Quarter # Form 941ME 99 *2106200* Maine Revenue

Understanding the Quarter # Form 941ME 99

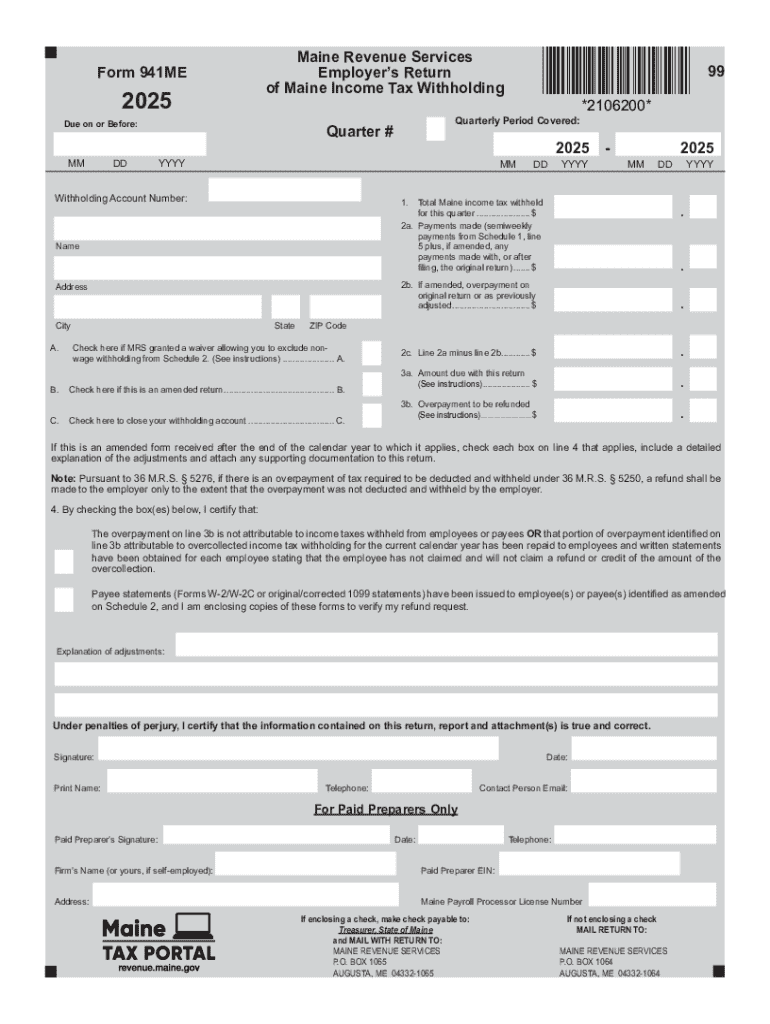

The Quarter # Form 941ME 99 is a specific tax form used by employers in Maine to report wages paid and taxes withheld. This form is crucial for compliance with state tax regulations and is part of the Maine income tax system. Employers must accurately fill out this form to ensure they meet their tax obligations and avoid penalties.

Steps to Complete the Quarter # Form 941ME 99

Completing the Quarter # Form 941ME 99 involves several key steps:

- Gather all necessary payroll information, including total wages paid and taxes withheld for the quarter.

- Fill in the employer's details, including name, address, and Employer Identification Number (EIN).

- Report the total number of employees and the total wages paid during the quarter.

- Calculate the total Maine income tax withheld and enter it in the appropriate section.

- Review the form for accuracy before submission.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the Quarter # Form 941ME 99 to avoid late fees. Typically, the form must be submitted quarterly. The deadlines are:

- For the first quarter: April 30

- For the second quarter: July 31

- For the third quarter: October 31

- For the fourth quarter: January 31 of the following year

Form Submission Methods

Employers have several options for submitting the Quarter # Form 941ME 99:

- Online submission through the Maine Revenue Services website.

- Mailing a paper copy of the form to the designated address.

- In-person submission at a local Maine Revenue Services office.

Penalties for Non-Compliance

Failure to file the Quarter # Form 941ME 99 on time or inaccuracies in reporting can lead to penalties. These may include:

- Late filing penalties, which can accumulate daily until the form is submitted.

- Interest on any unpaid taxes, which accrues from the due date until payment is made.

- Potential audits by the Maine Revenue Services if discrepancies are found.

Legal Use of the Quarter # Form 941ME 99

The Quarter # Form 941ME 99 serves a legal purpose in ensuring that employers comply with Maine's tax laws. Accurate reporting helps maintain transparency and accountability in the state's tax system. Employers are legally obligated to submit this form as part of their tax responsibilities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quarter form 941me 99 2106200 maine revenue 771843123

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the impact of the 2025 Maine income tax on businesses using airSlate SignNow?

The 2025 Maine income tax may affect your business's financial planning and document management. With airSlate SignNow, you can streamline your document processes, ensuring compliance with tax regulations while saving time and resources. Our platform helps you manage your documents efficiently, which is crucial during tax season.

-

How can airSlate SignNow help me prepare for the 2025 Maine income tax filing?

airSlate SignNow simplifies the document preparation process for your 2025 Maine income tax filing. You can easily collect eSignatures on necessary tax documents, ensuring that everything is in order before submission. This reduces the risk of errors and helps you meet deadlines efficiently.

-

What features does airSlate SignNow offer that are beneficial for managing 2025 Maine income tax documents?

Our platform offers features like customizable templates, automated workflows, and secure eSigning, which are essential for managing your 2025 Maine income tax documents. These tools help you create, send, and track documents effortlessly, ensuring that you stay organized and compliant with tax requirements.

-

Is airSlate SignNow cost-effective for small businesses dealing with 2025 Maine income tax?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing the 2025 Maine income tax. Our pricing plans are designed to fit various budgets, allowing you to access essential features without overspending. This affordability helps you allocate resources more effectively during tax season.

-

Can I integrate airSlate SignNow with my accounting software for 2025 Maine income tax purposes?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to manage your 2025 Maine income tax documents. This seamless integration allows you to sync data and streamline your workflow, ensuring that your tax-related documents are always up to date.

-

What are the benefits of using airSlate SignNow for eSigning tax documents related to the 2025 Maine income tax?

Using airSlate SignNow for eSigning tax documents related to the 2025 Maine income tax offers numerous benefits, including enhanced security and faster turnaround times. Our platform ensures that your documents are signed securely and stored safely, reducing the risk of fraud and ensuring compliance with state regulations.

-

How does airSlate SignNow ensure compliance with the 2025 Maine income tax regulations?

airSlate SignNow is designed to help businesses comply with the 2025 Maine income tax regulations by providing secure and legally binding eSignatures. Our platform adheres to industry standards and legal requirements, ensuring that your documents are valid and enforceable in the eyes of the law.

Get more for Quarter # Form 941ME 99 *2106200* Maine Revenue

- Before me a notary public on this day personally appeared known to me to be the form

- Should be signed by you in front of two witnesses not related to you and a notary form

- However this provision shall not form

- Property at your death form

- I may make a new will and this revocation is not intended to revoke any will i may make in the form

- Was gift split with spouse form

- Location of cemetery form

- With the terms of the will and laws of the state of texas in reference to the procedures and form

Find out other Quarter # Form 941ME 99 *2106200* Maine Revenue

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will