TY 502B TAX YEAR 502B INDIVIDUAL TAXPAYER FORM

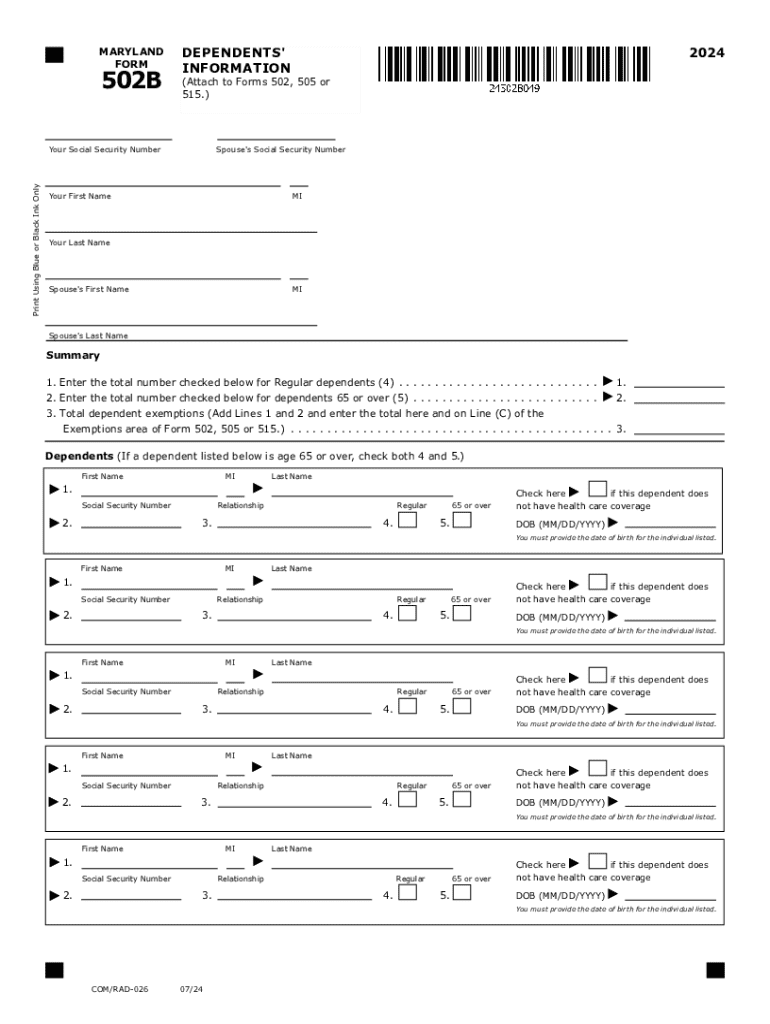

What is the Maryland Tax Form 502B?

The Maryland tax form 502B is an essential document used by individual taxpayers in Maryland to report their income and calculate their tax liability. This form is specifically designed for taxpayers who need to provide additional information regarding their income, deductions, and credits. It is part of the Maryland income tax return process and is often used in conjunction with the Maryland Form 502.

How to Obtain the Maryland Tax Form 502B

Taxpayers can easily obtain the Maryland tax form 502B from the official Maryland State Comptroller’s website. The form is available for download in a printable format, ensuring that individuals can fill it out at their convenience. Additionally, taxpayers may request a physical copy by contacting the Comptroller's office directly.

Steps to Complete the Maryland Tax Form 502B

Completing the Maryland tax form 502B involves several steps:

- Gather all necessary financial documents, including W-2s, 1099s, and records of other income.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, deductions, and any applicable credits as instructed on the form.

- Double-check your entries for accuracy before submitting the form.

Key Elements of the Maryland Tax Form 502B

The Maryland tax form 502B includes several key elements that taxpayers must understand:

- Personal Information: This section requires basic details about the taxpayer.

- Income Reporting: Taxpayers must report all sources of income accurately.

- Deductions and Credits: This section allows taxpayers to claim eligible deductions and credits.

- Signature: The form must be signed and dated by the taxpayer to validate the submission.

Filing Deadlines for the Maryland Tax Form 502B

Taxpayers should be aware of the filing deadlines for the Maryland tax form 502B to avoid penalties. Typically, the deadline aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be adjusted accordingly.

Form Submission Methods for Maryland Tax Form 502B

Taxpayers have several options for submitting the Maryland tax form 502B:

- Online Submission: The form can be submitted electronically through the Maryland Comptroller’s online portal.

- Mail: Taxpayers can print the completed form and mail it to the appropriate address provided in the instructions.

- In-Person: Forms can also be submitted in person at designated Comptroller’s office locations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ty 502b tax year 502b individual taxpayer form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland tax form 502B?

The Maryland tax form 502B is a document used for reporting income tax for businesses in Maryland. It is essential for ensuring compliance with state tax regulations. Understanding how to fill out this form correctly can help avoid penalties and ensure accurate tax reporting.

-

How can airSlate SignNow help with the Maryland tax form 502B?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Maryland tax form 502B. This streamlines the process, making it faster and more efficient. With our solution, you can ensure that your documents are securely signed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Maryland tax form 502B?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective while providing all the necessary features for managing documents like the Maryland tax form 502B. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Maryland tax form 502B?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These features simplify the process of preparing and submitting the Maryland tax form 502B. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for the Maryland tax form 502B?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow for the Maryland tax form 502B. This allows you to connect with accounting software and other tools you may already be using. Integration helps streamline the entire tax preparation process.

-

What are the benefits of using airSlate SignNow for the Maryland tax form 502B?

Using airSlate SignNow for the Maryland tax form 502B offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of loss or fraud. This can save you time and resources during tax season.

-

How secure is airSlate SignNow when handling the Maryland tax form 502B?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the Maryland tax form 502B. Our platform is designed to keep your sensitive information safe from unauthorized access. You can trust us to handle your documents with the utmost care.

Get more for TY 502B TAX YEAR 502B INDIVIDUAL TAXPAYER FORM

- Termination of lease landlord to tenant form

- Demand reimbursement of accrued vacation after termination form

- 1st ltr req for hearing not filed form

- Chapter 16 writing letters and memoswrite for business form

- Name vs form

- Division cause no form

- Our firm represents name form

- This confirms our telephone conversation of date wherein we agreed that the estate of form

Find out other TY 502B TAX YEAR 502B INDIVIDUAL TAXPAYER FORM

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form