Overview of Organizations Form

What is the Overview of Organizations

The Overview of Organizations refers to the essential framework that governs the establishment and operation of nonprofit entities in the United States. This framework includes various legal requirements, tax obligations, and operational guidelines that ensure compliance with federal and state laws. Nonprofit organizations, particularly those seeking 501(c)(3) status, must adhere to specific regulations set forth by the IRS, which allows them to operate as tax-exempt entities. Understanding this overview is crucial for anyone looking to form a nonprofit organization, as it lays the foundation for legal compliance and operational success.

Key Elements of the Overview of Organizations

Several key elements define the structure and function of nonprofit organizations. These include:

- Mission Statement: A clear articulation of the organization's purpose and goals.

- Governance Structure: A defined board of directors responsible for oversight and strategic direction.

- Compliance Requirements: Adherence to federal and state regulations, including tax filings and reporting obligations.

- Financial Management: Proper accounting practices to ensure transparency and accountability.

- Fundraising Strategies: Effective methods for generating revenue to support the organization's mission.

Steps to Complete the Overview of Organizations

Completing the Overview of Organizations involves several systematic steps:

- Research: Gather information about the nonprofit sector, including legal requirements and best practices.

- Draft a Mission Statement: Clearly define the organization's purpose and objectives.

- Establish Governance: Form a board of directors and outline their roles and responsibilities.

- Develop Policies: Create operational policies that align with legal requirements and organizational goals.

- File for Tax-Exempt Status: Complete and submit the IRS Form 1023 or Form 1023-EZ, depending on eligibility.

IRS Guidelines

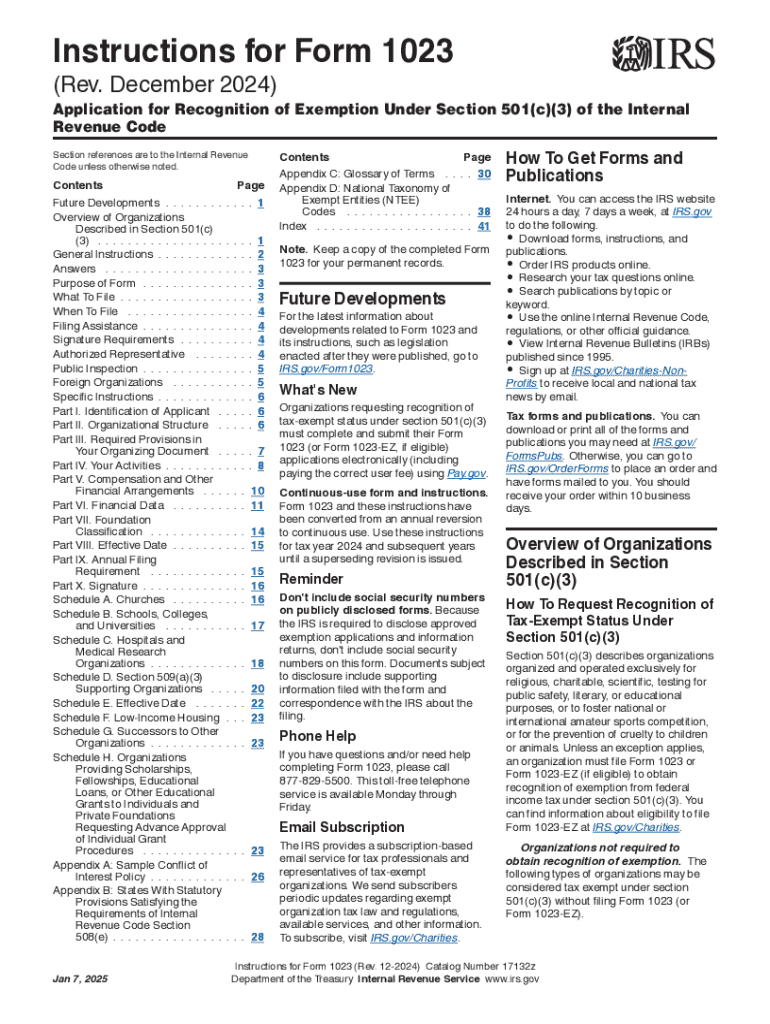

The IRS provides comprehensive guidelines for nonprofit organizations seeking tax-exempt status under section 501(c)(3). These guidelines cover eligibility criteria, required documentation, and the application process. Organizations must demonstrate that they operate exclusively for charitable, educational, religious, or scientific purposes. Additionally, they must adhere to restrictions on political activities and ensure that no part of their earnings benefits private individuals or shareholders. Familiarity with these guidelines is essential for compliance and successful operation.

