Retailers Sales Tax Return and Instructions ST 36 Rev 7 24 Form

Understanding the Retailers Sales Tax Return and Instructions ST 36

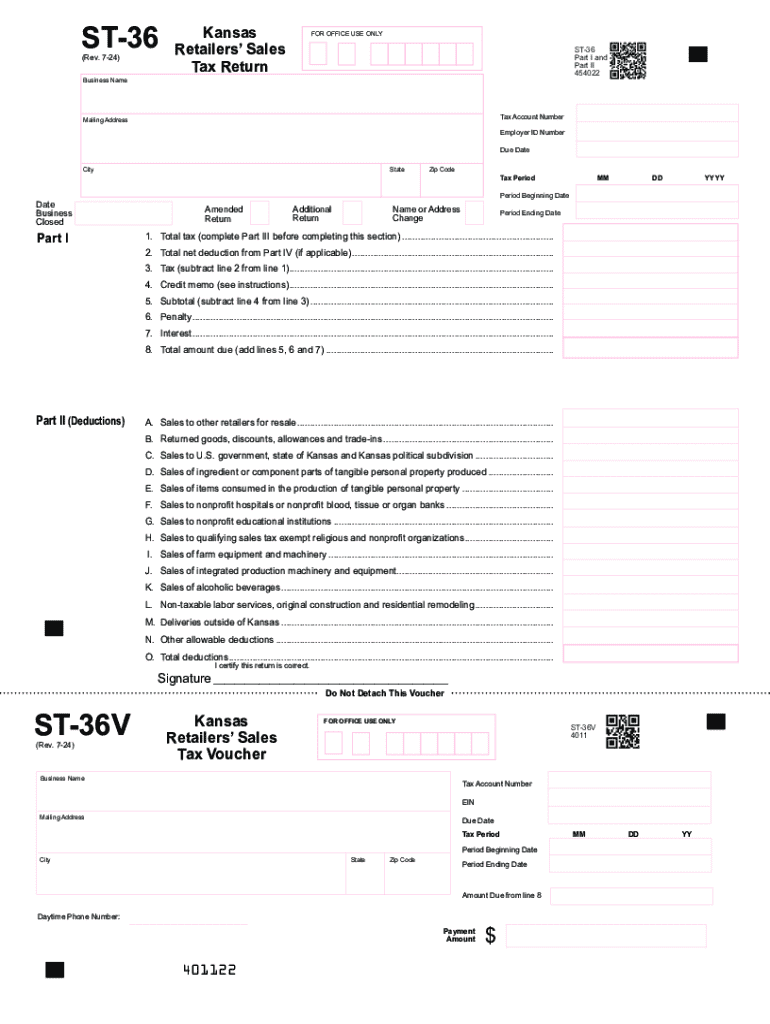

The Kansas Retailers Sales Tax Return, commonly referred to as the ST 36 form, is a critical document for businesses engaged in retail sales within the state. This form is used to report sales tax collected from customers and remit it to the state. The ST 36 includes detailed instructions that guide businesses on how to accurately complete the form, ensuring compliance with Kansas tax laws.

Key elements of the ST 36 form include the reporting period, total sales, exempt sales, and the amount of sales tax collected. It is essential for businesses to understand these components to avoid errors that could lead to penalties or audits.

Steps to Complete the Retailers Sales Tax Return ST 36

Completing the Kansas Retailers Sales Tax Return ST 36 involves several steps:

- Gather necessary documentation, including sales records and tax exemption certificates.

- Determine the reporting period for the sales tax return.

- Calculate the total sales, including taxable and exempt sales.

- Compute the total sales tax collected during the reporting period.

- Fill out the ST 36 form accurately, ensuring all figures are correct.

- Review the completed form for any errors before submission.

Following these steps helps ensure that the return is filed correctly and on time, minimizing the risk of compliance issues.

Obtaining the Retailers Sales Tax Return ST 36

The Kansas Retailers Sales Tax Return ST 36 can be obtained through the Kansas Department of Revenue's website or directly from their offices. Businesses can access the form in both digital and paper formats, allowing for flexibility in how they choose to file their returns. It is advisable to ensure that the most current version of the form is used, as outdated forms may not be accepted.

Legal Use of the Retailers Sales Tax Return ST 36

The ST 36 form is legally required for all retailers in Kansas who collect sales tax. Failure to file this return can result in penalties, interest on unpaid taxes, and potential legal action from the state. Understanding the legal implications of the ST 36 is crucial for businesses to maintain compliance and avoid costly repercussions.

Filing Deadlines for the Retailers Sales Tax Return ST 36

Businesses must adhere to specific filing deadlines for the ST 36 form, which are typically based on the frequency of their sales tax reporting (monthly, quarterly, or annually). Missing these deadlines can result in late fees and interest charges. It is important for businesses to keep track of these dates and set reminders to ensure timely submissions.

Form Submission Methods for the Retailers Sales Tax Return ST 36

The Kansas Retailers Sales Tax Return ST 36 can be submitted through various methods, including:

- Online filing through the Kansas Department of Revenue's e-file system.

- Mailing a paper copy of the completed form to the appropriate state address.

- In-person submission at designated Kansas Department of Revenue offices.

Choosing the right submission method can streamline the filing process and ensure that the return is received by the state in a timely manner.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the retailers sales tax return and instructions st 36 rev 7 24

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the kansas retail sales tax form?

The kansas retail sales tax form is a document used by businesses in Kansas to report and remit sales tax collected on taxable sales. This form is essential for compliance with state tax regulations and helps ensure that businesses fulfill their tax obligations accurately.

-

How can airSlate SignNow help with the kansas retail sales tax form?

airSlate SignNow simplifies the process of completing and submitting the kansas retail sales tax form by allowing users to eSign and send documents securely. With its user-friendly interface, businesses can easily manage their tax forms and ensure timely submissions.

-

Is there a cost associated with using airSlate SignNow for the kansas retail sales tax form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans provide access to features that streamline the completion of the kansas retail sales tax form, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for managing the kansas retail sales tax form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing the kansas retail sales tax form. These tools help businesses save time and reduce errors in their tax submissions.

-

Can I integrate airSlate SignNow with other software for the kansas retail sales tax form?

Yes, airSlate SignNow offers integrations with various accounting and business management software. This allows users to seamlessly incorporate the kansas retail sales tax form into their existing workflows, enhancing efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for the kansas retail sales tax form?

Using airSlate SignNow for the kansas retail sales tax form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Businesses can easily track their submissions and ensure they meet all state requirements.

-

How secure is airSlate SignNow when handling the kansas retail sales tax form?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect sensitive information. This ensures that your kansas retail sales tax form and other documents are handled securely throughout the signing process.

Get more for Retailers Sales Tax Return And Instructions ST 36 Rev 7 24

- Finance final finance 101 with lewis at university of form

- Default of obligor and demand for payment form

- Florida dhsmv agreement for release and monthly repayment note form

- Settlement agreement and mutual release b2 d the form

- Account application charles c parks company form

- Free state of minnesota county of district court judicial form

- Rons business letters forms notices ampampamp agreements

- Statementofcreditdenialterminationorchange lampampc3 form

Find out other Retailers Sales Tax Return And Instructions ST 36 Rev 7 24

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free