Schedule in 529 Form

Understanding the Schedule IN 529

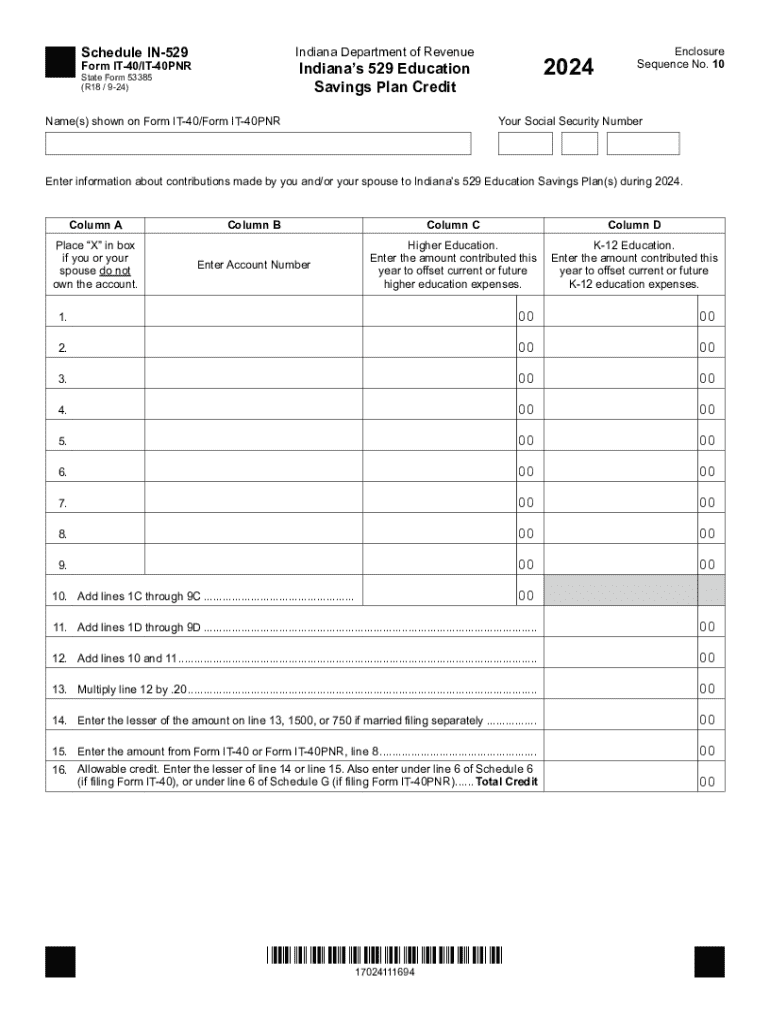

The Schedule IN 529 is a specific tax form used by residents of Indiana to report contributions made to a 529 college savings plan. This form allows taxpayers to claim a deduction for contributions made during the tax year. The 529 plan is designed to help families save for future educational expenses, making it an important tool for financial planning related to education.

How to Utilize the Schedule IN 529

To effectively use the Schedule IN 529, taxpayers must first gather relevant information about their contributions to the 529 plan. This includes the total amount contributed during the tax year and the names of the beneficiaries. Once this information is collected, it can be entered into the form, which will then calculate the eligible deduction. It is essential to ensure accuracy in reporting to avoid any issues with the Indiana Department of Revenue.

Steps for Completing the Schedule IN 529

Completing the Schedule IN 529 involves several key steps:

- Gather documentation of contributions made to the 529 plan.

- Fill out personal information, including name, address, and Social Security number.

- Report the total contributions made during the tax year.

- List the beneficiaries of the 529 plan.

- Calculate the deduction based on the contributions reported.

- Review the form for accuracy before submission.

Legal Considerations for the Schedule IN 529

The Schedule IN 529 must be completed in accordance with Indiana state tax laws. It is important to adhere to the guidelines set forth by the Indiana Department of Revenue to ensure compliance. Taxpayers should be aware of the eligibility criteria for deductions and any changes in legislation that may affect their filings. Understanding these legal aspects can help avoid penalties and ensure proper use of the form.

Required Documentation for the Schedule IN 529

When completing the Schedule IN 529, taxpayers need to have specific documentation on hand. This includes:

- Statements from the 529 plan provider detailing contributions.

- Information on the beneficiaries associated with the plan.

- Any prior year tax returns that may be relevant.

Having these documents readily available can streamline the process and ensure accurate reporting.

Filing Deadlines for the Schedule IN 529

Taxpayers should be aware of the filing deadlines associated with the Schedule IN 529. Typically, the form must be submitted by the same deadline as the individual income tax return, which is usually April 15. However, if additional time is needed, taxpayers may file for an extension, but they should ensure that the Schedule IN 529 is included in their extended return submission.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule in 529

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule IN 529 and how does it work?

Schedule IN 529 is a feature within airSlate SignNow that allows users to efficiently plan and manage their document signing processes. By utilizing this tool, businesses can streamline their workflows, ensuring that all necessary documents are signed in a timely manner. This feature is designed to enhance productivity and reduce delays in document handling.

-

How can I integrate Schedule IN 529 with my existing tools?

airSlate SignNow offers seamless integrations with various applications, allowing you to incorporate Schedule IN 529 into your current workflow. You can connect it with CRM systems, cloud storage services, and other productivity tools to enhance your document management process. This integration ensures that you can easily access and manage your documents from one central location.

-

What are the pricing options for using Schedule IN 529?

The pricing for Schedule IN 529 varies based on the plan you choose with airSlate SignNow. We offer flexible subscription options that cater to different business needs, ensuring that you only pay for what you use. For detailed pricing information, you can visit our website or contact our sales team for a personalized quote.

-

What benefits does Schedule IN 529 provide for businesses?

Schedule IN 529 provides numerous benefits, including increased efficiency in document signing and enhanced collaboration among team members. By automating the scheduling process, businesses can save time and reduce the risk of errors. This leads to faster turnaround times and improved customer satisfaction.

-

Is Schedule IN 529 secure for handling sensitive documents?

Yes, Schedule IN 529 is designed with security in mind. airSlate SignNow employs advanced encryption and security protocols to protect your sensitive documents during the signing process. You can trust that your data is safe and secure while using our platform.

-

Can I customize the Schedule IN 529 feature to fit my business needs?

Absolutely! Schedule IN 529 is highly customizable, allowing you to tailor the feature to meet your specific business requirements. You can set up custom workflows, notifications, and templates to ensure that the signing process aligns with your operational needs.

-

How does Schedule IN 529 improve team collaboration?

Schedule IN 529 enhances team collaboration by allowing multiple users to access and manage document signing processes simultaneously. This feature enables teams to work together more effectively, ensuring that everyone is on the same page and that documents are signed promptly. Improved collaboration leads to better project outcomes and faster decision-making.

Get more for Schedule IN 529

- Ma form 2

- Ma state tax form 2 fillable

- Tax exempt certificate form

- Pte ex massachusetts form

- Form pte ex

- Ma w4p form

- Sdat application for exemption for disabled veterans sdat application for exemption for disabled veterans form

- State of maryland department of assessments and taxation application for exemption disabled veterans dat state md form

Find out other Schedule IN 529

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now