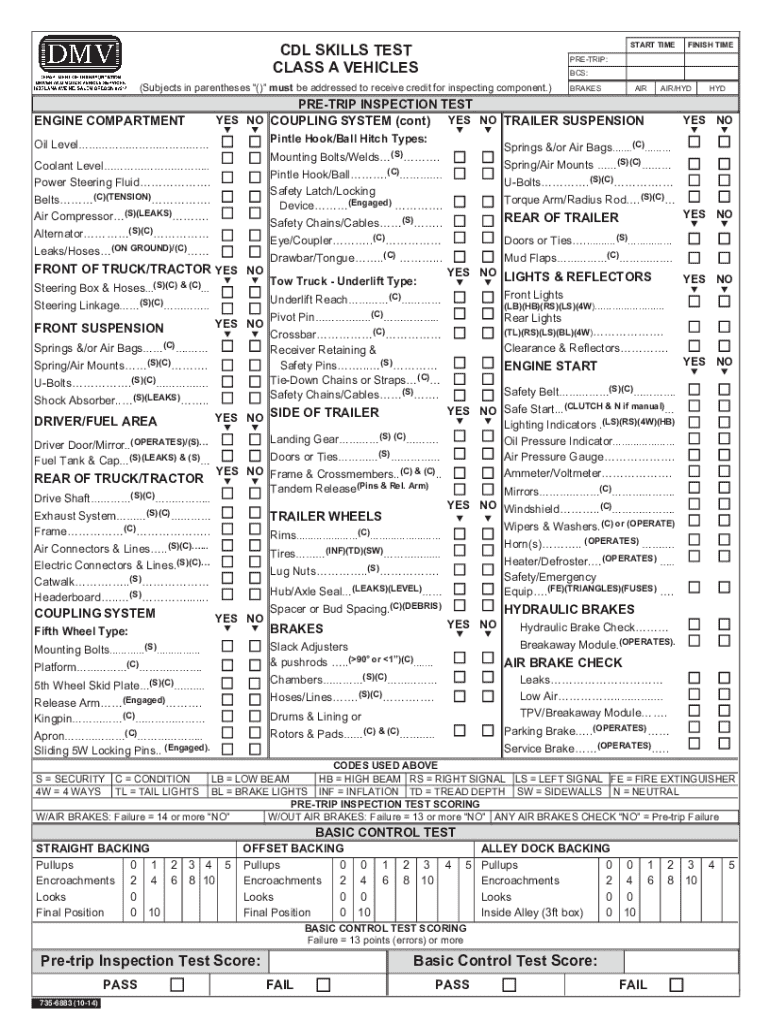

735 6883 2014-2026

What is the

The form is a specific document used primarily for reporting certain financial information to the Internal Revenue Service (IRS) in the United States. This form is essential for taxpayers who need to provide detailed information regarding their income, deductions, and credits. Understanding the purpose of this form is crucial for compliance with federal tax regulations.

How to use the

Using the form involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, including income statements and receipts for deductions. Once all information is collected, individuals can fill out the form, ensuring that all sections are completed accurately. After filling out the form, it should be reviewed for any errors before submission to the IRS.

Steps to complete the

Completing the form requires careful attention to detail. Here are the general steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts.

- Fill out personal information, including name, address, and Social Security number.

- Report income sources accurately, ensuring all figures match your documentation.

- Detail any deductions or credits you are eligible for, providing necessary explanations.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the specified deadline.

Legal use of the

The form must be used in accordance with IRS regulations. It is important for taxpayers to ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or audits. Legal use of the form also involves adhering to filing deadlines and maintaining copies of submitted forms for personal records.

Filing Deadlines / Important Dates

Filing deadlines for the form are typically aligned with the annual tax filing season. Taxpayers should be aware of the specific date by which the form must be submitted to avoid late penalties. It is advisable to mark these important dates on a calendar to ensure timely filing.

Required Documents

To complete the form, certain documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for additional income sources.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the form. Taxpayers should refer to these guidelines to ensure compliance with all requirements. This includes instructions on how to report income, claim deductions, and the proper method for submitting the form, whether electronically or via mail.

Create this form in 5 minutes or less

Find and fill out the correct 735 6883

Create this form in 5 minutes!

How to create an eSignature for the 735 6883

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 735 6883?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. The reference '735 6883' is associated with our customer support line, where you can get assistance with any queries related to our services.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow varies based on the plan you choose. For detailed pricing information, including any promotions related to '735 6883', please visit our pricing page or contact our support team.

-

What features does airSlate SignNow offer?

airSlate SignNow offers a range of features including document templates, real-time tracking, and secure cloud storage. These features are designed to enhance your document workflow and can be accessed easily by calling '735 6883' for more information.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can streamline their document signing process, reduce turnaround times, and improve overall efficiency. The benefits of our service can be discussed in detail by signNowing out to our support at '735 6883'.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your existing workflows. For specific integration queries, feel free to contact us at '735 6883' for personalized assistance.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures to ensure that your documents are safe and secure. If you have concerns about security protocols, please call '735 6883' for detailed information.

-

Can I try airSlate SignNow before committing?

Yes, airSlate SignNow offers a free trial that allows you to explore our features without any commitment. For more information on how to start your trial, you can signNow out to us at '735 6883'.

Get more for 735 6883

- Wisconsin modification placement form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497431060 form

- Wisconsin annual form

- Notices resolutions simple stock ledger and certificate wisconsin form

- Minutes for organizational meeting wisconsin wisconsin form

- Sample transmittal letter to secretary of states office to file articles of incorporation wisconsin wisconsin form

- Petition appointment guardian form

- Dispositional order concerning petition to appoint relative as guardian wisconsin form

Find out other 735 6883

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online