Web Fill 9 24 D 400TC PRINT Individual Inc Form

Understanding the D 400TC Part 3 Line 20

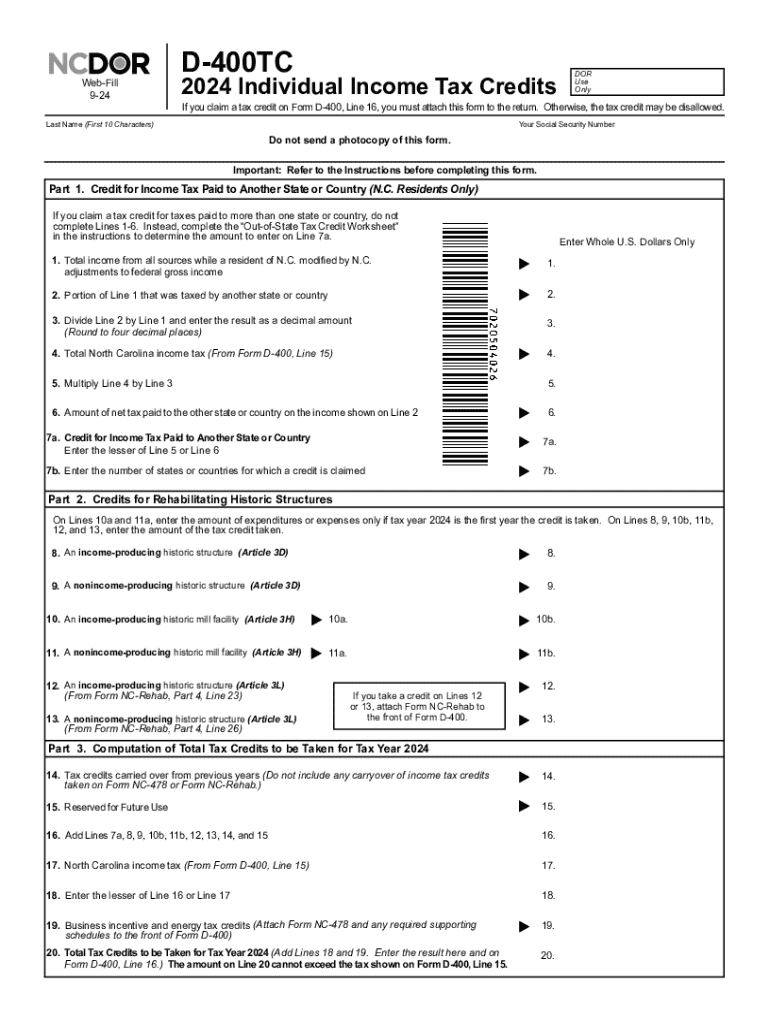

The D 400TC Part 3 Line 20 is a specific section of the North Carolina tax form that requires taxpayers to report certain types of income. This line is crucial for individuals who need to accurately declare their earnings to the North Carolina Department of Revenue (NCDOR). Understanding what qualifies as reportable income and how to fill this line correctly can help avoid potential penalties and ensure compliance with state tax laws.

Steps to Complete the D 400TC Part 3 Line 20

Filling out the D 400TC Part 3 Line 20 involves several steps to ensure accuracy. First, gather all relevant financial documents, including W-2s and 1099s. Next, identify the specific income types that need to be reported on this line. Carefully enter the amounts in the appropriate fields, ensuring that all figures are accurate and match your documentation. Finally, review your entries for any errors before submitting the form to the NCDOR.

Required Documents for the D 400TC Part 3 Line 20

To complete the D 400TC Part 3 Line 20, certain documents are essential. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Any other documentation that verifies income, such as bank statements or business records

Having these documents on hand will streamline the process and help ensure that all income is reported accurately.

Filing Deadlines for the D 400TC

It is important to be aware of the filing deadlines associated with the D 400TC form. Typically, the deadline for submitting your North Carolina tax return is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure that their forms, including the D 400TC Part 3 Line 20, are submitted on time to avoid any late fees or penalties.

Penalties for Non-Compliance with the D 400TC

Failing to accurately complete the D 400TC Part 3 Line 20 can lead to significant penalties. The North Carolina Department of Revenue may impose fines for underreporting income or failing to file by the deadline. These penalties can include monetary fines and interest on any unpaid taxes. It is crucial to take the time to ensure that all information is correct and submitted on time to avoid these consequences.

Legal Use of the D 400TC Part 3 Line 20

The D 400TC Part 3 Line 20 is legally binding and must be filled out in accordance with North Carolina tax laws. Taxpayers are required to report all applicable income accurately. Misrepresentation or failure to disclose income can result in legal repercussions, including audits or investigations by the NCDOR. Understanding the legal implications of this form is essential for maintaining compliance and protecting oneself from potential legal issues.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the web fill 9 24 d 400tc print individual inc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the d 400tc part 3 line 20 feature in airSlate SignNow?

The d 400tc part 3 line 20 feature in airSlate SignNow allows users to efficiently manage document workflows. This feature streamlines the process of sending and eSigning documents, ensuring that all parties can easily access and complete necessary paperwork. With this functionality, businesses can enhance their productivity and reduce turnaround times.

-

How does airSlate SignNow pricing work for the d 400tc part 3 line 20 feature?

airSlate SignNow offers competitive pricing plans that include access to the d 400tc part 3 line 20 feature. Customers can choose from various subscription tiers based on their needs, ensuring they only pay for the features they require. This flexibility makes it a cost-effective solution for businesses of all sizes.

-

What are the benefits of using the d 400tc part 3 line 20 feature?

Using the d 400tc part 3 line 20 feature provides numerous benefits, including improved efficiency and reduced paper usage. It allows for faster document processing and enhances collaboration among team members. Additionally, this feature helps ensure compliance with legal standards, making it a reliable choice for businesses.

-

Can I integrate the d 400tc part 3 line 20 feature with other tools?

Yes, the d 400tc part 3 line 20 feature in airSlate SignNow can be seamlessly integrated with various third-party applications. This integration capability allows businesses to connect their existing tools and streamline their workflows. Popular integrations include CRM systems, project management tools, and cloud storage services.

-

Is the d 400tc part 3 line 20 feature user-friendly?

Absolutely! The d 400tc part 3 line 20 feature is designed with user experience in mind. Its intuitive interface makes it easy for users of all skill levels to navigate and utilize the eSigning process effectively. This ease of use contributes to quicker adoption and better overall satisfaction.

-

What types of documents can I manage with the d 400tc part 3 line 20 feature?

The d 400tc part 3 line 20 feature allows you to manage a wide variety of documents, including contracts, agreements, and forms. This versatility makes it suitable for different industries and use cases. Whether you need to send a simple document or a complex contract, airSlate SignNow has you covered.

-

How secure is the d 400tc part 3 line 20 feature?

Security is a top priority for airSlate SignNow, and the d 400tc part 3 line 20 feature is no exception. The platform employs advanced encryption and security protocols to protect your documents and data. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for Web Fill 9 24 D 400TC PRINT Individual Inc

- Was body part injured before form

- Lhwca procedure manual division of longshore and harbor form

- Box 115512 juneau ak 99811 5512 form

- Affidavit of readiness for hearing alaska department of labor form

- Compensation report alaskaworkers comp forms workflow

- Notice of possible claim against the second injury fund form

- Alaska workers compensation alaska department of form

- Alaska workers compensation board employee s u b p o e form

Find out other Web Fill 9 24 D 400TC PRINT Individual Inc

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed