Rita Net Profit Tax Return Form

What is the Rita Net Profit Tax Return

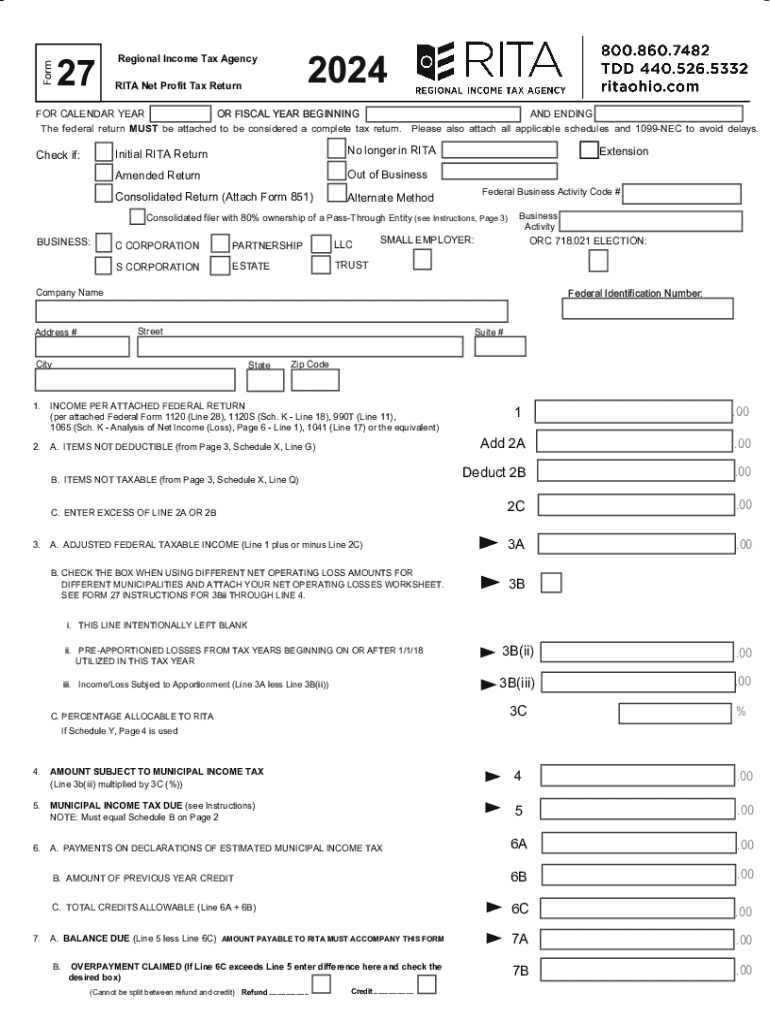

The Rita Net Profit Tax Return is a tax form specifically designed for businesses operating within the Regional Income Tax Agency (RITA) jurisdictions in Ohio. This form is essential for reporting net profits earned by businesses, including sole proprietorships, partnerships, and corporations. It ensures compliance with local tax regulations and helps businesses accurately calculate their tax obligations to RITA. Understanding this form is crucial for any business that generates income in areas covered by RITA.

Steps to complete the Rita Net Profit Tax Return

Completing the Rita Net Profit Tax Return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including profit and loss statements, balance sheets, and any other relevant income records. Next, fill out the form by entering your business's gross income, allowable deductions, and calculating net profit. Ensure that all figures are accurate, as discrepancies can lead to penalties. Finally, review the completed form for any errors before submitting it to RITA.

Required Documents

To successfully complete the Rita Net Profit Tax Return, certain documents are required. These include:

- Financial statements, such as profit and loss statements and balance sheets

- Records of all business income and expenses

- Previous year’s tax return for reference

- Any supporting documentation for deductions claimed

Having these documents ready will streamline the process and help ensure that the return is filed accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Rita Net Profit Tax Return are crucial for compliance. Typically, the return is due on the fifteenth day of the fourth month following the end of your business's fiscal year. For businesses operating on a calendar year, this means the return is due by April 15. It is important to stay informed about any changes in deadlines or additional requirements that may arise, especially during tax season.

Legal use of the Rita Net Profit Tax Return

The Rita Net Profit Tax Return is legally mandated for businesses earning income within RITA jurisdictions. Filing this form is not only a requirement but also a means to contribute to local funding for public services. Non-compliance can result in penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of this form is essential for all business owners operating in Ohio.

Who Issues the Form

The Rita Net Profit Tax Return is issued by the Regional Income Tax Agency (RITA), which is responsible for administering municipal income taxes in Ohio. RITA provides resources and guidance for businesses to ensure they meet their tax obligations. It is advisable to consult RITA's official communications for the most current version of the form and any updates regarding filing procedures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rita net profit tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rita net form and how does it work?

The rita net form is a digital document solution that allows users to create, send, and eSign forms seamlessly. With airSlate SignNow, you can easily customize your rita net form to meet your specific needs, ensuring a smooth workflow for document management.

-

How much does the rita net form service cost?

Pricing for the rita net form service varies based on the plan you choose. airSlate SignNow offers flexible pricing options to accommodate businesses of all sizes, ensuring you get the best value for your document signing needs.

-

What features are included with the rita net form?

The rita net form includes features such as customizable templates, real-time tracking, and secure eSignature capabilities. These features enhance your document workflow, making it easier to manage and sign important documents efficiently.

-

Can I integrate the rita net form with other applications?

Yes, the rita net form can be integrated with various applications, including CRM systems and cloud storage services. This integration allows for a more streamlined workflow, enabling you to manage documents across different platforms effortlessly.

-

What are the benefits of using the rita net form for my business?

Using the rita net form can signNowly reduce the time spent on document management and signing processes. It enhances productivity, minimizes errors, and provides a secure way to handle sensitive information, making it an ideal solution for businesses.

-

Is the rita net form secure for sensitive documents?

Absolutely! The rita net form is designed with security in mind, employing encryption and secure access protocols to protect your documents. You can confidently use airSlate SignNow for all your sensitive document needs.

-

How can I get started with the rita net form?

Getting started with the rita net form is easy. Simply sign up for an airSlate SignNow account, choose your plan, and start creating your forms. Our user-friendly interface will guide you through the process of setting up your documents.

Get more for Rita Net Profit Tax Return

- Medication destruction form pdf

- Hpcl e mandate form

- Noc for gas connection from landlord form

- Neale analysis of reading ability download form

- Personal narrative rubric 3rd grade form

- Form 20 rto in hindi

- Ignou project front page form

- Sample letter requesting copy of policy united policyholders uphelp form

Find out other Rita Net Profit Tax Return

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure