It 40RNR Form

What is the IT 40RNR

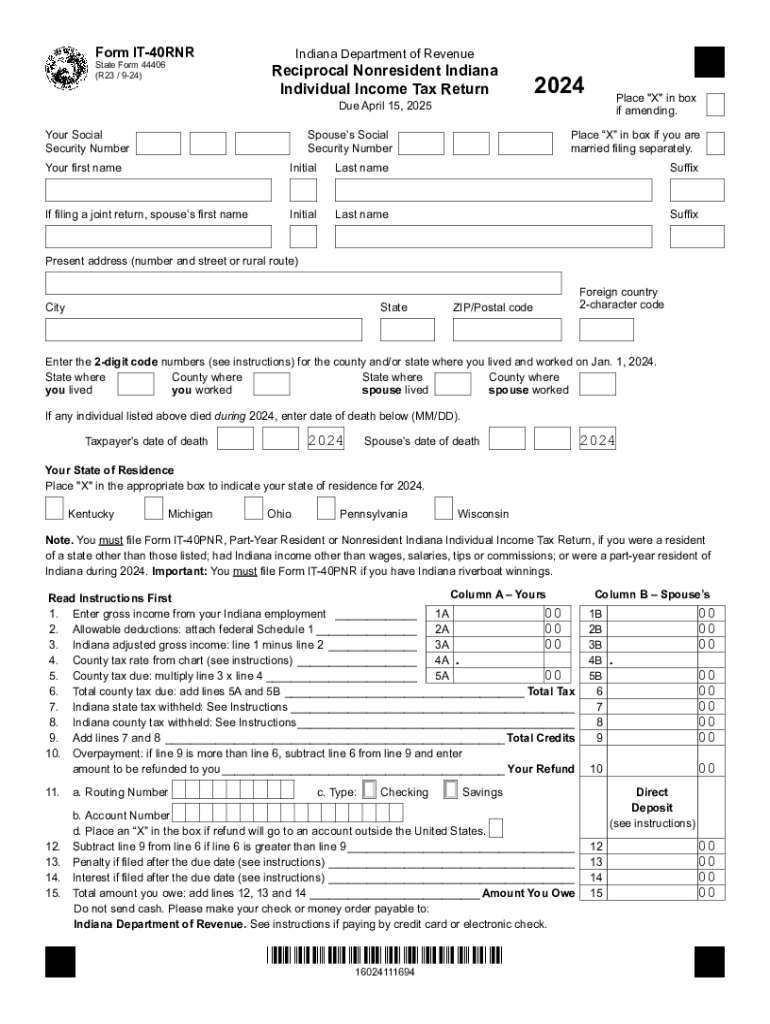

The Indiana Form IT 40RNR, or the Reciprocal Nonresident Return, is a tax form specifically designed for individuals who earn income in Indiana but reside in a state that has a reciprocal agreement with Indiana. This form allows nonresidents to file their state tax returns and claim any tax credits or deductions applicable to their situation. It is essential for ensuring that nonresidents are taxed appropriately on their Indiana-sourced income while avoiding double taxation.

Steps to complete the IT 40RNR

Completing the Indiana Form IT 40RNR involves several steps to ensure accuracy and compliance. Start by gathering all necessary documents, including W-2 forms and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your income earned in Indiana, and calculate any deductions or credits you may qualify for. Finally, review your form for accuracy before submitting it to the Indiana Department of Revenue.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Indiana Form IT 40RNR. Typically, the deadline for submitting the form is the same as the federal tax deadline, which falls on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be mindful of any changes in deadlines for specific tax years, such as the 2024 tax year, to ensure timely filing.

Required Documents

To successfully complete the Indiana Form IT 40RNR, you will need several key documents. These typically include your W-2 forms from Indiana employers, any 1099 forms for additional income, and records of any deductions or credits you plan to claim. It is advisable to keep copies of all documents submitted, as they may be required for future reference or audits.

Eligibility Criteria

Eligibility for filing the IT 40RNR is primarily based on residency and income sources. To qualify, you must be a nonresident of Indiana who earns income from Indiana sources. Additionally, you must reside in a state that has a reciprocal agreement with Indiana, allowing you to file this specific form rather than the standard nonresident return. Understanding these criteria is essential for ensuring compliance and avoiding potential penalties.

Form Submission Methods

The Indiana Form IT 40RNR can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file the form online via the Indiana Department of Revenue's e-filing system, which provides a convenient and efficient way to submit your tax return. Alternatively, you can mail a paper copy of the completed form to the appropriate address provided by the state. In-person submission may also be available at designated tax offices, depending on local regulations.

Penalties for Non-Compliance

Failing to file the Indiana Form IT 40RNR or submitting it inaccurately can result in penalties. The Indiana Department of Revenue may impose fines for late filings, underreporting income, or failing to pay taxes owed. It is important to understand these potential consequences and ensure that all forms are completed accurately and submitted on time to avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 40rnr 771936161

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana Form IT 40RNR?

The Indiana Form IT 40RNR is a state tax form used by residents of Indiana to report their income and calculate their tax liability. It is specifically designed for individuals who are non-residents or part-year residents. Understanding this form is crucial for accurate tax filing in Indiana.

-

How can airSlate SignNow help with the Indiana Form IT 40RNR?

airSlate SignNow provides an efficient platform for electronically signing and sending the Indiana Form IT 40RNR. With its user-friendly interface, you can easily manage your tax documents and ensure they are securely signed and submitted on time.

-

What are the pricing options for using airSlate SignNow for the Indiana Form IT 40RNR?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for individuals and teams. You can choose a plan that best fits your requirements for managing documents like the Indiana Form IT 40RNR, ensuring you get the best value for your investment.

-

Are there any features specifically beneficial for the Indiana Form IT 40RNR?

Yes, airSlate SignNow includes features such as templates, reminders, and secure storage that are particularly beneficial for handling the Indiana Form IT 40RNR. These tools streamline the process, making it easier to complete and submit your tax forms accurately and on time.

-

Can I integrate airSlate SignNow with other software for filing the Indiana Form IT 40RNR?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, allowing you to seamlessly manage your Indiana Form IT 40RNR alongside other financial documents. This integration enhances efficiency and reduces the risk of errors during the filing process.

-

What are the benefits of using airSlate SignNow for tax documents like the Indiana Form IT 40RNR?

Using airSlate SignNow for tax documents like the Indiana Form IT 40RNR provides numerous benefits, including time savings, enhanced security, and improved compliance. The platform ensures that your documents are signed and stored securely, giving you peace of mind during tax season.

-

Is airSlate SignNow easy to use for filing the Indiana Form IT 40RNR?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to file the Indiana Form IT 40RNR. The intuitive interface guides you through the process, ensuring that you can complete your tax forms without any hassle.

Get more for IT 40RNR

- Sample crummy letter for ilit form

- Sample letter response to request for documents form

- Unintended client and non engagement letters aon attorneys form

- Sample letter to unrepresented party opposite regarding respond to form

- Enclosed herewith please find the acknowledgement of receipt of summons filed in the form

- Please be advised that our firm represents form

- In re family law rules of procedure 663 so 2d 1049casetext form

- Your name address line 1 address line 2 city state zip code form

Find out other IT 40RNR

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document