FORM 725 KENTUCKY SINGLE MEMBER LLC INDIVIDUALLY O

What is the form 725 Kentucky single member LLC individually owned?

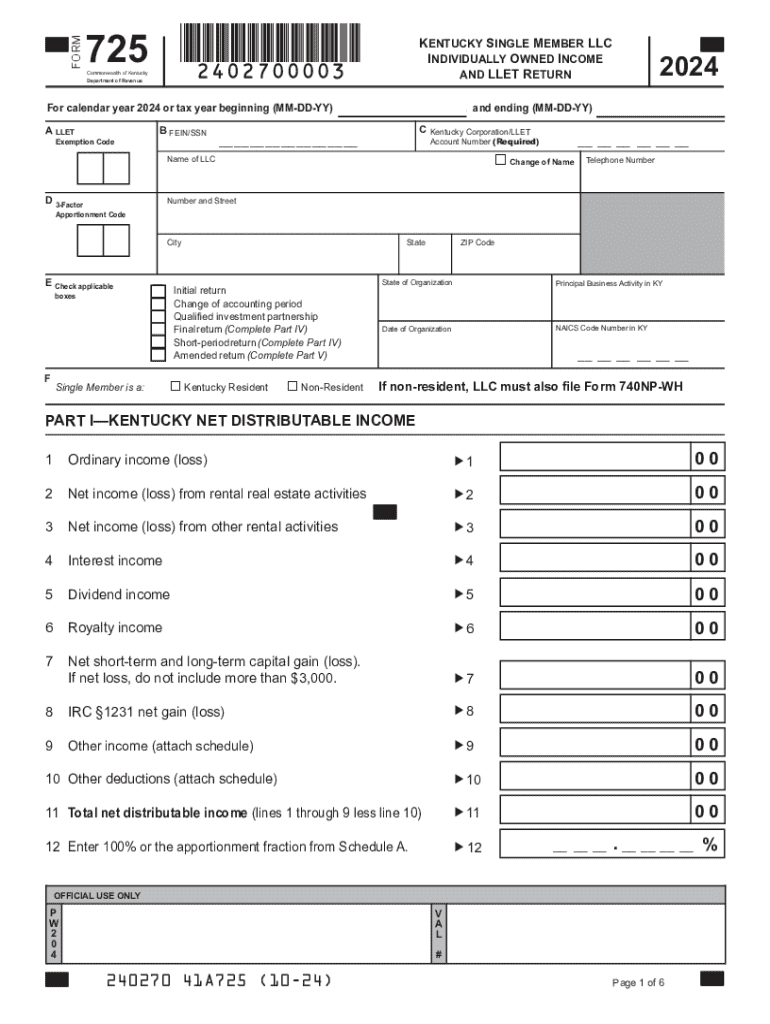

The form 725 is a tax document used specifically for single-member limited liability companies (LLCs) in Kentucky. This form allows the owner to report income, deductions, and other financial information related to the business. It is essential for ensuring compliance with state tax regulations and is designed to facilitate the proper reporting of business activities for tax purposes. By utilizing this form, single-member LLC owners can effectively manage their tax obligations while benefiting from the liability protections that an LLC structure provides.

Steps to complete the form 725 Kentucky single member LLC individually owned

Completing the form 725 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and any relevant receipts. Next, accurately fill out the form with your business information, including the LLC's name, address, and federal identification number. Be sure to report all income earned and deductions applicable to your business activities. After completing the form, review it thoroughly for any errors or omissions. Finally, sign and date the form before submitting it to the Kentucky Department of Revenue.

How to obtain the form 725 Kentucky single member LLC individually owned

The form 725 can be obtained directly from the Kentucky Department of Revenue's website. It is available for download in a printable format, allowing you to complete it by hand if preferred. Additionally, the form may be accessible through various tax preparation software, which can simplify the filling process. Ensure that you are using the most current version of the form to comply with the latest tax regulations.

Filing deadlines / important dates for form 725 Kentucky

Filing deadlines for the form 725 are crucial to avoid penalties and interest. Typically, the form must be filed by April 15 of each year, aligning with the federal tax deadline. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these deadlines, as the Kentucky Department of Revenue may announce updates or extensions in specific circumstances.

Key elements of the form 725 Kentucky single member LLC individually owned

The form 725 includes several key elements that must be accurately reported. These elements consist of the business name, address, and federal employer identification number (EIN). Additionally, the form requires detailed reporting of gross income, allowable deductions, and any credits that may apply. Understanding these components is vital for ensuring that the form is completed correctly and that all relevant financial information is included.

Legal use of the form 725 Kentucky single member LLC individually owned

The legal use of the form 725 is essential for compliance with Kentucky tax laws. By submitting this form, single-member LLC owners fulfill their obligation to report income and pay taxes on their business activities. Failure to file the form accurately or on time can result in penalties, interest, or legal consequences. It is crucial for business owners to understand the legal implications of the form and to ensure that it is completed in accordance with all applicable laws and regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 725 kentucky single member llc individually o

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 725 and how can airSlate SignNow help with it?

Form 725 is a document used for various administrative purposes. airSlate SignNow simplifies the process of filling out and signing form 725 by providing an intuitive platform that allows users to easily create, send, and eSign the document securely.

-

What features does airSlate SignNow offer for managing form 725?

airSlate SignNow offers a range of features for managing form 725, including customizable templates, real-time collaboration, and secure cloud storage. These features ensure that users can efficiently handle their documents while maintaining compliance and security.

-

Is there a cost associated with using airSlate SignNow for form 725?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to essential features for managing form 725, ensuring that users can choose an option that fits their budget and requirements.

-

Can I integrate airSlate SignNow with other applications for form 725?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing users to streamline their workflow when handling form 725. This includes popular tools like Google Drive, Salesforce, and more, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for form 725?

Using airSlate SignNow for form 725 offers several benefits, including faster turnaround times, reduced paperwork, and improved accuracy. The platform's user-friendly interface makes it easy for anyone to manage their documents without extensive training.

-

How secure is airSlate SignNow when handling form 725?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your form 725 and other documents. Users can trust that their sensitive information is safe while using the platform.

-

Can I track the status of my form 725 with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow users to monitor the status of their form 725. This includes notifications for when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for FORM 725 KENTUCKY SINGLE MEMBER LLC INDIVIDUALLY O

Find out other FORM 725 KENTUCKY SINGLE MEMBER LLC INDIVIDUALLY O

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors