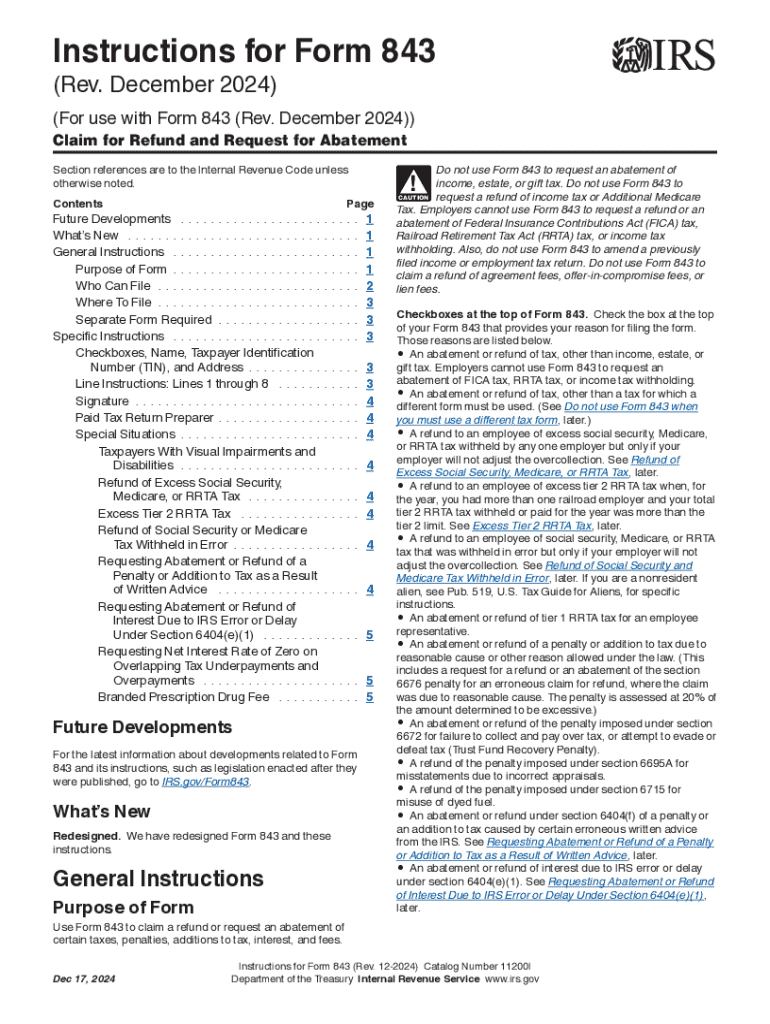

Instructions for Form 843 Rev December Instructions for Form 843, Claim for Refund and Request for Abatement

Understanding Form 843: Claim for Refund and Request for Abatement

Form 843 is a crucial document used by taxpayers to request a refund or abatement of certain taxes. This form is particularly relevant for individuals or businesses seeking to recover overpaid taxes or to request a reduction in tax liabilities. Understanding the purpose and requirements of Form 843 is essential for ensuring that your claim is processed smoothly. The form can be used for various tax types, including income, employment, and excise taxes.

Steps to Complete Form 843

Filling out Form 843 requires careful attention to detail. Here are the key steps to ensure accurate completion:

- Begin by providing your personal information, including your name, address, and taxpayer identification number.

- Clearly state the reason for your refund request or abatement. It is essential to provide a detailed explanation to support your claim.

- Attach any necessary documentation that substantiates your request, such as proof of payment or correspondence with the IRS.

- Sign and date the form before submission to confirm that the information provided is accurate and complete.

Where to Mail Form 843

Mailing Form 843 to the correct IRS address is critical for timely processing. The address can vary depending on your location and the type of tax involved. Generally, you should refer to the IRS instructions specific to Form 843 for the correct mailing address. Ensure that you use the most current address to avoid delays in your refund or abatement request.

Required Documents for Form 843 Submission

To support your claim when submitting Form 843, certain documents may be required. These can include:

- Copies of previous tax returns related to the claim.

- Proof of payment, such as canceled checks or bank statements.

- Any correspondence from the IRS that pertains to your tax situation.

Including these documents helps substantiate your claim and can expedite the review process by the IRS.

IRS Guidelines for Form 843

The IRS provides specific guidelines for completing and submitting Form 843. Familiarizing yourself with these guidelines can help ensure compliance and increase the likelihood of a successful claim. Key points include:

- Understanding the eligibility criteria for filing the form.

- Awareness of any applicable deadlines for submission.

- Following the instructions provided in the IRS documentation to avoid common mistakes.

Filing Deadlines for Form 843

Timeliness is crucial when filing Form 843. Generally, you must submit the form within three years from the date you filed your original return or within two years from the date you paid the tax, whichever is later. Being aware of these deadlines helps ensure that your claim is considered by the IRS.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 843 rev december instructions for form 843 claim for refund and request for abatement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can airSlate SignNow help me with my refund IRS process?

airSlate SignNow streamlines the document signing process, making it easier to manage forms related to your refund IRS claims. With our platform, you can quickly send, sign, and store necessary documents securely, ensuring you meet all deadlines efficiently.

-

What features does airSlate SignNow offer for managing refund IRS documents?

Our platform includes features like customizable templates, automated workflows, and real-time tracking, which are essential for managing refund IRS documents. These tools help you ensure that all necessary paperwork is completed accurately and on time.

-

Is airSlate SignNow cost-effective for small businesses dealing with refund IRS claims?

Yes, airSlate SignNow offers competitive pricing plans that are designed to be budget-friendly for small businesses. By using our service, you can save time and reduce costs associated with managing refund IRS documentation.

-

Can I integrate airSlate SignNow with other tools for my refund IRS needs?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including accounting and tax software, to enhance your refund IRS workflow. This integration allows for a more efficient process, reducing the need for manual data entry.

-

What are the benefits of using airSlate SignNow for refund IRS documentation?

Using airSlate SignNow for your refund IRS documentation offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform ensures that your documents are signed and stored securely, giving you peace of mind.

-

How does airSlate SignNow ensure the security of my refund IRS documents?

airSlate SignNow prioritizes the security of your refund IRS documents by employing advanced encryption and secure cloud storage. This ensures that your sensitive information remains protected throughout the signing and storage process.

-

What support does airSlate SignNow provide for refund IRS inquiries?

We offer comprehensive customer support to assist you with any refund IRS inquiries you may have. Our team is available via chat, email, or phone to help you navigate the platform and address any concerns related to your documents.

Get more for Instructions For Form 843 Rev December Instructions For Form 843, Claim For Refund And Request For Abatement

- County court judge of form

- Sample letter of request for representation form

- Please find your copy of the courts order denying motion form

- Please be advised that the trial on the above referenced traffic ticket has been set for form

- I apologize for the delay in responding to your letter of form

- Please find enclosed herewith two ucc 1s which were recorded with the chancery clerk form

- Solved please type a breif statement for each line descrichegg form

- Enclosed herewith please find a copy of the lawsuit that was filed against form

Find out other Instructions For Form 843 Rev December Instructions For Form 843, Claim For Refund And Request For Abatement

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template