Rent and Royalty Income and Expenses ORG25 BASIC P Form

Understanding the Rent and Royalty Income and Expenses ORG25

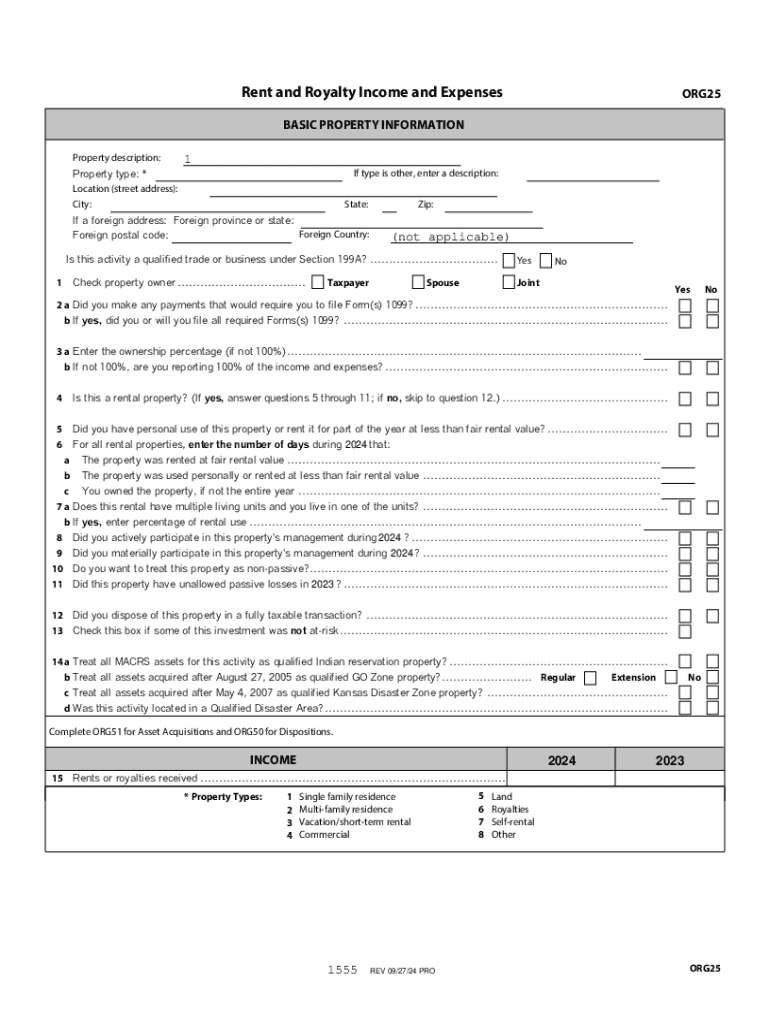

The Rent and Royalty Income and Expenses ORG25 form is essential for reporting income generated from rental properties and royalties. This form is typically used by individuals and businesses to declare earnings from real estate rentals, royalties from intellectual properties, and associated expenses. Understanding the purpose of this form helps ensure accurate reporting and compliance with tax regulations.

Steps to Complete the Rent and Royalty Income and Expenses ORG25

Filling out the ORG25 requires careful attention to detail. Start by gathering all relevant financial documents, including income statements from rental properties and records of any expenses incurred. Follow these steps:

- Begin with the identification section, providing your name, address, and taxpayer identification number.

- List all sources of rental income, detailing each property's address and the amount earned.

- Document any expenses related to property management, repairs, and maintenance.

- Calculate your net income by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal Use of the Rent and Royalty Income and Expenses ORG25

The ORG25 is legally required for taxpayers who earn rental income or royalties. Proper use of this form ensures compliance with IRS regulations, helping to avoid potential penalties. It is crucial to report all income accurately and to maintain supporting documentation for all expenses claimed. This form serves as a legal record of your income and expenses, which may be reviewed by tax authorities during audits.

IRS Guidelines for the Rent and Royalty Income and Expenses ORG25

The IRS provides specific guidelines regarding the use of the ORG25 form. Taxpayers must adhere to these guidelines to ensure compliance. Key points include:

- Filing the form by the designated deadlines to avoid late penalties.

- Ensuring all income and expenses are reported accurately and completely.

- Maintaining records for at least three years in case of an audit.

Examples of Using the Rent and Royalty Income and Expenses ORG25

Practical examples can clarify how to use the ORG25 effectively. For instance, a landlord renting out a single-family home would report monthly rental income and any repairs made during the year. Similarly, an author receiving royalties from book sales would include those earnings along with any expenses related to publishing. These examples illustrate the diverse applications of the form across different income-generating activities.

Filing Deadlines for the Rent and Royalty Income and Expenses ORG25

Timely filing of the ORG25 is crucial to avoid penalties. The IRS typically sets the deadline for submission on April fifteenth of each year for individual taxpayers. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to keep track of these dates to ensure compliance and avoid unnecessary complications.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rent and royalty income and expenses org25 basic p 771934696

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is org25 and how does it benefit my business?

Org25 is a powerful feature within airSlate SignNow that streamlines document management and eSigning processes. By utilizing org25, businesses can enhance their workflow efficiency, reduce turnaround times, and improve overall productivity. This solution is designed to cater to organizations of all sizes, making it a versatile choice for any business.

-

How much does org25 cost?

The pricing for org25 within airSlate SignNow is competitive and designed to fit various budgets. We offer flexible plans that cater to different business needs, ensuring that you only pay for what you use. For detailed pricing information, please visit our pricing page or contact our sales team.

-

What features are included with org25?

Org25 includes a range of features such as customizable templates, advanced security options, and real-time tracking of document status. Additionally, it allows for seamless collaboration among team members, ensuring that everyone stays on the same page. These features make org25 an essential tool for efficient document management.

-

Can org25 integrate with other software?

Yes, org25 offers robust integration capabilities with various third-party applications, including CRM systems and cloud storage services. This flexibility allows businesses to incorporate org25 into their existing workflows without disruption. Our integration options enhance the overall functionality of airSlate SignNow.

-

Is org25 suitable for small businesses?

Absolutely! Org25 is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses. With its scalable features, small businesses can easily adapt org25 to their specific needs, ensuring they can manage documents efficiently as they grow.

-

What are the security measures in place for org25?

Org25 prioritizes security with features such as encryption, secure access controls, and compliance with industry standards. These measures ensure that your documents are protected from unauthorized access and data bsignNowes. Trusting org25 means trusting a secure environment for your sensitive information.

-

How can org25 improve my team's productivity?

By implementing org25, your team can automate repetitive tasks, reduce manual errors, and streamline the eSigning process. This leads to faster document turnaround times and allows your team to focus on more strategic initiatives. Overall, org25 enhances collaboration and efficiency within your organization.

Get more for Rent And Royalty Income And Expenses ORG25 BASIC P

Find out other Rent And Royalty Income And Expenses ORG25 BASIC P

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document