Instructions for Form 720 Department of the Treasury Internal 2021

What is the Instructions For Form 720 Department Of The Treasury Internal

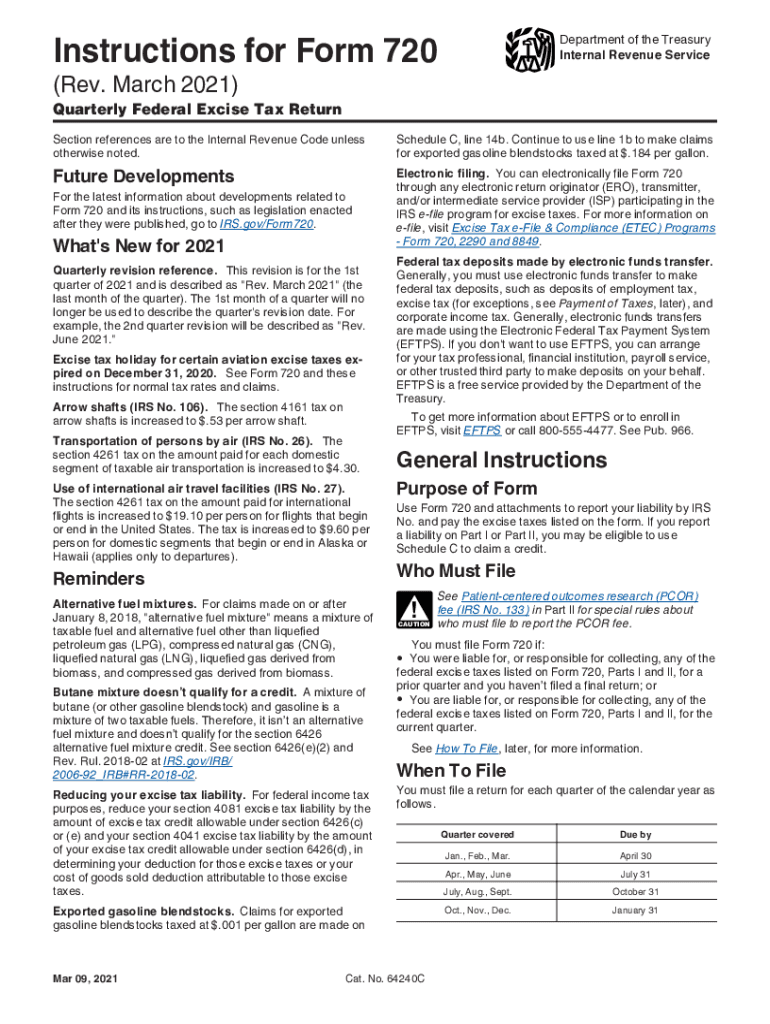

The Instructions for Form 720 are provided by the Department of the Treasury and serve as a comprehensive guide for taxpayers who need to report and pay federal excise taxes. This form is crucial for businesses involved in specific activities subject to excise tax, including the sale of certain goods and services. Understanding these instructions is essential for compliance with federal tax regulations, ensuring that all necessary information is accurately reported to avoid penalties.

Steps to complete the Instructions For Form 720 Department Of The Treasury Internal

Completing the Instructions for Form 720 involves several key steps that ensure accurate reporting of excise taxes. First, gather all necessary financial documents that relate to the taxable activities. Next, carefully read through the instructions to understand the requirements for each section of the form. Fill out the form systematically, ensuring that all information is complete and accurate. After completing the form, review it for any errors or omissions. Finally, submit the form by the designated deadline to avoid late fees.

Filing Deadlines / Important Dates

Filing deadlines for Form 720 are critical for compliance. This form is typically filed quarterly, with specific due dates for each quarter. For the first quarter, the deadline is usually April 30; for the second quarter, July 31; for the third quarter, October 31; and for the fourth quarter, January 31 of the following year. It is important to stay informed about any changes to these dates, as timely submission is essential to avoid penalties.

Penalties for Non-Compliance

Failure to comply with the filing requirements for Form 720 can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. The IRS may impose penalties for late filings and for underreporting tax liabilities. It is crucial for businesses to adhere to the guidelines and deadlines outlined in the instructions to mitigate these risks.

Legal use of the Instructions For Form 720 Department Of The Treasury Internal

The legal use of the Instructions for Form 720 is governed by federal tax laws. Businesses must ensure that they follow these instructions accurately to maintain compliance with the Internal Revenue Service (IRS) regulations. Proper use of the form not only fulfills legal obligations but also protects businesses from potential audits and penalties associated with incorrect filings.

Required Documents

To complete Form 720, certain documents are required. These may include financial statements, records of sales subject to excise tax, and any previous tax returns related to excise taxes. Having these documents readily available can streamline the process of filling out the form and ensure that all information is accurate and complete.

Quick guide on how to complete instructions for form 720 department of the treasury internal

Complete Instructions For Form 720 Department Of The Treasury Internal effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the resources you need to create, alter, and eSign your documents quickly without delays. Manage Instructions For Form 720 Department Of The Treasury Internal on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign Instructions For Form 720 Department Of The Treasury Internal with ease

- Find Instructions For Form 720 Department Of The Treasury Internal and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that need new document copies printed out. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choosing. Modify and eSign Instructions For Form 720 Department Of The Treasury Internal and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 720 department of the treasury internal

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 720 department of the treasury internal

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What are the 2021 instructions 720 for using airSlate SignNow?

The 2021 instructions 720 provide guidelines for utilizing airSlate SignNow effectively. They cover how to send, sign, and manage documents seamlessly. Following these instructions helps users maximize the platform's features for efficient document handling.

-

How can I access the 2021 instructions 720 for airSlate SignNow?

You can easily access the 2021 instructions 720 on the airSlate SignNow website. Simply navigate to the support section where detailed guides and resources are available. This ensures you have the latest and most accurate information at your fingertips.

-

What features does airSlate SignNow offer according to the 2021 instructions 720?

According to the 2021 instructions 720, airSlate SignNow offers features such as customizable templates, real-time tracking, and advanced security measures. These features help streamline document workflows and enhance productivity for businesses of all sizes.

-

Is airSlate SignNow a cost-effective solution as mentioned in the 2021 instructions 720?

Yes, airSlate SignNow is highlighted as a cost-effective solution in the 2021 instructions 720. With flexible pricing plans, businesses can choose options that fit their budget while still accessing robust eSigning capabilities and document management tools.

-

What are the benefits of using airSlate SignNow as per the 2021 instructions 720?

The benefits outlined in the 2021 instructions 720 include enhanced efficiency, improved collaboration, and reduced turnaround times for document signing. By using airSlate SignNow, businesses can streamline their processes and ensure compliance effortlessly.

-

What integrations are available with airSlate SignNow that align with the 2021 instructions 720?

The 2021 instructions 720 indicate that airSlate SignNow integrates seamlessly with popular tools such as Google Drive, Salesforce, and Dropbox. These integrations allow teams to connect their preferred applications and enhance their workflows signNowly.

-

How secure is airSlate SignNow in accordance with the 2021 instructions 720?

According to the 2021 instructions 720, airSlate SignNow employs advanced security protocols including encryption and multi-factor authentication. This ensures that your documents and sensitive information are protected from unauthorized access at all times.

Get more for Instructions For Form 720 Department Of The Treasury Internal

Find out other Instructions For Form 720 Department Of The Treasury Internal

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast