Schedule CT 40 Form

What is the Schedule CT 40

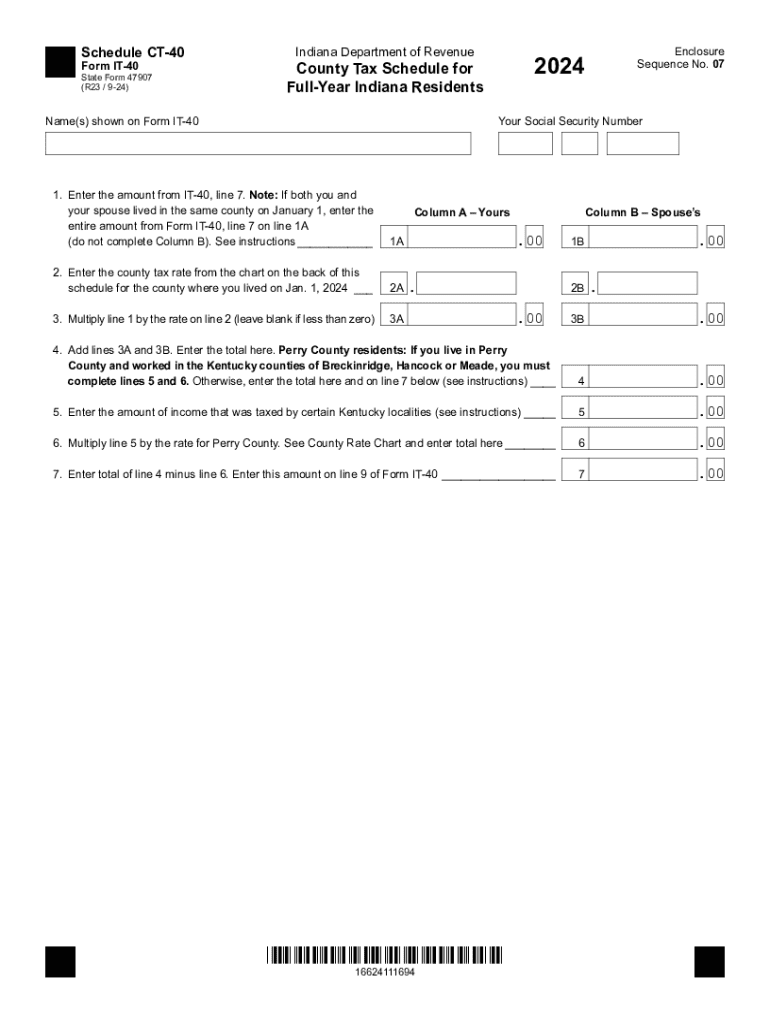

The Schedule CT 40 is a tax form used by businesses in Indiana to report their state income tax liability. It is specifically designed for corporations and partnerships that need to calculate and remit their tax obligations accurately. This form allows taxpayers to detail their income, deductions, and credits, ensuring compliance with state tax laws. Understanding the Schedule CT 40 is essential for any business entity operating in Indiana, as it helps in determining the correct amount of tax owed to the state.

How to use the Schedule CT 40

Using the Schedule CT 40 involves several steps that ensure accurate reporting of your business's income and tax liability. First, gather all necessary financial documents, including income statements and expense reports. Next, carefully fill out the form, entering your business's gross income, allowable deductions, and applicable tax credits. After completing the form, review it for accuracy before submitting it to the Indiana Department of Revenue. This process ensures that your business remains compliant with state tax regulations.

Steps to complete the Schedule CT 40

Completing the Schedule CT 40 requires a systematic approach. Start by downloading the form from the Indiana Department of Revenue website or obtaining a physical copy. Follow these steps:

- Enter your business name, address, and identification number at the top of the form.

- Report your total gross income from all sources in the designated section.

- List any deductions your business qualifies for, such as operating expenses and depreciation.

- Calculate your taxable income by subtracting deductions from gross income.

- Apply the appropriate tax rate to determine your total tax liability.

- Include any credits you are eligible for to reduce your tax due.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Schedule CT 40 to avoid penalties. Typically, the form must be filed by the fifteenth day of the fourth month following the end of your fiscal year. For businesses operating on a calendar year, this means the due date is April 15. If you are unable to meet this deadline, consider filing for an extension, which may provide additional time to submit your form without incurring late fees.

Required Documents

When preparing to file the Schedule CT 40, gather the necessary documents to support your reported income and deductions. Required documents may include:

- Financial statements, including profit and loss statements.

- Records of all income received during the tax year.

- Documentation for all deductions claimed, such as receipts and invoices.

- Any prior year tax returns that may provide context for your current filing.

Having these documents ready will streamline the completion process and ensure accuracy in your reporting.

Penalties for Non-Compliance

Failing to file the Schedule CT 40 on time or inaccurately reporting information can lead to significant penalties. The Indiana Department of Revenue may impose fines for late submissions, which can increase over time. Additionally, underreporting income or claiming ineligible deductions can result in interest charges on unpaid taxes. It is essential to adhere to all filing requirements and deadlines to avoid these financial repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule ct 40

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 ct 40 and how does it benefit my business?

The 2024 ct 40 is an advanced eSignature solution offered by airSlate SignNow that streamlines document signing processes. It empowers businesses to send and eSign documents quickly and securely, enhancing productivity and reducing turnaround times. By utilizing the 2024 ct 40, you can ensure compliance and improve customer satisfaction.

-

How much does the 2024 ct 40 cost?

The pricing for the 2024 ct 40 is competitive and designed to fit various business needs. airSlate SignNow offers flexible subscription plans that cater to different usage levels, ensuring you only pay for what you need. For detailed pricing information, visit our pricing page or contact our sales team.

-

What features are included in the 2024 ct 40?

The 2024 ct 40 includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. Additionally, it supports multiple file formats and integrates seamlessly with popular business applications. These features make the 2024 ct 40 a comprehensive solution for all your eSigning needs.

-

Can the 2024 ct 40 integrate with other software?

Yes, the 2024 ct 40 is designed to integrate with various software applications, enhancing your workflow. It supports integrations with CRM systems, project management tools, and cloud storage services. This flexibility allows you to streamline your processes and improve efficiency.

-

Is the 2024 ct 40 secure for sensitive documents?

Absolutely, the 2024 ct 40 prioritizes security with advanced encryption and compliance with industry standards. Your documents are protected throughout the signing process, ensuring that sensitive information remains confidential. Trust in the 2024 ct 40 for secure eSigning solutions.

-

How can I get started with the 2024 ct 40?

Getting started with the 2024 ct 40 is simple. You can sign up for a free trial on the airSlate SignNow website to explore its features. Once you're ready, choose a subscription plan that fits your needs and start sending and eSigning documents effortlessly.

-

What types of businesses can benefit from the 2024 ct 40?

The 2024 ct 40 is suitable for businesses of all sizes across various industries. Whether you're in real estate, healthcare, or finance, the 2024 ct 40 can help streamline your document workflows. Its versatility makes it an ideal choice for any organization looking to enhance efficiency.

Get more for Schedule CT 40

- Fl allmand boats bill of sale for a vessel form

- Mi zeeland bpw hydrant meterrpz checkout form and permit

- Pk pc 1 form production sectors

- Pk form s i

- Pk 20 months achievements brochure form

- Pk cpsp application form for mcps hpemcps hcsm

- Pk cdc securities deposit continuation sheet form

- Nh dsmv 505 form

Find out other Schedule CT 40

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself