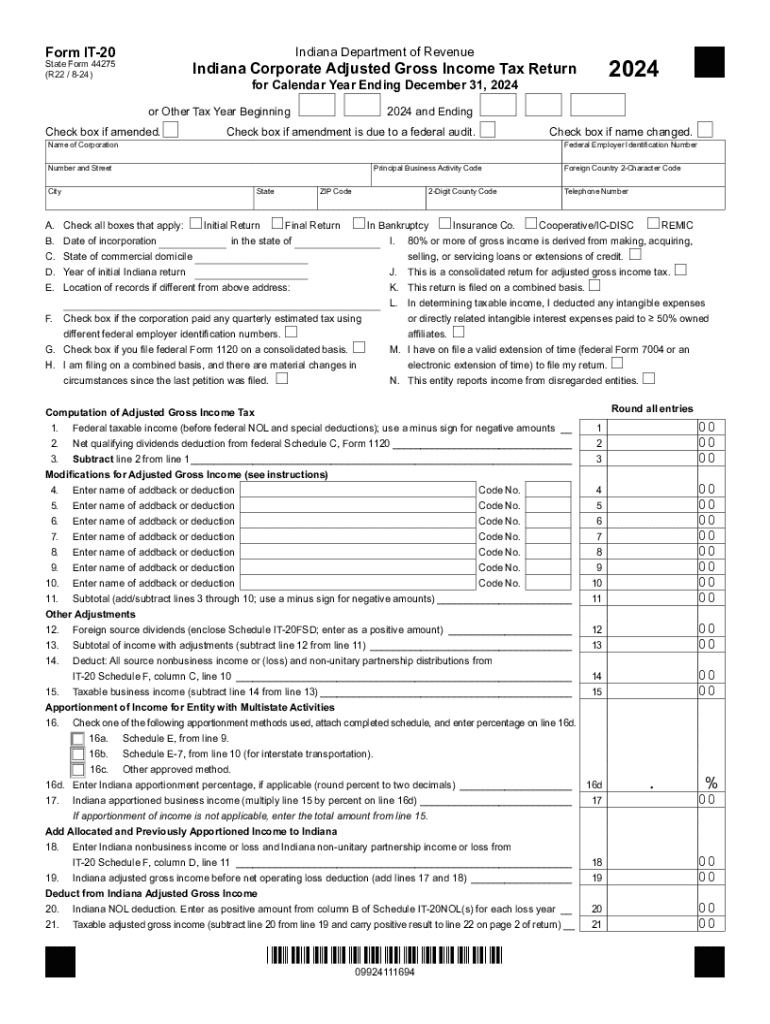

It 20 Form

What is the IT 20

The IT 20 form is a tax document used by businesses and individuals in the United States to report specific income and tax information to the Internal Revenue Service (IRS). It is primarily utilized for reporting income that is not subject to withholding, such as certain types of self-employment income or miscellaneous income. Understanding the purpose of the IT 20 is crucial for accurate tax reporting and compliance.

How to use the IT 20

Using the IT 20 involves accurately filling out the form with the relevant income details. Taxpayers should gather all necessary documentation, including records of income received, before starting the form. Once completed, the IT 20 must be submitted to the IRS by the designated deadline. It is important to ensure that all information is correct to avoid potential penalties or issues with the IRS.

Steps to complete the IT 20

Completing the IT 20 involves several key steps:

- Gather all necessary income documentation.

- Fill out the form with accurate income figures.

- Review the form for any errors or omissions.

- Sign and date the form as required.

- Submit the form to the IRS by the specified deadline.

Following these steps carefully can help ensure a smooth filing process.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the IT 20. Typically, the form must be submitted by April fifteenth of the following tax year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Staying informed about these dates is crucial for timely compliance.

Legal use of the IT 20

The IT 20 must be used in accordance with IRS guidelines to ensure legal compliance. Failure to use the form correctly can result in penalties or audits. Taxpayers should familiarize themselves with the legal requirements surrounding the form, including eligibility criteria and appropriate usage scenarios.

Examples of using the IT 20

Common scenarios for using the IT 20 include reporting income from freelance work, rental properties, or other sources not subject to withholding. For instance, a self-employed individual might use the IT 20 to report income earned from consulting services. Understanding these examples can help taxpayers recognize when the form is applicable to their financial situation.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the IT 20. These guidelines include instructions on what information must be reported, how to calculate taxable income, and any additional forms that may be required. Adhering to these guidelines is essential for accurate tax reporting and avoiding penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 20

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IT 20 and how does it relate to airSlate SignNow?

IT 20 refers to the innovative features and capabilities offered by airSlate SignNow that enhance document management and eSigning processes. With IT 20, businesses can streamline their workflows, ensuring that document handling is efficient and secure.

-

How much does airSlate SignNow cost under the IT 20 plan?

The IT 20 plan offers competitive pricing tailored to meet the needs of various businesses. By choosing this plan, you gain access to a range of features at an affordable rate, making it a cost-effective solution for document management.

-

What features are included in the IT 20 package?

The IT 20 package includes advanced eSigning capabilities, customizable templates, and robust security features. These tools are designed to enhance user experience and ensure that your documents are handled with the utmost care.

-

How can IT 20 benefit my business?

Implementing IT 20 can signNowly improve your business's efficiency by reducing the time spent on document processing. With its user-friendly interface and powerful features, airSlate SignNow helps you focus on what matters most—growing your business.

-

Can I integrate airSlate SignNow with other software using IT 20?

Yes, airSlate SignNow under the IT 20 plan supports integrations with various software applications. This flexibility allows you to connect your existing tools and streamline your workflows seamlessly.

-

Is there a free trial available for the IT 20 plan?

Yes, airSlate SignNow offers a free trial for the IT 20 plan, allowing you to explore its features without any commitment. This trial period is an excellent opportunity to see how IT 20 can transform your document management processes.

-

What kind of customer support is available for IT 20 users?

Customers using the IT 20 plan have access to dedicated support through various channels, including email, chat, and phone. Our support team is committed to helping you resolve any issues and maximize your use of airSlate SignNow.

Get more for IT 20

- Court appoints receiver to protect partnership assetsthe form

- Walker v liberty mut ins co civil action no 416 cv 01388 rbh form

- Faqs uttarakhand human right commission dehradun uttarakhand form

- In the court of appeals 42297 of the state of mississippi form

- Motion for entry of default judgment form

- United states district court northern district govinfo form

- Court issues mixed ruling in mississippi eminent domain case form

- Xerox settlement agreement california department of form

Find out other IT 20

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT