TC 65 Forms, Utah PartnershipLLPLLC Return

What is the TC 65 Form, Utah Partnership Return

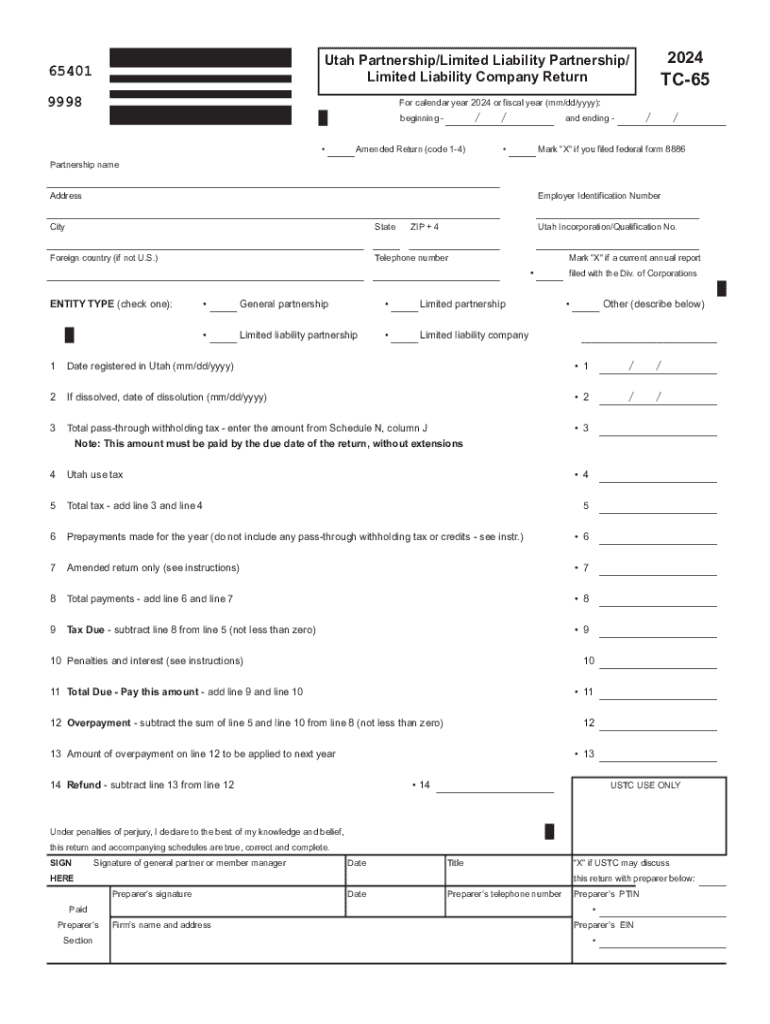

The TC 65 form, also known as the Utah Partnership Return, is a tax document used by partnerships operating in Utah. This form is essential for reporting the income, deductions, and credits of partnerships, including limited liability partnerships (LLPs) and limited liability companies (LLCs) that are taxed as partnerships. The TC 65 allows partnerships to report their financial activities to the state, ensuring compliance with Utah tax laws.

Steps to Complete the TC 65 Form, Utah Partnership Return

Completing the TC 65 form involves several key steps:

- Gather necessary financial documents, including income statements, expense records, and prior year tax returns.

- Fill out the partnership information section, including the name, address, and federal employer identification number (EIN).

- Report the income earned by the partnership, detailing all sources of revenue.

- List all allowable deductions, such as operating expenses and depreciation.

- Calculate the partnership's tax liability based on the net income reported.

- Ensure all partners review and sign the form before submission.

Filing Deadlines / Important Dates

The TC 65 form must be filed by the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year basis, this means the form is due by April 15. It is important to note that extensions may be available, but they must be requested in advance and filed appropriately.

Required Documents for the TC 65 Form

To successfully complete the TC 65 form, partnerships should prepare the following documents:

- Income statements detailing all revenue sources.

- Expense records to substantiate deductions claimed.

- Prior year TC 65 forms for reference.

- Partner information, including Social Security numbers or EINs.

Legal Use of the TC 65 Form, Utah Partnership Return

The TC 65 form serves a legal purpose by ensuring that partnerships comply with state tax regulations. Filing this form is not only a requirement but also a way to maintain transparency and accountability in financial reporting. Failure to file accurately can result in penalties or legal consequences, making it crucial for partnerships to understand their obligations.

Examples of Using the TC 65 Form, Utah Partnership Return

Partnerships in various industries use the TC 65 form to report their income and expenses. For instance:

- A small law firm structured as an LLP would report its earnings and expenses using the TC 65.

- A real estate partnership would detail rental income and property expenses on the form.

- A consulting firm operating as an LLC would use the TC 65 to report its consulting fees and related costs.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 65 forms utah partnershipllpllc return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Utah partnership return?

A Utah partnership return is a tax document that partnerships in Utah must file to report their income, deductions, and credits. It is essential for ensuring compliance with state tax laws and for the accurate distribution of income among partners. Understanding how to complete a Utah partnership return can help avoid penalties and ensure that all partners are properly informed.

-

How can airSlate SignNow help with filing a Utah partnership return?

airSlate SignNow simplifies the process of preparing and submitting a Utah partnership return by allowing users to easily eSign and send necessary documents. Our platform streamlines collaboration among partners, ensuring that everyone can review and approve the return efficiently. This reduces the time spent on paperwork and helps ensure compliance with state regulations.

-

What features does airSlate SignNow offer for managing Utah partnership returns?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, which are essential for managing Utah partnership returns. These tools help users create, edit, and store their tax documents securely. Additionally, the platform allows for easy tracking of document status, ensuring that all partners are on the same page.

-

Is airSlate SignNow cost-effective for small businesses filing a Utah partnership return?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses needing to file a Utah partnership return. Our pricing plans are flexible and cater to various business sizes, ensuring that you only pay for what you need. By reducing the time and resources spent on document management, our platform can save your business money in the long run.

-

Can I integrate airSlate SignNow with other accounting software for my Utah partnership return?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to manage your Utah partnership return. This seamless integration allows you to import data directly from your accounting system, reducing manual entry errors and streamlining the filing process. You can focus more on your business and less on paperwork.

-

What are the benefits of using airSlate SignNow for my Utah partnership return?

Using airSlate SignNow for your Utah partnership return provides numerous benefits, including enhanced efficiency, improved collaboration, and secure document handling. Our platform ensures that all partners can easily access and sign documents from anywhere, which is crucial for timely filing. Additionally, the user-friendly interface makes it easy for anyone to navigate the process.

-

How secure is airSlate SignNow when handling my Utah partnership return?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like a Utah partnership return. Our platform employs advanced encryption and security protocols to protect your data. You can rest assured that your information is safe while using our services, allowing you to focus on your business without worrying about data bsignNowes.

Get more for TC 65 Forms, Utah PartnershipLLPLLC Return

Find out other TC 65 Forms, Utah PartnershipLLPLLC Return

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure