DR 0104AD, Subtractions from Income Schedule Form

Understanding the DR 0104AD, Subtractions From Income Schedule

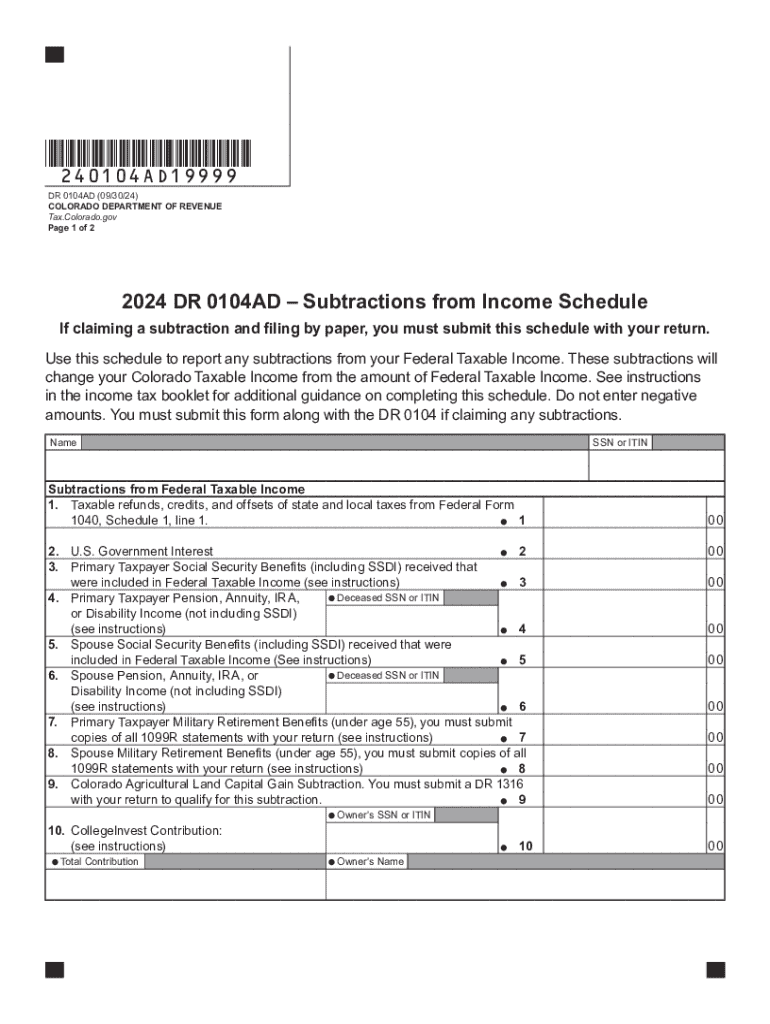

The DR 0104AD, Subtractions From Income Schedule, is a crucial form used by Colorado taxpayers to report specific subtractions from their taxable income. This form allows individuals to claim deductions that reduce their overall tax liability, making it an essential component of the state income tax filing process. Taxpayers can utilize this form to ensure they are not overpaying on their state taxes by accurately reflecting their financial situation.

Steps to Complete the DR 0104AD, Subtractions From Income Schedule

Completing the DR 0104AD requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including income statements and any relevant financial records.

- Review the instructions provided with the form to understand the specific subtractions available.

- Fill out the form by entering your total income and the applicable subtractions in the designated fields.

- Double-check your entries for accuracy to avoid errors that could lead to delays or penalties.

- Submit the completed form along with your Colorado income tax return.

Legal Use of the DR 0104AD, Subtractions From Income Schedule

The DR 0104AD is legally recognized by the Colorado Department of Revenue. Taxpayers must use this form to claim legitimate subtractions from their income as outlined in Colorado tax law. Proper use of the form ensures compliance with state regulations and helps avoid potential legal issues related to tax filings.

Examples of Using the DR 0104AD, Subtractions From Income Schedule

Several scenarios illustrate how the DR 0104AD can be beneficial:

- A taxpayer who has made contributions to a qualified retirement account may use the form to subtract those contributions from their income.

- Individuals who have incurred certain medical expenses can report these costs as subtractions, thereby lowering their taxable income.

- Taxpayers who have received income from specific state-funded programs may also be eligible to report this income as a subtraction.

Filing Deadlines for the DR 0104AD, Subtractions From Income Schedule

It is essential to be aware of the filing deadlines associated with the DR 0104AD. Typically, Colorado income tax returns, including the DR 0104AD, must be filed by April 15 of each year. However, taxpayers may qualify for extensions, allowing additional time to submit their forms. Staying informed about these deadlines helps ensure compliance and avoids penalties.

Required Documents for the DR 0104AD, Subtractions From Income Schedule

To accurately complete the DR 0104AD, taxpayers need to gather several documents:

- W-2 forms from employers to report income.

- Documentation of any subtractions being claimed, such as receipts for medical expenses or proof of retirement contributions.

- Any other relevant financial statements that support the claims made on the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0104ad subtractions from income schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 0104 and how does it relate to airSlate SignNow?

dr 0104 refers to a specific document type that can be managed using airSlate SignNow. This platform allows users to easily send, sign, and store dr 0104 documents securely. By utilizing airSlate SignNow, businesses can streamline their document workflows and enhance efficiency.

-

What are the pricing options for using airSlate SignNow with dr 0104?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for handling dr 0104 documents. The plans are designed to be cost-effective, ensuring that businesses can choose a solution that fits their budget while still accessing essential features for managing dr 0104.

-

What features does airSlate SignNow provide for dr 0104 document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning specifically for dr 0104 documents. These features help businesses save time and reduce errors when handling important paperwork. Additionally, users can track the status of their dr 0104 documents in real-time.

-

How can airSlate SignNow benefit my business when dealing with dr 0104?

Using airSlate SignNow for dr 0104 can signNowly enhance your business's efficiency by simplifying the document signing process. The platform allows for quick turnaround times, reducing the time spent on paperwork. This leads to improved productivity and a better overall customer experience.

-

Can I integrate airSlate SignNow with other tools for managing dr 0104?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, making it easy to manage dr 0104 documents alongside your existing tools. This flexibility allows businesses to create a cohesive workflow that enhances productivity. Popular integrations include CRM systems, cloud storage services, and project management tools.

-

Is airSlate SignNow secure for handling sensitive dr 0104 documents?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that all dr 0104 documents are protected. The platform employs advanced encryption and follows industry standards to safeguard sensitive information. Users can trust that their documents are secure throughout the signing process.

-

What support options are available for airSlate SignNow users dealing with dr 0104?

airSlate SignNow provides comprehensive support options for users managing dr 0104 documents. This includes a detailed knowledge base, live chat, and email support to assist with any questions or issues. The support team is dedicated to helping users maximize their experience with the platform.

Get more for DR 0104AD, Subtractions From Income Schedule

- Kansas charitable health care provider program point of form

- Hiv perinatal exposure report form

- Facility use request form clover sites

- Upon completion please send this form to in regards to

- Authorization for release of protected health information kdhe kdheks

- General prior authorization request kmap state ksus form

- Hepatitis c agents prior authorization form new

- Chronic wasting disease cwd kansas department of agriculture form

Find out other DR 0104AD, Subtractions From Income Schedule

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation