Complete If the Organization Answered Yes on Form 990, Part IV, Lines 31 or 32, or Form 990 EZ, Line 36

Understanding the Form Requirements

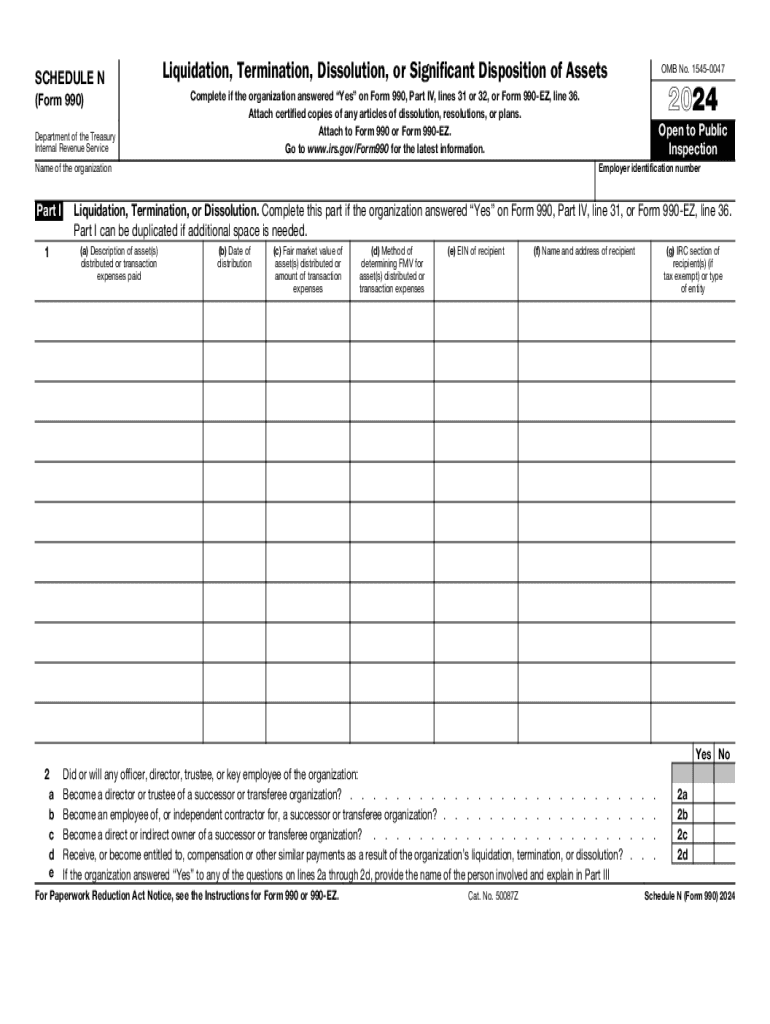

The section titled "Complete If The Organization Answered Yes On Form 990, Part IV, Lines 31 Or 32, Or Form 990 EZ, Line 36" pertains to specific disclosures required by the IRS for organizations that meet certain criteria. This requirement is crucial for maintaining transparency and compliance with federal regulations. Organizations must provide detailed information regarding their activities, governance, and financial practices when they answer 'yes' to these lines. This ensures that the IRS can effectively assess the organization's operations and adherence to tax-exempt status.

Steps to Complete the Form

To complete this section accurately, organizations should follow these steps:

- Review the questions on Form 990, Part IV, Lines 31 or 32, or Form 990 EZ, Line 36 to determine if the organization qualifies for this section.

- Gather necessary documentation that supports the 'yes' answer, including financial records, governance policies, and any relevant correspondence.

- Provide clear and concise explanations for each affirmative response, ensuring that all information is truthful and complete.

- Double-check all entries for accuracy before submission to avoid potential penalties for misinformation.

Legal Considerations

Filing the form accurately is not just a matter of compliance; it also has legal implications. Organizations that fail to disclose required information may face penalties, including fines or loss of tax-exempt status. It is essential to understand the legal responsibilities associated with this form and ensure that all disclosures are made in accordance with IRS guidelines. Consulting with a tax professional or legal advisor can provide additional assurance that the organization meets all legal requirements.

IRS Guidelines and Compliance

The IRS provides specific guidelines regarding the completion of Form 990 and its parts. Organizations should familiarize themselves with these guidelines to ensure compliance. This includes understanding the definitions of terms used in the form and the implications of answering 'yes' to the specified lines. The IRS may require additional documentation or clarification if the submitted information raises questions or concerns. Staying informed about IRS updates and changes to form requirements is also essential for ongoing compliance.

Required Documents for Submission

When completing the section related to affirmative responses on Form 990 or Form 990 EZ, organizations should prepare the following documents:

- Financial statements that reflect the organization's activities.

- Minutes from board meetings that discuss relevant governance issues.

- Policies and procedures that support the organization's operations.

- Any correspondence with the IRS or other regulatory bodies that may be pertinent.

Examples of Common Scenarios

Organizations may encounter various scenarios that require them to answer 'yes' on the specified lines. For instance, if an organization engaged in lobbying activities or political campaign interventions, it must disclose these actions. Another example includes organizations that have made significant changes to their governance structure or financial practices. Each scenario requires careful documentation and explanation to ensure transparency and compliance with IRS regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the complete if the organization answered yes on form 990 part iv lines 31 or 32 or form 990 ez line 36

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to Complete If The Organization Answered Yes On Form 990, Part IV, Lines 31 Or 32, Or Form 990 EZ, Line 36?

Completing this section indicates that your organization has engaged in specific activities that require additional disclosures. It is crucial to accurately report these activities to maintain compliance with IRS regulations. airSlate SignNow can help streamline this process by providing templates and eSigning capabilities.

-

How can airSlate SignNow assist with Form 990 compliance?

airSlate SignNow offers tools that simplify the document signing process, ensuring that all necessary forms, including those related to Form 990, are completed accurately. By using our platform, organizations can efficiently manage their compliance documentation and ensure that they Complete If The Organization Answered Yes On Form 990, Part IV, Lines 31 Or 32, Or Form 990 EZ, Line 36.

-

What features does airSlate SignNow provide for document management?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These tools are designed to enhance your workflow and ensure that you can easily Complete If The Organization Answered Yes On Form 990, Part IV, Lines 31 Or 32, Or Form 990 EZ, Line 36 without hassle.

-

Is airSlate SignNow cost-effective for small organizations?

Yes, airSlate SignNow offers competitive pricing plans tailored for small organizations. Our solution is designed to be budget-friendly while providing all the necessary tools to help you Complete If The Organization Answered Yes On Form 990, Part IV, Lines 31 Or 32, Or Form 990 EZ, Line 36 efficiently.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including CRM systems and accounting tools. This integration allows you to manage your documents and compliance processes more effectively, especially when you need to Complete If The Organization Answered Yes On Form 990, Part IV, Lines 31 Or 32, Or Form 990 EZ, Line 36.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including enhanced security, faster turnaround times, and improved document tracking. These advantages are essential for organizations that need to Complete If The Organization Answered Yes On Form 990, Part IV, Lines 31 Or 32, Or Form 990 EZ, Line 36 efficiently and accurately.

-

How does airSlate SignNow ensure document security?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your documents. This level of security is vital for organizations that need to Complete If The Organization Answered Yes On Form 990, Part IV, Lines 31 Or 32, Or Form 990 EZ, Line 36 while safeguarding sensitive information.

Get more for Complete If The Organization Answered Yes On Form 990, Part IV, Lines 31 Or 32, Or Form 990 EZ, Line 36

- Control number nd p078 pkg form

- Control number nd p082 pkg form

- Reporting identity theft attorney general ndgov form

- Control number nd p084 pkg form

- Control number nd p085 pkg form

- Free north dakota llc operating agreement templates form

- Small claims court legal services of north dakota form

- Control number nd p091 pkg form

Find out other Complete If The Organization Answered Yes On Form 990, Part IV, Lines 31 Or 32, Or Form 990 EZ, Line 36

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors