New Jersey Resident Return, Form NJ 1040

What is the New Jersey Resident Return, Form NJ 1040

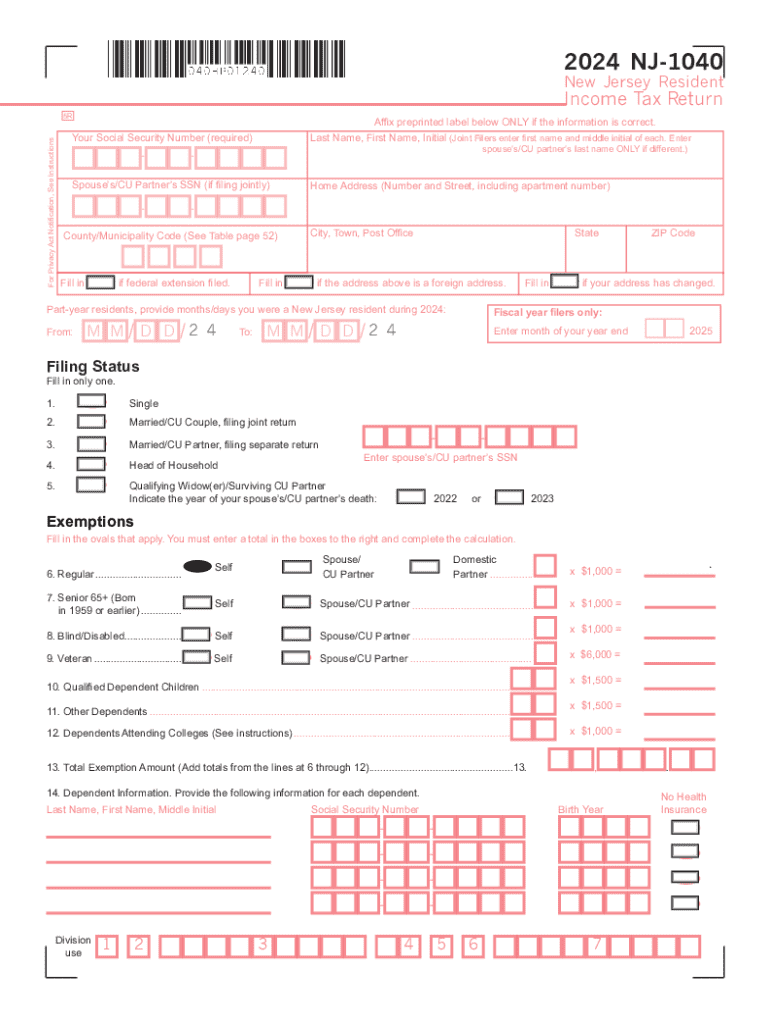

The New Jersey Resident Return, known as Form NJ 1040, is the official state tax form used by residents of New Jersey to report their income and calculate their state tax liability. This form is essential for individuals who maintain residency in New Jersey for the entire tax year. It encompasses various income types, including wages, interest, dividends, and retirement benefits. Completing this form accurately is crucial for ensuring compliance with state tax laws and for determining eligibility for any applicable deductions or credits.

Steps to complete the New Jersey Resident Return, Form NJ 1040

Completing the New Jersey Resident Return involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Accurately report all sources of income on the designated lines of the form.

- Calculate deductions and credits: Identify any eligible deductions or credits to reduce your taxable income.

- Determine tax liability: Use the provided tax tables to calculate your total tax due based on your taxable income.

- Review and sign: Carefully review your completed form for accuracy and sign it before submission.

How to obtain the New Jersey Resident Return, Form NJ 1040

Residents can obtain the New Jersey Resident Return, Form NJ 1040, through several methods. The form is available for download from the New Jersey Division of Taxation website in a printable PDF format. Additionally, physical copies can be requested by contacting the state tax office directly. Many tax preparation services also provide access to this form as part of their software packages, allowing users to fill it out electronically.

Filing Deadlines / Important Dates

For the 2024 tax year, the deadline to file the New Jersey Resident Return, Form NJ 1040, is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to be aware of these dates to avoid late filing penalties. Additionally, extensions may be available, but they must be filed properly to ensure compliance with state regulations.

Required Documents

To accurately complete the New Jersey Resident Return, several documents are required:

- W-2 forms: These are necessary for reporting wages and salaries.

- 1099 forms: Required for reporting other income sources, such as freelance work or interest income.

- Proof of residency: Documentation that verifies your residency in New Jersey during the tax year.

- Receipts for deductions: Keep records of any deductible expenses to support your claims.

Key elements of the New Jersey Resident Return, Form NJ 1040

The New Jersey Resident Return includes several key elements that taxpayers must understand:

- Personal information section: This section captures essential taxpayer information.

- Income reporting section: Here, all income types must be reported accurately.

- Deductions and credits: Taxpayers can claim various deductions that may lower their taxable income.

- Tax computation: This part calculates the total tax liability based on reported income.

Handy tips for filling out New Jersey Resident Return, Form NJ 1040 online

Quick steps to complete and e-sign New Jersey Resident Return, Form NJ 1040 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant platform for optimum simpleness. Use signNow to e-sign and send New Jersey Resident Return, Form NJ 1040 for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new jersey resident return form nj 1040 771936582

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the airSlate SignNow platform for handling 2024 NJ 1040 instructions?

The airSlate SignNow platform offers a user-friendly interface that simplifies the process of managing 2024 NJ 1040 instructions. Key features include customizable templates, secure eSigning, and real-time collaboration, making it easier for users to complete their tax documents efficiently.

-

How does airSlate SignNow help with the completion of 2024 NJ 1040 instructions?

airSlate SignNow streamlines the completion of 2024 NJ 1040 instructions by providing step-by-step guidance and easy access to necessary forms. Users can fill out their tax documents electronically, ensuring accuracy and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for 2024 NJ 1040 instructions?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans provide access to features that facilitate the completion of 2024 NJ 1040 instructions, ensuring a cost-effective solution for users.

-

Can I integrate airSlate SignNow with other software for managing 2024 NJ 1040 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for managing 2024 NJ 1040 instructions. This integration allows users to connect their existing tools and streamline the document signing process.

-

What benefits does airSlate SignNow offer for businesses handling 2024 NJ 1040 instructions?

Using airSlate SignNow for 2024 NJ 1040 instructions provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security for sensitive tax documents. Businesses can also improve collaboration among team members, ensuring a smoother tax filing process.

-

How secure is airSlate SignNow when dealing with 2024 NJ 1040 instructions?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect sensitive information related to 2024 NJ 1040 instructions, ensuring that your documents are safe and secure throughout the signing process.

-

What support options are available for users of airSlate SignNow regarding 2024 NJ 1040 instructions?

airSlate SignNow provides comprehensive support options for users needing assistance with 2024 NJ 1040 instructions. This includes access to a knowledge base, live chat support, and email assistance, ensuring that users can get help whenever they need it.

Get more for New Jersey Resident Return, Form NJ 1040

- Control number ut p024 pkg form

- Utah living wills and advance health care directives what you form

- Control number va 004 d form

- Control number va p029 pkg form

- Legal forms prepared by tysons corner attorney brien roche

- Tennessee contract forms and faqus legal forms

- Control number va p052 pkg form

- Pdf templates free vermont power of attorney forms

Find out other New Jersey Resident Return, Form NJ 1040

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will