Schedule in OCC Form

What is the Schedule IN OCC

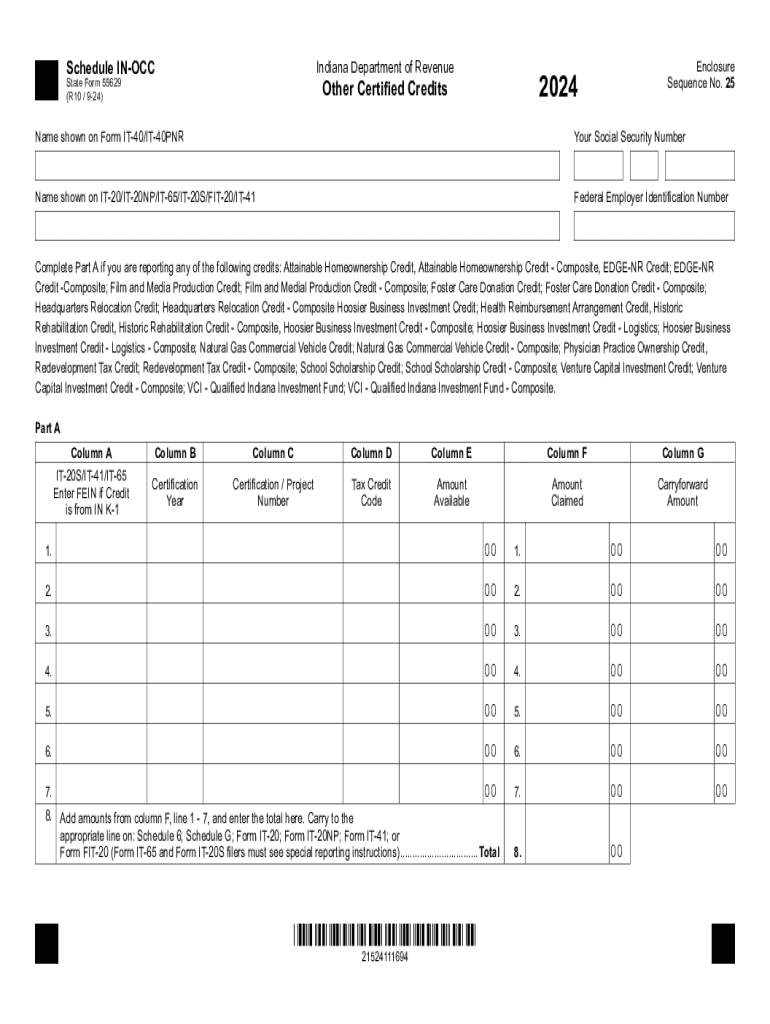

The Schedule IN OCC is a specific form used in the context of tax reporting, particularly for businesses and individuals who need to report certain types of income or deductions. This form is essential for accurately detailing specific financial activities that may not be captured on standard tax forms. Understanding its purpose helps ensure compliance with tax regulations and can aid in optimizing tax liabilities.

How to use the Schedule IN OCC

Using the Schedule IN OCC involves filling out the form with accurate information regarding the relevant income or deductions. It is important to gather all necessary documentation before starting the process. The form typically requires details such as the type of income, amounts, and any applicable deductions. Once completed, it should be attached to the main tax return form when submitted.

Steps to complete the Schedule IN OCC

To complete the Schedule IN OCC effectively, follow these steps:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Attach the Schedule IN OCC to your main tax return when filing.

Legal use of the Schedule IN OCC

The Schedule IN OCC must be used in accordance with IRS guidelines to avoid potential legal issues. It is designed to ensure that taxpayers report their income and deductions accurately, which is crucial for compliance with federal tax laws. Failure to use the form correctly can lead to penalties or audits, emphasizing the importance of understanding its legal implications.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule IN OCC align with the overall tax return deadlines. Typically, individual tax returns are due on April 15th of each year. However, if the due date falls on a weekend or holiday, the deadline may be extended. It's essential to keep track of these dates to ensure timely submission and avoid penalties.

Required Documents

When preparing to fill out the Schedule IN OCC, certain documents are required to ensure accuracy and completeness. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any relevant financial records that support the reported amounts.

Examples of using the Schedule IN OCC

Examples of when to use the Schedule IN OCC include reporting income from freelance work, rental properties, or other sources that do not fall under traditional employment. For instance, a self-employed individual may need to report income earned through contracts, while a landlord would use the form to report rental income and associated expenses. Each scenario highlights the importance of accurately documenting financial activities for tax purposes.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule in occ

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Schedule IN OCC using airSlate SignNow?

To Schedule IN OCC with airSlate SignNow, simply log into your account, select the document you wish to send, and choose the scheduling option. You can set specific dates and times for when the document should be sent for signing. This feature ensures that your documents are sent at the most convenient times for your recipients.

-

What are the pricing options for using airSlate SignNow to Schedule IN OCC?

airSlate SignNow offers various pricing plans that cater to different business needs. You can choose from monthly or annual subscriptions, with options that allow you to Schedule IN OCC as often as required. Each plan includes features that enhance your document management experience, making it a cost-effective solution.

-

What features does airSlate SignNow offer for scheduling documents?

airSlate SignNow provides robust features for scheduling documents, including customizable reminders and notifications. You can easily Schedule IN OCC and track the status of your documents in real-time. These features help streamline your workflow and ensure timely responses from recipients.

-

How can I integrate airSlate SignNow with other tools to enhance my scheduling?

airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and Microsoft Office. By integrating these tools, you can enhance your ability to Schedule IN OCC and manage documents more efficiently. This connectivity allows for a smoother workflow and better collaboration across teams.

-

What are the benefits of using airSlate SignNow for scheduling documents?

Using airSlate SignNow to Schedule IN OCC offers numerous benefits, including increased efficiency and reduced turnaround times. The platform's user-friendly interface makes it easy to manage your documents, while its secure eSigning capabilities ensure compliance and safety. This combination helps businesses save time and resources.

-

Is there a mobile app for airSlate SignNow to Schedule IN OCC on the go?

Yes, airSlate SignNow offers a mobile app that allows you to Schedule IN OCC from anywhere. The app provides full access to your documents and scheduling features, enabling you to manage your eSigning needs while on the move. This flexibility is ideal for busy professionals who need to stay productive.

-

Can I customize the scheduling options in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your scheduling options to fit your specific needs. You can set preferred times, add personalized messages, and choose how reminders are sent, making it easy to Schedule IN OCC according to your preferences and those of your recipients.

Get more for Schedule IN OCC

- Louisiana landlord tenant package form

- Download llc filing forms by state all 50 states included

- How to form a new business entity division of corporations state

- Colorado land contractcolorado deed formsus legal forms

- Self help forms name change adult colorado judicial branch

- Achieving family harmony in estate plans practice tools ampamp trust form

- Full text of ampquotdelaware and hudson railroad 24 e booksampquot form

- Tennessee contract for deed forms land contractsus legal forms

Find out other Schedule IN OCC

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online