Clear Print MEMBERRECIPIENT a B Maine Pass Throug Form

What is the Clear Print MEMBERRECIPIENT A B Maine Pass through

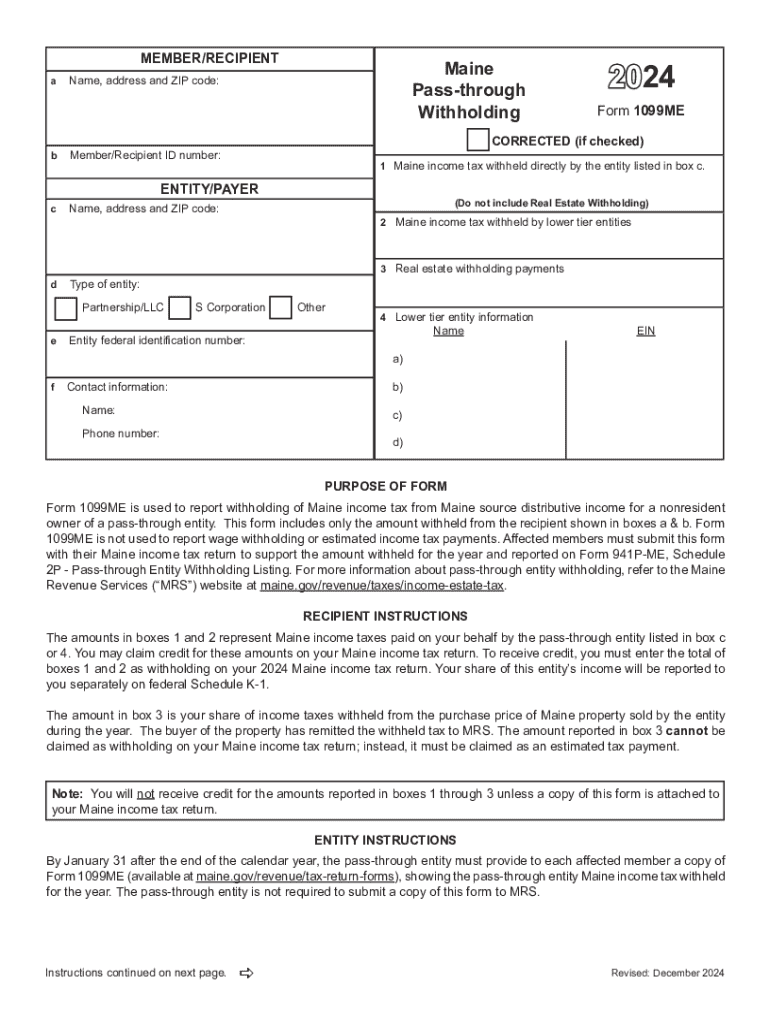

The Clear Print MEMBERRECIPIENT A B Maine Pass through is a specific form used in Maine for documenting certain transactions or communications between members and recipients. This form is essential for ensuring compliance with state regulations and maintaining clear records of interactions. It serves to formalize agreements and transactions, providing a structured way to present essential information regarding the parties involved.

How to use the Clear Print MEMBERRECIPIENT A B Maine Pass through

Using the Clear Print MEMBERRECIPIENT A B Maine Pass through involves several straightforward steps. First, gather all necessary information about the parties involved, including names, addresses, and any relevant identification numbers. Next, fill out the form accurately, ensuring that all fields are completed. It is crucial to review the information for accuracy before submission. Once completed, the form can be submitted according to the specific guidelines provided by the relevant authorities in Maine.

Steps to complete the Clear Print MEMBERRECIPIENT A B Maine Pass through

Completing the Clear Print MEMBERRECIPIENT A B Maine Pass through requires careful attention to detail. Follow these steps:

- Collect all necessary information about the member and recipient.

- Access the form and begin filling it out, ensuring all required fields are completed.

- Double-check the information for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the completed form through the appropriate channels, such as online submission or mailing it to the designated office.

Legal use of the Clear Print MEMBERRECIPIENT A B Maine Pass through

The legal use of the Clear Print MEMBERRECIPIENT A B Maine Pass through is critical for ensuring compliance with state laws. This form is recognized by Maine authorities and is used to document transactions or agreements that may have legal implications. Proper use of the form helps protect the rights of all parties involved and can serve as a legal record in case of disputes. It is important to understand the legal requirements surrounding its use to avoid potential penalties.

State-specific rules for the Clear Print MEMBERRECIPIENT A B Maine Pass through

Maine has specific rules governing the use of the Clear Print MEMBERRECIPIENT A B Maine Pass through. These rules dictate how the form should be filled out, submitted, and maintained. It is essential to be aware of any state updates or changes to ensure compliance. Familiarizing oneself with these regulations can help avoid errors that may lead to delays or legal issues.

Examples of using the Clear Print MEMBERRECIPIENT A B Maine Pass through

Examples of using the Clear Print MEMBERRECIPIENT A B Maine Pass through include documenting transactions between businesses and individual members, formalizing agreements for services rendered, or confirming the receipt of payments. Each of these examples highlights the form's role in maintaining clear communication and record-keeping among parties, which is vital for transparency and accountability.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the clear print memberrecipient a b maine pass throug

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Clear Print MEMBERRECIPIENT A B Maine Pass throug feature?

The Clear Print MEMBERRECIPIENT A B Maine Pass throug feature allows users to easily manage and send documents for eSignature. This feature ensures that all recipients can view and sign documents clearly, enhancing the overall user experience. With airSlate SignNow, you can streamline your document workflows efficiently.

-

How much does the Clear Print MEMBERRECIPIENT A B Maine Pass throug feature cost?

Pricing for the Clear Print MEMBERRECIPIENT A B Maine Pass throug feature varies based on the subscription plan you choose. airSlate SignNow offers flexible pricing options to accommodate businesses of all sizes. You can visit our pricing page for detailed information on plans and features.

-

What are the benefits of using Clear Print MEMBERRECIPIENT A B Maine Pass throug?

Using the Clear Print MEMBERRECIPIENT A B Maine Pass throug feature enhances document clarity and ensures that all recipients can easily read and sign documents. This leads to faster turnaround times and improved efficiency in your business processes. Additionally, it helps reduce errors and miscommunication.

-

Can I integrate Clear Print MEMBERRECIPIENT A B Maine Pass throug with other applications?

Yes, airSlate SignNow allows seamless integration of the Clear Print MEMBERRECIPIENT A B Maine Pass throug feature with various applications. You can connect it with popular tools like Google Drive, Salesforce, and more to enhance your document management workflow. This integration helps streamline your processes and improve productivity.

-

Is the Clear Print MEMBERRECIPIENT A B Maine Pass throug feature secure?

Absolutely! The Clear Print MEMBERRECIPIENT A B Maine Pass throug feature is designed with security in mind. airSlate SignNow employs advanced encryption and security protocols to protect your documents and sensitive information, ensuring that your data remains safe throughout the signing process.

-

How does Clear Print MEMBERRECIPIENT A B Maine Pass throug improve document workflows?

The Clear Print MEMBERRECIPIENT A B Maine Pass throug feature simplifies the document signing process, making it more efficient. By providing clear visibility and easy navigation for recipients, it reduces the time spent on document management. This leads to quicker approvals and enhances overall workflow efficiency.

-

What types of documents can I use with Clear Print MEMBERRECIPIENT A B Maine Pass throug?

You can use the Clear Print MEMBERRECIPIENT A B Maine Pass throug feature with a variety of document types, including contracts, agreements, and forms. airSlate SignNow supports multiple file formats, allowing you to send any document that requires a signature. This versatility makes it an ideal solution for diverse business needs.

Get more for Clear Print MEMBERRECIPIENT A B Maine Pass throug

- 874 false statement to a bank or other federally insured form

- Wwwca7uscourtsgov form

- Computer fraud injury to united states form

- Computer fraud causing damage to computer or program form

- Violent crimes department of justice form

- 1536 murder definition and degreesjmdepartment of form

- 1537 manslaughter definedjmdepartment of justice form

- 2041 bribery of public officialsjmdepartment of justice form

Find out other Clear Print MEMBERRECIPIENT A B Maine Pass throug

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast