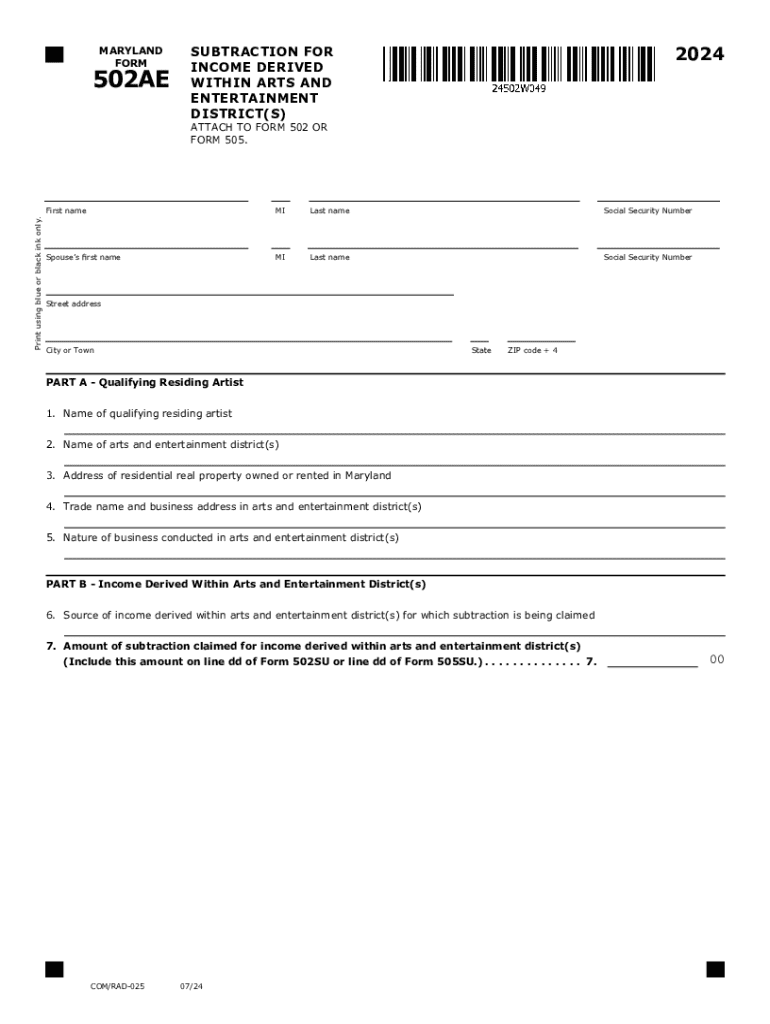

The Maryland Form 502AE is designed for individuals and businesses to claim a subtraction from their Maryland taxable income for income derived from activities within designated Arts and Entertainment Districts. This form allows eligible taxpayers to reduce their taxable income by the amount of income earned from qualifying activities, thus encouraging economic growth in these areas. The Arts and Entertainment Districts are established to promote cultural and artistic development, making this form a valuable tool for those involved in the arts and entertainment sectors.

How to Complete the Maryland Form 502AE

Completing the Maryland Form 502AE involves several key steps. First, gather all necessary documentation that supports your claim of income derived from activities within an Arts and Entertainment District. This may include financial statements, invoices, or contracts that clearly outline the income earned. Next, accurately fill out the form by providing your personal information, the total amount of qualifying income, and any other required details. Ensure all calculations are correct to avoid delays in processing. Finally, review the completed form for accuracy before submission.

Eligibility Criteria for the Maryland Form 502AE

To qualify for the Maryland Form 502AE subtraction, taxpayers must meet specific eligibility criteria. The income must be derived from activities conducted within a designated Arts and Entertainment District, which can include performances, exhibitions, or other artistic endeavors. Additionally, the taxpayer must be a resident of Maryland or a business entity registered in the state. It is crucial to verify that the income source aligns with the guidelines set forth by the Maryland State Arts Council to ensure compliance and eligibility for the subtraction.

Required Documentation for the Maryland Form 502AE

When filing the Maryland Form 502AE, certain documents are essential to substantiate your claim. These documents typically include proof of income earned from qualifying activities, such as sales receipts, contracts, or financial statements that detail the income generated. Additionally, you may need to provide evidence of your residency or business registration in Maryland. Keeping organized records will facilitate a smoother filing process and help in case of any inquiries from the Maryland State Comptroller's office.

Filing Deadlines for the Maryland Form 502AE

Filing deadlines for the Maryland Form 502AE generally align with the state’s income tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of each year, while businesses may have different deadlines based on their fiscal year. It is important to stay informed about any changes to deadlines, as late submissions may result in penalties or the loss of the subtraction benefit. Marking these dates on your calendar will help ensure timely filing.

Examples of Income Qualifying for the Maryland Form 502AE

Examples of income that qualify for the Maryland Form 502AE subtraction include earnings from live performances, art sales, and workshops conducted within an Arts and Entertainment District. For instance, a musician performing at a local venue in a designated district can claim the income earned from ticket sales. Similarly, an artist selling their artwork at a gallery located in the district may also qualify. It is essential to document all qualifying income to support your claim effectively.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 502ae subtraction for income derived within arts and entertainment districts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it benefit businesses in the Maryland district?

airSlate SignNow is a powerful eSignature solution that enables businesses in the Maryland district to send and sign documents electronically. This platform streamlines the signing process, reduces paperwork, and enhances productivity. By using airSlate SignNow, companies can save time and resources while ensuring compliance with legal standards.

-

How much does airSlate SignNow cost for businesses in the Maryland district?

Pricing for airSlate SignNow varies based on the plan selected, but it is designed to be cost-effective for businesses in the Maryland district. We offer flexible pricing options that cater to different business sizes and needs. You can choose from monthly or annual subscriptions to find the best fit for your budget.

-

What features does airSlate SignNow offer for users in the Maryland district?

airSlate SignNow provides a range of features tailored for users in the Maryland district, including customizable templates, real-time tracking, and secure cloud storage. These features help streamline document workflows and enhance collaboration among team members. Additionally, the platform supports various file formats for added convenience.

-

Can airSlate SignNow integrate with other tools commonly used in the Maryland district?

Yes, airSlate SignNow offers seamless integrations with popular business tools and applications used in the Maryland district. This includes CRM systems, project management software, and cloud storage services. These integrations help businesses maintain their existing workflows while enhancing efficiency.

-

Is airSlate SignNow compliant with legal regulations in the Maryland district?

Absolutely! airSlate SignNow is compliant with all relevant eSignature laws and regulations in the Maryland district, including the ESIGN Act and UETA. This ensures that all electronically signed documents are legally binding and secure. Businesses can confidently use airSlate SignNow for their document signing needs.

-

How does airSlate SignNow enhance security for businesses in the Maryland district?

Security is a top priority for airSlate SignNow, especially for businesses in the Maryland district. The platform employs advanced encryption methods and secure access controls to protect sensitive information. Additionally, audit trails are provided to track document activity, ensuring transparency and accountability.

-

What support options are available for Maryland district users of airSlate SignNow?

airSlate SignNow offers comprehensive support options for users in the Maryland district, including live chat, email support, and an extensive knowledge base. Our dedicated support team is available to assist with any questions or issues that may arise. We strive to ensure that all users have a smooth experience with our platform.

Get more for Maryland Form 502AE Subtraction For Income Derived Within Arts And Entertainment Districts

- Maine home sale package form

- Control number or p001 pkg form

- Loans and lending formsus legal forms

- Real estate forms get printable rental forms onlineuslegalforms

- Instructions and forms pdf docplayernet

- Control number id p001 pkg form

- Hold harmless agreement texas everything you need to know form

- Parent attorney handbook wyoming judicial branch form

Find out other Maryland Form 502AE Subtraction For Income Derived Within Arts And Entertainment Districts

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free