Required Documents

To establish a nonprofit organization and apply for 501(c)(3) status, several documents are typically required:

- Articles of Incorporation: A legal document filed with the state to formally create the nonprofit entity.

- Bylaws: Internal rules governing the operation of the organization.

- IRS Form 1023 or Form 1023-EZ: The application for tax-exempt status, which includes detailed information about the organization.

- Financial Statements: Projections or current financial data that demonstrate the organization's funding sources and budget.

- Conflict of Interest Policy: A policy to ensure that decisions are made in the best interest of the organization.

Application Process & Approval Time

The application process for obtaining 501(c)(3) status involves several steps. After preparing the necessary documents, organizations must submit the IRS Form 1023 or Form 1023-EZ, along with the required filing fee. The IRS typically takes between three to six months to process applications, although this timeframe can vary based on the volume of applications and the complexity of the submission. Organizations may receive a determination letter confirming their tax-exempt status, which is crucial for fundraising and operational legitimacy.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the overview of organizations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 501c3 non profit organization?

A form 501c3 non profit organization is a tax-exempt entity recognized by the IRS, primarily established for charitable, educational, or religious purposes. This designation allows organizations to receive tax-deductible donations, making it easier to fund their missions. Understanding this form is crucial for any non-profit looking to operate legally and effectively.

-

How can airSlate SignNow help with the form 501c3 non profit organization process?

airSlate SignNow streamlines the process of completing and submitting the form 501c3 non profit organization by providing easy-to-use eSignature solutions. Our platform allows you to securely sign and send documents, ensuring compliance and efficiency. This can signNowly reduce the time and effort required to manage your non-profit's paperwork.

-

What are the pricing options for using airSlate SignNow for my form 501c3 non profit organization?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of non-profit organizations, including those filing a form 501c3. We provide discounts for non-profits, making our services cost-effective. You can choose from monthly or annual subscriptions based on your organization's requirements.

-

What features does airSlate SignNow offer for managing form 501c3 non profit organization documents?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, all designed to simplify the management of form 501c3 non profit organization documents. Additionally, you can track document status in real-time, ensuring that all necessary signatures are obtained promptly. These features enhance efficiency and organization for your non-profit.

-

Are there any integrations available with airSlate SignNow for form 501c3 non profit organization management?

Yes, airSlate SignNow integrates seamlessly with various applications commonly used by non-profits, such as CRM systems and cloud storage services. This allows for a more streamlined workflow when managing your form 501c3 non profit organization documents. Integrations help you maintain a cohesive system for all your organizational needs.

-

What are the benefits of using airSlate SignNow for my form 501c3 non profit organization?

Using airSlate SignNow for your form 501c3 non profit organization provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our eSignature solution ensures that your documents are signed quickly and securely, allowing you to focus more on your mission. Additionally, our user-friendly interface makes it accessible for all team members.

-

How does airSlate SignNow ensure the security of my form 501c3 non profit organization documents?

airSlate SignNow prioritizes the security of your form 501c3 non profit organization documents by employing advanced encryption and compliance with industry standards. Our platform ensures that all data is securely stored and transmitted, protecting sensitive information. You can trust that your non-profit's documents are safe with us.

Get more for Overview Of Organizations

- Form fl 640 s aviso y peticion para cancelar la orden de

- Fl 350s form

- 2018 2020 form ca jv 421 fill online printable fillable

- Childs attorney form

- Renuncia de la confidencialidad de una audiencia y form

- Complete items 1 and 2 only form

- House counsel application authorization and release form

- Dr 705motion to change custody support or visitation form

Find out other Overview Of Organizations

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free