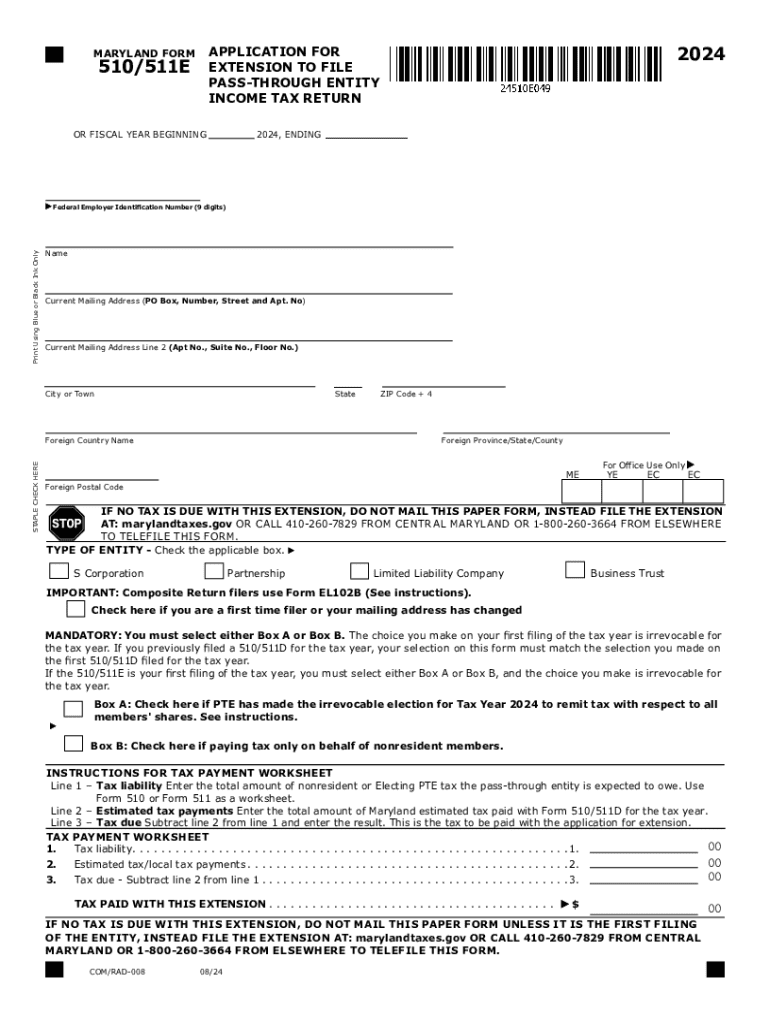

Maryland Form 510511E Application for Extension to File Pass through Entity Income Tax Return

Understanding the Maryland Form 510E

The Maryland Form 510E is an essential document for individuals and businesses seeking to file an income tax return for pass-through entities. This form is specifically designed to report income, deductions, and credits for entities such as partnerships, S corporations, and limited liability companies (LLCs) that pass income directly to their owners. Understanding this form is crucial for compliance with Maryland tax regulations.

Steps to Complete the Maryland Form 510E

Completing the Maryland Form 510E involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the entity information section, providing details such as the entity name, address, and federal employer identification number (EIN).

- Report all income received by the entity and any deductions that apply.

- Calculate the total tax owed based on the reported income and applicable tax rates.

- Review the completed form for accuracy before submission.

Filing Deadlines for the Maryland Form 510E

It is important to be aware of the filing deadlines associated with the Maryland Form 510E. Typically, the form must be submitted by the 15th day of the fourth month following the end of the entity's tax year. For entities operating on a calendar year, this means the due date is April 15. If additional time is needed, an extension can be requested using the appropriate application form.

Required Documents for Filing the Maryland Form 510E

When preparing to file the Maryland Form 510E, certain documents are required to ensure accurate reporting:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received by the entity during the tax year.

- Documentation for any deductions claimed, such as receipts for business expenses.

- Previous tax returns, if applicable, for consistency and reference.

Eligibility Criteria for Using the Maryland Form 510E

The Maryland Form 510E is intended for specific types of entities. To be eligible to use this form, the entity must be classified as a pass-through entity under Maryland tax law. This includes partnerships, S corporations, and LLCs that choose to be taxed as partnerships or S corporations. Additionally, the entity must have a valid EIN and comply with all Maryland tax regulations.

Submission Methods for the Maryland Form 510E

The Maryland Form 510E can be submitted through various methods to accommodate different preferences:

- Online submission through the Maryland Comptroller's website, which offers a streamlined process.

- Mailing a paper copy of the completed form to the appropriate Maryland tax office.

- In-person submission at designated tax offices, providing an opportunity for immediate assistance if needed.

Penalties for Non-Compliance with the Maryland Form 510E

Failure to file the Maryland Form 510E on time or inaccuracies in the form can lead to penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is important for entities to adhere to filing deadlines and ensure the accuracy of reported information to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 510511e application for extension to file pass through entity income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form 510E?

The Maryland Form 510E is a tax form used by businesses to report income and calculate tax liabilities in the state of Maryland. It is essential for ensuring compliance with state tax regulations. Using airSlate SignNow, you can easily eSign and submit your Maryland Form 510E securely.

-

How can airSlate SignNow help with the Maryland Form 510E?

airSlate SignNow streamlines the process of completing and eSigning the Maryland Form 510E. Our platform allows you to fill out the form electronically, ensuring accuracy and saving time. Additionally, you can send the completed form directly to relevant parties with just a few clicks.

-

Is there a cost associated with using airSlate SignNow for the Maryland Form 510E?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are cost-effective and provide access to features that simplify the eSigning process for documents like the Maryland Form 510E. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Maryland Form 510E?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the Maryland Form 510E. These tools enhance efficiency and ensure that your documents are handled securely and professionally. You can also integrate with other applications for a seamless workflow.

-

Can I integrate airSlate SignNow with other software for the Maryland Form 510E?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your Maryland Form 510E alongside your existing tools. This integration capability enhances productivity and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the Maryland Form 510E?

Using airSlate SignNow for the Maryland Form 510E provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to eSign documents quickly, ensuring that you meet deadlines without hassle. Additionally, you can access your documents anytime, anywhere.

-

Is airSlate SignNow secure for submitting the Maryland Form 510E?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Maryland Form 510E is submitted safely. We use advanced encryption and secure servers to protect your sensitive information. You can trust that your documents are handled with the utmost care.

Get more for Maryland Form 510511E Application For Extension To File Pass Through Entity Income Tax Return

- Chapter 0244 oregon state legislature form

- Jafra worldwide holdings lux sarl et al s 4 on 63003 sec info form

- 08 mutual nondisclosure agreement form

- Easement agreement this easement town of lyons form

- Family and medical leave fmlaus department of labor form

- Computer law drafting and negotiating forms and agreements

- Form letter of intent for development agreement

- Shareholder agreement template get free sample pandadoc form

Find out other Maryland Form 510511E Application For Extension To File Pass Through Entity Income Tax Return

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF